What are the potential implications for the global Bitcoin market and Norway’s economy following the country’s stricter regulations on cryptocurrency mining?

With Bitcoin’s (BTC) latest halving event now behind us, where miner rewards were reduced to 3.125 Bitcoins, Norway is determined to tackle the energy-consuming activity of cryptocurrency mining that takes place within its territory.

The Norwegian government is planning new laws to control data centers amid Bitcoin’s price instability, currently at approximately $66,000, with the goal of reducing crypto mining operations.

Based on information from Norwegian news source VG, and quotes from Digitalization Minister Karianne Tung and Energy Minister Terje Aasland, this proposed legislation represents the initial government regulation for Norway’s data center sector.

Starting next, data center managers must sign up with local government agencies to boost supervision and responsibility in accordance with new rules.

The main motivation fueling this proposed legislation is the government’s determination to restrict or completely ban cryptocurrency mining within Norway.

Tung and Aasland have expressed worries about the negative effects of crypto mining on the environment, specifically its high greenhouse gas emissions, which they believe conflict with Norway’s commitment to sustainability.

Norway’s action follows a comparable trend in adjacent Sweden, as they raised taxes on data centers earlier last year to dampen crypto mining operations.

The goal is evident: guiding the industry toward eco-friendly methods and bringing it in line with larger environmental goals.

Current crypto mining legislation in Norway

At present, crypto mining isn’t outright prohibited, yet the social climate suggests stricter oversight for data centers and comparable establishments engaged in mining activities.

The government’s move to abolish discounted electricity taxes for data centers and crypto mining in the State Budget 2023 is a reflection of this developing trend.

Starting October 2022, the Norwegian administration suggested eliminating the discounted electricity tax for data centers. This means that energy used in data center mining would now be charged at regular tax rates.

Trygve Slagsvold Vedum, Finland’s Finance Minister, underscored the significance of ensuring electricity is allocated for essential social uses, as crypto mining becomes increasingly common.

The suggested modifications are predicted to bring in an extra income of around 150 million NOK ($13.61 million) by the year 2023, with approximately 110 million NOK anticipated to be gained during that time.

The Norwegian administration’s stance on potentially harming the entire data center business to restrict Bitcoin mining stands out as noteworthy, given their previous endeavors in 2018 to make Norway a major data center destination.

Furthermore, digital currency obtained through mining becomes taxable upon receipt.

Miners need to assess the worth of the dug-up virtual currency in various instances and then change that value into Norwegian krone based on conversion rates given by Norges Bank.

Mining operations allow miners to take tax deductions on expenditures associated with their work, including the purchase of equipment like machines and software, as well as the cost of electricity usage.

Mining machinery and equipment, which are mainly employed for this purpose, can be spread out as a depreciation expense over multiple years. On the other hand, electricity costs associated with mining operations can be reduced by claiming deductions based on actual usage exceeding typical consumption levels.

The secret sauce of Norway

Norwegian Bitcoin miners may not be the largest players in the industry, but they significantly contribute to ensuring the security of the Bitcoin network.

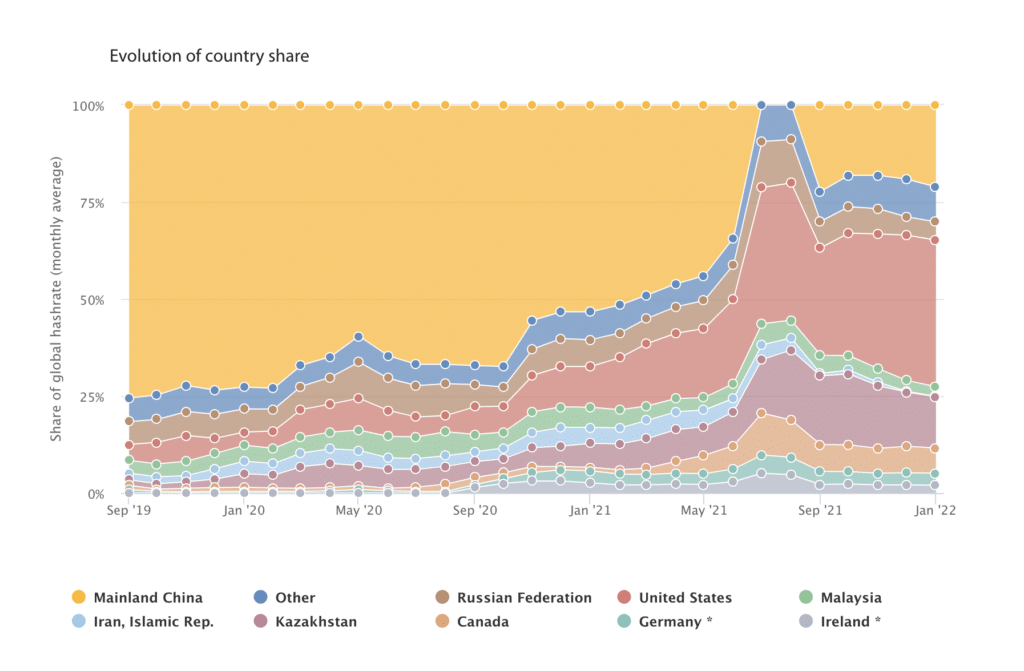

Based on data from Cambridge University’s Center for Alternative Finance (CCAF) Bitcoin Mining Map as of January 2022, these miners account for around 0.74% of Bitcoin’s total hashrate or computational power used for mining.

In the heart of Norway, particularly the middle and northern areas, you’ll find a mix of international corporations such as Bitfury and Bitdeer, along with local businesses like Arcario, actively engaging in their operations.

The attraction of Bitcoin mining in Norway lies in its plentiful renewable energy supply, specifically from hydropower.

This country is amongst the world’s leaders in generating electricity per person, mainly because of its abundant mountains and frequent rainfall. These natural features make it ideal for constructing many hydropower plants.

In the year 2021, nearly all of Norway’s electricity production came from hydropower, amounting to 92%, while wind power accounted for an extra 7%. The heavy reliance on renewable energy sources makes Norway an enticing choice for Bitcoin miners pursuing carbon neutrality.

In addition, the chilly Norwegian weather acts as a built-in cooling system for mining activities, minimizing the requirement for extra cooling facilities.

In the northern regions of Norway, where temperatures vary between an average of -4 degrees Celsius and 13 degrees Celsius monthly, mining operations experience reduced maintenance needs and extended equipment durability due to the cooler climate, in contrast to warmer areas such as West Texas.

Despite contributing less to Bitcoin’s overall hashrate than other countries, Norway plays a significant role in the global Bitcoin mining community.

What could new legislation mean for Norway’s BTC miners?

The new law may have significant consequences for Bitcoin miners based in Norway.

Initially, stricter regulations could result in extra paperwork and expenses for miners to follow.

Strictly following ecological rules, acquiring necessary permits, and undergoing routine inspections to stay in regulation.

Additionally, the push towards eco-friendly methods due to environmental issues may lead miners to rethink their mining activities in Norway.

With an abundance of renewable energy resources like hydropower at its disposal, the country is appealing. however, stricter regulations and accompanying expenses linked to mining activities could make it less desirable.

Miners could choose to move their operations to areas with less strict rules or lower expenses, which might affect Norway’s standing in the international mining industry.

On the positive note, this situation might stimulate inventiveness. Miners could be motivated to explore energy-saving methods or discover greener mining techniques, potentially leading to technological advancements within the industry.

In essence, the recent rule modifications may lead Bitcoin miners in Norway to reassess their methods and consider new locations for their operations. The outcome is uncertain as we observe how miners respond to these developments.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-04-22 13:29