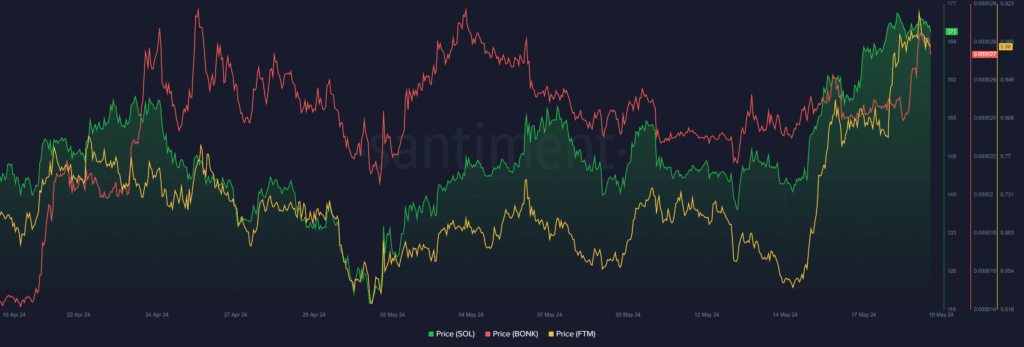

As an experienced cryptocurrency analyst, I’ve closely observed the market trends and performance of various digital assets last week. The global cryptocurrency market cap showed impressive recovery, with a 7% surge and a significant $160 billion gain in valuation. Among the top performers, Solana (SOL) and Bonk (BONK) stood out for me.

As a cryptocurrency market analyst, I’ve observed an impressive rebound among the top digital currencies over the past week. The aggregate market capitalization experienced a noteworthy growth of approximately 7%, which translates to a substantial increase in value – around $160 billion. This expansion can be attributed to substantial price surges in the majority of the prominent cryptocurrencies.

Here are our picks for the top cryptocurrencies to watch this week:

SOL retests 1-month high

Last week, Solana (SOL) rose to prominence among the leading cryptocurrencies, even though it exhibited limited price fluctuations during the initial stages.

The previous week saw the price failing to hold above the crucial $150 mark and facing challenges as the larger market displayed a bearish trend.

As a researcher studying the cryptocurrency market, I’ve observed an intriguing development following Bitcoin‘s (BTC) noteworthy 7.52% surge on May 15, instigated by the U.S. Consumer Price Index (CPI) data release. This event sparked a broader market upswing, which Solana effectively capitalized on. Consequently, it recorded an impressive gain of 11.61%. The daily chart for Solana now reflects this progression as it successfully breached the resistance level at the upper Bollinger Band.

When European traders on the Robinhood platform could begin staking Solana coins on May 15, the cryptocurrency was priced at around $158, aiming to capitalize on the ongoing upward trend and secure greater profits.

As a crypto investor, I’ve noticed an exciting development in my Solana investment recently. From May 16 to 18, this asset posted three straight intraday gains, surpassing the significant price level of $170 and reaching a one-month high of $176 for retesting. In the previous week, Solana delivered a robust 21% price increase, placing it among the top-performing assets during that timeframe.

BONK breaches 50-day EMA

Last week, Bonk (BONK) started off with a bearish compression after the decline seen in the previous seven days. However, it took advantage of the market rebound on May 15 to achieve a daily increase of 8.42%, ending the day at $0.00002153.

As a researcher studying the cryptocurrency market, I’ve observed an uptrend that finally allowed BONK to break above its 50-day moving average on May 11, after multiple attempts since May 10. This achievement resulted in a new 10-day high of $0.00002648 the following day. However, encountering resistance at this price level, BONK experienced a significant intraday price drop, resulting in a 3.9% loss on May 16.

Despite suffering a setback, BONK managed to stay above its 50-day moving average, signaling that the positive trend was still in place. The following two days proved particularly profitable, resulting in a 9.88% increase in value. With BONK currently priced at $0.00002601, bullish investors will aim to push the price above the resistance level at the upper Bollinger Band ($0.00002748) to maintain the upward trend.

As a crypto investor, I’ve noticed that BONK‘s price action has been quite bullish lately, with a solid 13.4% gain in the previous week. However, a potential pullback toward the middle band at $0.00002444 could test the asset’s resilience significantly. If the price were to dip below this level, it might trigger a free fall and force us to retest the 50-day Exponential Moving Average (EMA) as support.

FTM spikes 21% in a week

Last week, Fantom (FTM) took a turn for the worse compared to the general crypto market. Within the initial three days, its value dropped by almost 10%. Meanwhile, other digital assets displayed relatively stable price movements.

Despite the market-wide rally following the CPI data release, FTM managed to recover all its losses and soared by an impressive 18.22% on May 15. This brought its closing price for the day up to a monthly peak of $0.7590, a level last seen on April 20.

The significant surge in Fantom’s price on May 16, 2023, which represented its most substantial intraday growth since March 17, 2023, was fueled by a rise in the Accumulation/Distribution metric. This indicator experienced a notable increase from 1.197 billion FTM on May 14 to 1.308 billion FTM on May 16, indicating a heightened buying trend among investors.

As an analyst, I’d rephrase the given text as follows:

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Maiden Academy tier list

2024-05-19 19:02