In this piece, we delve into the anticipated Solana (SOL) pricing developments in the imminent period and possible trends over the next few years. Our analysis covers SOL’s prospective growth, influential factors, and prevailing market sentiments.

As an analyst, I would recommend examining the potential future direction of the coin according to present market tendencies and technical indicators.

Table of Contents

What is Solana (SOL)?

Solana (SOL), an advanced blockchain platform recognized for its impressive speed and scalability, has drawn significant interest in the crypto world. With capabilities that rival Ethereum‘s, Solana is frequently referred to as a strong competitor, earning the moniker “Ethereum’s challenger.”

As a seasoned analyst, I’ve observed that this platform’s capacity to handle an impressive number of transactions per second, all while keeping fees low, has been a significant draw for developers, investors, and decentralized applications (dApps) alike. This powerful combination has solidified its position as a key player in the digital asset ecosystem.

Solana (SOL) price analysis

I’ve been closely monitoring my Solana (SOL) investment, and as of mid-May 2024, its price hovers around $167.87. The cryptocurrency market is known for its volatility, and Solana has certainly shown its fair share in recent months. I’ve witnessed both bullish and bearish trends, which have been influenced by various technical indicators and overall market sentiments.

Moving average convergence divergence (MACD)

The MACD indicator, which follows price trends and measures momentum for Solana, calculates the difference between two moving averages, specifically a 12-period and a 26-period Exponential Moving Average. The MACD line itself is derived by subtracting the longer-term EMA from the shorter-term one. A 9-period Exponential Moving Average of the MACD line is then used as a signal line to help identify potential buying or selling opportunities.

Lately, the Moving Average Convergence Divergence (MACD) chart for Solana shows signs of a bullish trend. The MACD line has moved above its signal line, implying a possible price surge ahead. Moreover, the histogram, which reflects the difference between the MACD and signal lines, has been positive, reinforcing the bullish sentiment. This crossover is indicative of heightened buying activity and can be seen as a potential indicator for future price increases.

Relative strength index (RSI)

As a researcher studying technical analysis, I would describe the Relative Strength Index (RSI) as a valuable tool for evaluating momentum in financial markets. This oscillator calculates the speed and magnitude of price changes, ranging from 0 to 100. When the RSI exceeds 70, it’s often perceived as an overbought signal, suggesting potential for price correction. Conversely, if the RSI falls below 30, it may indicate an oversold condition, potentially signaling a buying opportunity.

The RSI, or Relative Strength Index, for Solana hovers around the mark of 58.89. This figure signifies that the asset is neither overbought nor oversold at the moment. At this point, there’s a noticeable demand for purchasing the asset, but it hasn’t yet reached an excessive level which usually signals a potential price reversal. An RSI value above 50 implies the presence of bullish trends.

Moving averages

Paraphrasing: Moveaverages help clarify pricing trends by averaging out price data. The disparity between short-term and long-term moveaverages serves as a barometer for market sentiments.

As a market analyst, I’ve observed an intriguing development in Solana’s price trend: its 50-day moving average (MA) has surpassed its 200-day MA, resulting in what is known as a “Golden Cross.” This technical indicator often foreshadows further price growth. Given that the current market price lies above both the 50-day and 200-day MAs, it’s clear that the bullish sentiment among Solana investors remains robust.

Support and resistance levels

Key price points in Solana’s history serve as important reversal points for its price. Recognizing these support and resistance levels aids traders in making well-informed choices regarding buying and selling.

Solana’s price has formed a robust support at approximately $135.89. This level has withstood recent market downturns, acting as a solid base for potential price surges. On the flip side, there is resistance around $174.35 where the price has repeatedly met obstacles. A successful breach above this resistance could pave the way for additional growth and potentially propel the price toward the next resistance at $200.

Key factors influencing Solana’s price

Though technical analysis offers valuable market information, it’s essential to assess the project’s progression from various angles as well.

Technological Advancements and Strong Market Sentiment

The sturdy technology behind Solana’s blockchain, noted for swift transaction processing and affordable fees, significantly fuels its expansion. As Solana progresses in improving its infrastructure and addressing past concerns like network interruptions, its allure for developers and users is predicted to intensify.

As an analyst, I would interpret this news in the following way: The unveiling of a cross-chain connection between Bitcoin and Solana by Zeus Network has instilled a positive outlook among market participants. This development will facilitate atomic swaps between Bitcoin (BTC) and Solana (SOL), thereby enhancing compatibility between these two networks.

Community and ecosystem

An essential role is played by the active participation of the Solana community and the expansion of its ecosystem in ensuring continuous growth. Initiatives and collaborations spearheaded by the community in the Decentralized Finance (DeFi) sector are predicted to boost Solana’s value and usage, fueling a price increase.

