As a researcher with a background in cryptocurrencies and market analysis, I find the recent trend of traders increasing their exposure to Ethereum (ETH) over Bitcoin (BTC) intriguing. According to data from CryptoQuant and Santiment, this shift is likely due to growing expectations for the approval of a spot ETH exchange-traded fund (ETF).

With the anticipation of Ethereum (ETH) exchange-traded funds (ETFs) being approved drawing nearer, investors are increasingly wagering larger positions on ETH compared to Bitcoin (BTC).

Based on a recent report by CryptoQuant and published in crypto.news, the ratio of open interest for Ethereum-Bitcoin trading has risen from 0.54 to 0.67 within the last week. This indicates that investors are seeking greater exposure to Ethereum compared to Bitcoin, driven by optimism surrounding the potential approval of an ETH spot Exchange Traded Fund (ETF).

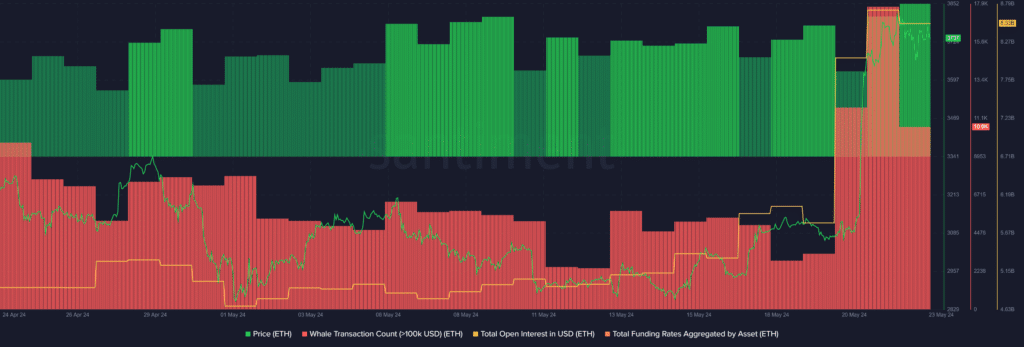

According to Santiment’s data, the total open interest for Ethereum is now at $8.53 billion. Additionally, the average funding rate for Ethereum transactions has risen from 0.016% to 0.018% within the last 24 hours.

As a researcher studying market trends, I have observed an uptick in the number of traders placing wagers on a potential Ethereum price increase. Consequently, given the heightened volatility, it is reasonable to anticipate a series of substantial liquidations in the near future.

Additionally, there has been a rise in the desire for Ethereum among “permanent holders” as indicated by CryptoQuant. These particular investors, who do not sell their assets and exclude exchange addresses, currently possess over 100,000 ETH on May 20, which is the highest amount recorded since September 2023.

On May 20, the number of Ethereum tokens flowing into cryptocurrency exchanges increased significantly, reaching a total of 62,000 tokens. A large portion of these inflows were recorded in Binance and Bybit exchanges, as reported by CryptoQuant.

According to Santiment’s data, there were approximately 18,758 whale-sized Ethereum transactions worth over $100,000 in the previous day. However, this figure has decreased by around 40% within the last 24 hours and now stands at roughly 10,689 daily transactions.

The convergence of this action with incoming investments indicates that investors are on the lookout for Ethereum ETF approval. A surge in price instability could ensue as a result of traders capitalizing on temporary gains.

At present, ETH has experienced a 1.7% increase in value over the last 24 hours and is being transacted at a price of $1,810. The market capitalization of this asset amounts to an impressive $457 billion, while its daily trading volume reaches a significant figure of $24.6 billion.

As a crypto investor, I can’t stress enough the potential impact on Ethereum if the U.S. Securities and Exchange Commission (SEC) decides to reject or delay the approval of spot Ethereum Exchange Traded Funds (ETFs). The rejection could lead to a significant downturn in Ethereum’s price, as institutional investors may hold off on investing until the regulatory uncertainty is resolved.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-05-23 11:56