According to Juniper Research, merchants around the world are expected to lose $362 billion between 2023 and 2028 due to fraud and chargebacks. To address this issue, Mastercard is aiming to make payment card digits obsolete by implementing tokenization, which has the potential to transform smartphones and cars into commerce devices. In Europe, e-commerce is planned to be 100% tokenized by 2030.

Approximately 86% of Fortune 500 executives hold that tokenization could bring significant value to their businesses, while The State of Crypto research indicates a strong optimism towards stablecoins among this group as well.

Table of Contents

The new “State of Crypto” report from Coinbase is out, providing intriguing insights as usual.

The study from the exchange revealed an optimistic outlook, highlighting that Bitcoin ETFs in the United States have attracted substantial hidden demand by enabling investors to access the largest cryptocurrency. The total assets managed in these funds currently amount to $63 billion, with Coinbase expecting strong interest in Ethereum ETFs if approved by the U.S. Securities and Exchange Commission.

Instead of focusing solely on the buoyant crypto market recovery, Coinbase’s report highlighted the significant interest and excitement amongst major American corporations towards on-chain projects.

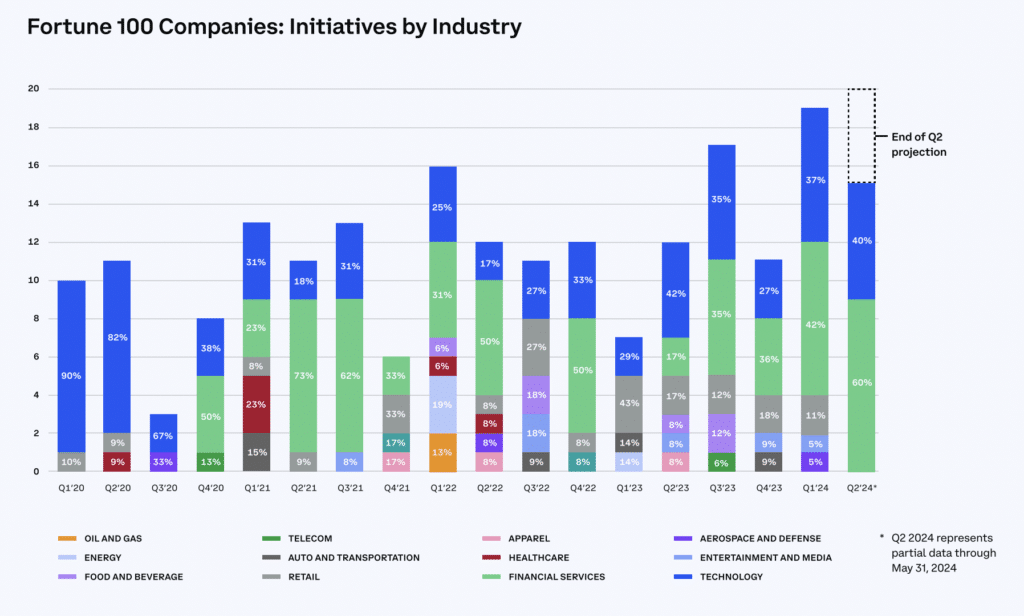

The data indicates a 39% increase in the past year for Fortune 100 companies adopting on-chain projects. Furthermore, approximately two-thirds (56%) of executives from Fortune 500 firms are now exploring and developing this technology. A significant focus lies in creating “consumer-facing payments applications.” These corporations are also prepared to invest substantial resources, with an average on-chain project budget being $9.5 million.

Based on Coinbase’s perspective, entrepreneurs are drawn to the various advantages of stablecoins and tokenization.

As a crypto investor, I’ve noticed that one of the most compelling advantages of investing in USD-pegged digital assets is the potential for instantaneous settlements. Fortune 500 executives have identified this feature as a major draw. Additionally, there’s excitement about the possibility of merchants accepting stablecoins as a payment method to reduce transaction fees. However, scalability issues that can impact major blockchains might not always allow for this cost savings. Faster transfers within businesses and seamless cross-border payments are also significant benefits.