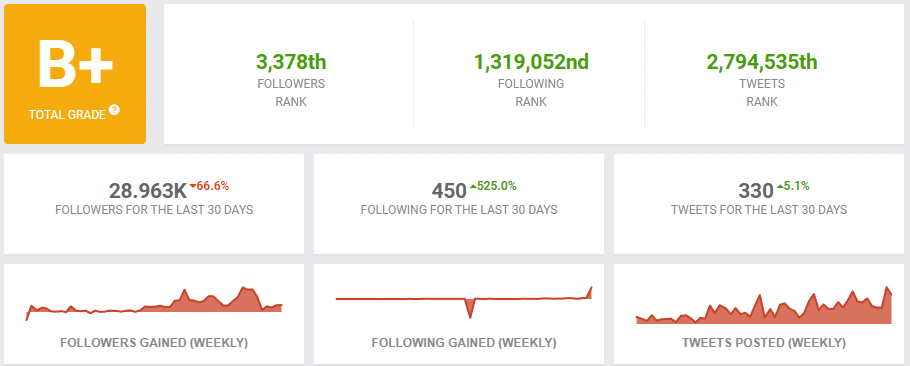

Over the past month, there’s been a significant surge in Solana’s social media following with approximately 30,000 new fans, reflecting a positive trend in public sentiment and active community participation.

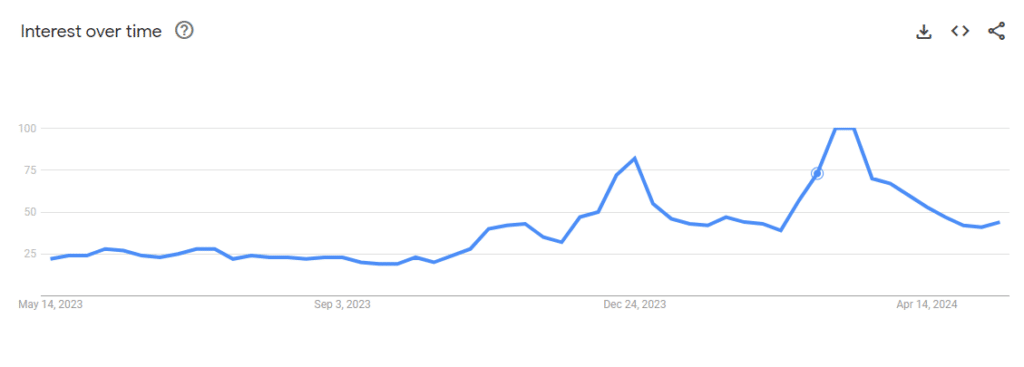

The level of public curiosity and involvement with Solana can be gauged by examining Google Trends data related to the term “Solana.”

Solana price prediction 2024

By mid-May 2024, the value of Solana (SOL) hovers around $168.68, and its market capitalization amounts to a significant $75.7 billion. Analysts offer varying perspectives on where the price of SOL might settle by year-end 2024. The bullish projections anticipate that it could climb as high as $200, while more cautious assessments suggest a range between $150 and $170.

As a crypto investor, I’m bullish about Solana because of its robust foundations. Its impressive speed and scalability are major draws, bringing in both individual and institutional investors.

Keep in mind that the projected 2024 price for SOL, as well as the other price points discussed in this article, are speculative and derived from existing trends and technical analysis. However, cryptocurrencies are known for their volatility, so unexpected occurrences could cause any crypto’s value to plummet below the more cautious projections presented here.

Solana price prediction 2025

As a researcher looking towards the future, I anticipate that Solana’s price projections in 2025 will showcase a wide array of possibilities. Some industry experts believe that the broader market trends, including the anticipated impacts of Bitcoin’s halving, could positively influence Solana’s price. Estimated values for Solana in the year 2025 span from a more cautious forecast of $200 to a bullish prediction of $750.

A positive perspective on Solana’s future is grounded in its persistent network advancements and expanding utilization within the Decentralized Finance (DeFi) community. However, it’s important to remember that unforeseen circumstances, such as black swan events, could unexpectedly influence the value of SOL or any cryptocurrency.

Solana price prediction 2030

From a longer-term viewpoint, the forecast for Solana’s price by 2030 carries a high degree of uncertainty but is generally optimistic. By the year 2030, Solana may have established itself as a significant player in the cryptocurrency sector, potentially rivaling Ethereum in market share. However, it’s premature to predict where SOL prices will trend, despite the belief among supporters and advocates that the project will thrive.

Some forecasts indicate that Solana’s advancements and growing community may lead to substantial price hikes within the next ten years. However, other analysts take a more cautious approach.

Risks to consider

As a crypto investor, I’m well aware that the value of my investments in Solana (SOL) can fluctuate greatly, making it essential for me to only invest an amount of money that I’m prepared to potentially lose. The price movements of SOL can be influenced by a multitude of factors beyond the control of the Solana network itself. Market events, both positive and negative, can significantly impact the price of SOL, so it’s crucial for me to stay informed and adapt my investment strategy accordingly.

Is Solana a good investment?

Solana is known for its cutting-edge tech, impressive scalability, and increasing popularity, making it a potentially solid investment. However, be mindful that, like all cryptocurrencies, Solana involves risks and price fluctuations.

Will Solana’s price go up or down?

Should I invest in Solana?

Considering the long-term prospects of Solana and being comfortable with the inherent risks associated with cryptocurrency investments, putting your resources into this digital asset could potentially bring rewards. However, it’s crucial that you engage in extensive research and assess your own risk appetite before making a decision.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-05-17 17:49