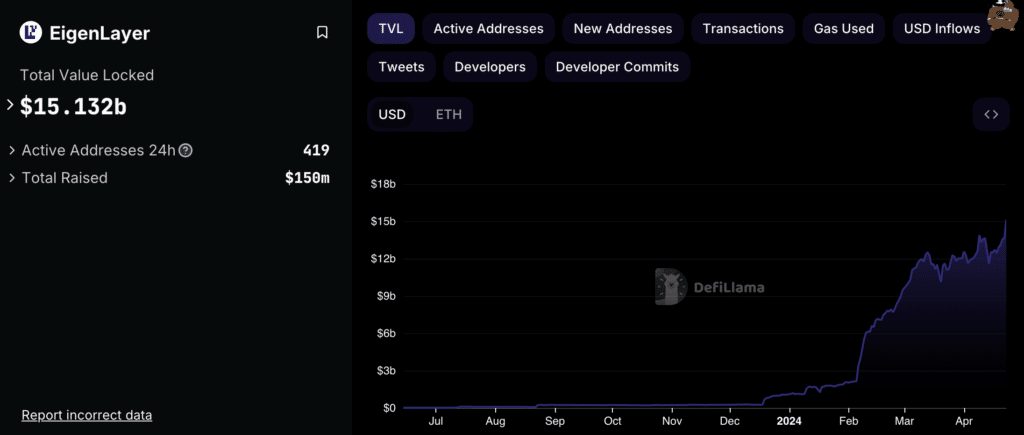

The total value of locked funds in the EigenLayer restaking protocol exceeded $15.1 billion.

Based on DefiLlama’s report, the team behind the project removed limitations on pool sizes. Consequently, this led to a substantial rise in the total value locked (TVL), which grew from $11 billion at the start of March to over $15 billion within just a few weeks.

To reach the $29.6 billion TVL (Total Value Locked) of Lido Finance’s liquid staking platform, EigenLayer’s TVL must be enhanced further.

Around April, Dune Analytics reported that EigenLayer had amassed approximately 115,000 unique users. Not long after, in early April, the team behind EigenLayer unveiled their mainnet and incorporated new capabilities for both operators and restakers. As a result, users can now enjoy several enhanced features. Furthermore, this year, the developers have pledged to introduce intra-protocol transactions.

Announcing: EigenLayer ♾ EigenDA Mainnet Launch

— EigenLayer (@eigenlayer) April 9, 2024

According to Sreeram Kannan, the founder of EigenLayer, this protocol enhances Ethereum‘s functionality and ensures financial safety for its assets.

Our goal is to make @eigenlayer eventually permissionless on the staking assets.

———–

When any asset can be staked, what asset *will* be staked?

———–

– There is a common misconception that lower volatility assets are better. Is USDC the lowest volatility asset then?…— Sreeram Kannan (@sreeramkannan) April 15, 2024

In 2021, Kannan, who is an assistant professor at the University of Washington, came up with a new protocol. This protocol operates using Ethereum and empowers users to withdraw cryptocurrencies while expanding crypto security for novel network applications like bridges and oracles.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-04-23 17:55