The report highlights that the conversion of tangible assets into digital tokens has the capability to significantly alter the world economy in the upcoming years. Top executives are particularly intrigued by the advantages and applications, such as quickened transaction processing, heightened efficiency, increased transparency, smoother regulatory frameworks, and revitalizing loyalty programs for enhanced customer interaction. Coinbase estimates that the worth of tokenized assets could reach a staggering $16 trillion by the onset of the next decade – a figure equivalent to the EU’s total GDP.

Tokenization in action

As a researcher exploring the world of cryptocurrencies and tokenization, I can’t help but echo the popular sentiment in this space: “We’re just scratching the surface” when it comes to realizing the full potential of tokenization. A multitude of applications remain unexplored. Among the companies leading the charge is Mastercard, known for its grand objectives in this area.

This week, the leading payments company announced plans to significantly update the electronic commerce sector, with the ultimate goal of eliminating the requirement for lengthy credit card number entry during online purchases.

As a crypto investor, I can tell you that this technology is about so much more than just making online shopping slightly faster for consumers. In fact, it could potentially be a game-changer when it comes to combating fraud. With the increasing use of artificial intelligence and the growing demand for e-commerce in emerging markets, the number of false and illegal transactions taking place online has reached alarming levels. According to reports from Mastercard and Juniper Research, merchants worldwide are projected to lose a staggering $362 billion between 2023 and 2028 due to these fraudulent transactions.

Mastercard aims to render the standard 16-digit numbers on payment cards outdated by introducing a secure token as their replacement. The firm is convinced that this technology, known as tokenization, could also convert everyday items like smartphones and cars into effective commercial tools, significantly expanding the horizons of contactless payments.

According to the company’s strategy, e-commerce transactions will be completely converted to digital tokens in Europe by the year 2030. Valerie Nowak, Mastercard’s executive vice president, views this development as beneficial for all parties involved – shoppers, retailers, and card issuers.

“The use of tokenization in Europe is on the rise, and its benefits – including ease of use and lower risk of fraud – make it an attractive option.”

Valerie Nowak

Moving back to Coinbase and its recent report, it’s worth mentioning that on-chain government securities have gained significant traction as a preferred use case. The value of tokenized U.S. Treasury products has surged to $1.29 billion, marking a staggering 1,000% growth since the beginning of last year.

As a financial analyst at Franklin Templeton, I can tell you that our adoption of cryptocurrency and tokenization technology is not a choice, but rather a necessary step to remain competitive and innovative in today’s rapidly evolving financial landscape. Our groundbreaking tokenized money market funds are just one example of how we’re harnessing this technology to better serve our clients and stay at the forefront of the industry.

“The market infrastructure we’ve been utilizing for issuing, trading, and constructing asset portfolios is over half a century old. However, with blockchain technology, there are innovative solutions that significantly enhance this infrastructure. These include reducing processing times, providing real-time data, and enabling continuous trading, as businesses today function globally around the clock.”

Sandy Kaull, Franklin Templeton’s head of digital assets

Approximately 86% of Fortune 500 executives consider tokenization to be beneficial for their businesses based on the report’s findings.

The power of stablecoins

In other parts, Coinbase acknowledged the growing significance of stablecoins in the world economy. Notably, daily transfer volumes for these digital currencies surpassed previous records and reached an astounding $150 billion during the first quarter of the year. It’s important to mention that Coinbase holds an investment in Circle, the issuer of USD Coin.

The authors of the report noted that the corporations managing USDC and USDT currently possess massive quantities of U.S. Treasury bills as reserves – a collective amount comparable to those held by Norway, Saudi Arabia, and South Korea.

At the same time, there have been significant strides made towards streamlining the experience of utilizing stablecoins for those less accustomed to dealing with digital currencies.

Merchants using Stripe now have the ability to receive USDC payments through Circle, which can be processed via Ethereum, Solana, and Polygon networks. These transactions will be automatically converted into fiat currency. PayPal enables cross-border transfers for stablecoin users in approximately 160 countries without charging any transaction fees.

Coinbase

As a crypto investor, I’ve noticed that remitting funds back home to loved ones can be a lengthy and costly process for foreign workers. However, using stablecoins could provide a more efficient and equitable solution. Stablecoins are digital currencies that maintain a stable value, pegged to traditional assets like the US Dollar. By leveraging these coins for remittances, transactions could be processed faster than through conventional banking methods, ultimately saving time and resources for both sender and receiver.

