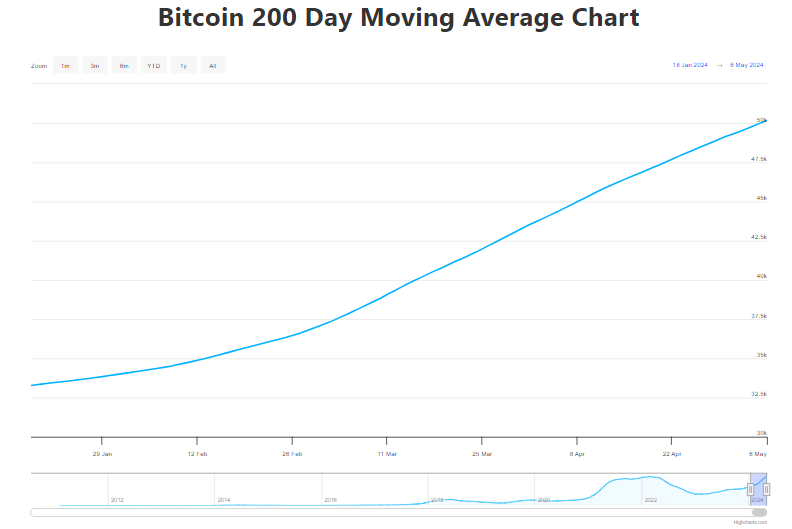

As a researcher with extensive experience in the cryptocurrency market, I find the current state of Bitcoin’s 200-day moving average to be an exciting development. Reaching an all-time high of $50,178, this indicator suggests a bullish outlook for long-term price trends.

Bitcoin, the initial decentralized cryptocurrency, has attained an extraordinary mark of $50,178 as its 200-day moving average, suggesting a favorable perspective for future price developments.

This significant marker filters out short-term price fluctuations, revealing an upward trend for Bitcoin when its value exceeds it, which is the case now. Following a brief decline after the halving event, Bitcoin’s resurgence is clear as it surpassed $56,800 on April 20th.

The 200-day Simple Moving Average (SMA), which considers the closing prices over the last 200 days, helps smooth out short-term market fluctuations. When current trading prices sit above this average, it generally suggests a bullish market trend.

The analyst Wily Woo’s charts indicate that Bitcoin’s 200-week moving average stands at a notable $34,000 mark. This trend is showing signs of a significant upward momentum for the remainder of the year. Since mid-October, Bitcoin has consistently remained near this level.

Over the past 50 days, there has been a drop of 100 contracts in this number. This figure is now somewhat smaller than its mid-April high. Indicators of revival are emerging, including the initial influx of Bitcoin ETF shares from Grayscale on May 3, pointing towards increasing investor optimism.

As a market analyst, I’ve noticed an intriguing development in the Bitcoin market: the 200-day moving average has surged to $50,178. This trend, backed by technical indicators, recent market events, and heightened investor interest, points to a robust bullish long-term tendency for Bitcoin. The implications are significant – opportunities for substantial growth lie ahead.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

2024-05-07 10:28