According to Coinbase’s estimation, the global cross-border payments market amounts to a staggering $860 billion. However, when making transactions through conventional methods, individuals may be subjected to fees reaching up to 6.39%. This equates to approximately $55 billion annually being potentially lost to these high charges. In simpler terms, this significant sum could have benefited countless hard-working consumers, their loved ones, and local economies instead.

An intriguing example emerged from Compass Coffee, a chain based in Washington D.C. As more customers opted for card payments instead of cash, Compass grew tired of the substantial transaction fees they were required to pay. These fees represented funds that could have been utilized to enhance their business. In response, they introduced stablecoins as an alternative payment option.

As a business analyst, I believe that embracing crypto payments, specifically USDC, has the potential to significantly revolutionize our business operations. By doing so, we aim to contribute to the evolution of retail experiences.

Michael Haft, Compass Coffee founder

Challenges that lie ahead

Although there’s much cause for optimism and significant momentum in the cryptocurrency sector, Coinbase issued a caution that various external influences could hinder forward progress.

As a crypto market analyst, I strongly believe that the heightened level of activity in the cryptocurrency space necessitates the establishment of transparent and well-defined regulations for the industry. By doing so, we can ensure that American crypto developers and other skilled professionals are encouraged to stay within our borders, upholding the potential benefits of improved access and innovation. Furthermore, clear-cut rules will position the U.S. as a leader in the global crypto landscape, ensuring a competitive edge in this rapidly evolving market.

Coinbase

Demonstrating the significant effect of regulatory immobility that has caused numerous businesses to relocate, the exchange highlighted a troubling 14-percentage point decrease in American crypto developers since 2019. Consequently, only approximately one quarter (26%) of these professionals now reside in the United States.

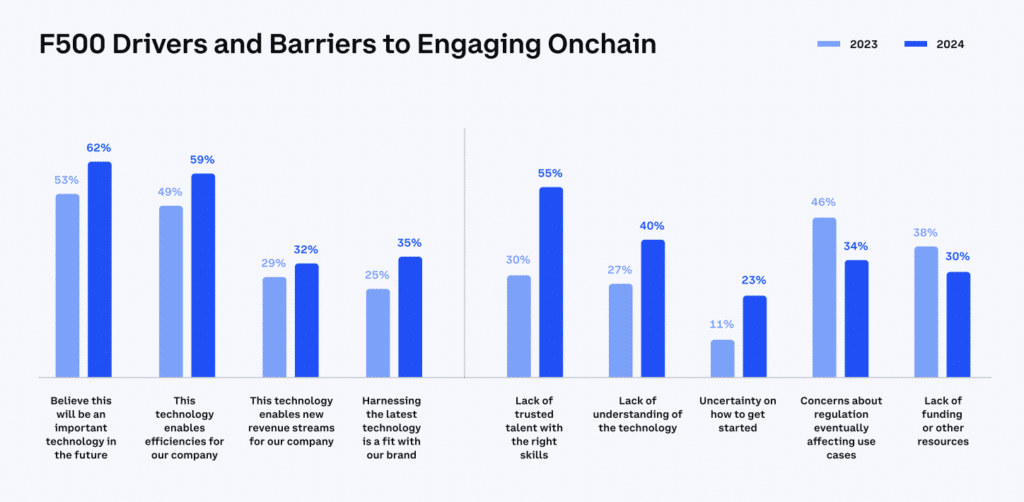

As a researcher studying the adoption of on-chain projects among Fortune 500 companies, I’ve discovered an intriguing trend: Nearly six in ten executives (55%) identified a shortage of trustworthy talent with the necessary skills as the most significant obstacle preventing them from implementing such projects. This is a notable increase compared to the 30% reported in 2023.

As cryptocurrency-friendly regulations progress in Congress, and the SEC becomes more lenient towards Bitcoin and Ether ETFs, it’s noteworthy that the number of entrepreneurs viewing regulation as an obstacle has dropped significantly. Only 34% of entrepreneurs now identify regulation as a barrier – a decrease of 12 percentage points compared to the previous year.

In the upcoming presidential election, digital assets have emerged as a contentious topic. Previously, Donald Trump expressed his dislike for Bitcoin due to its competition with the US dollar. However, Trump has now voiced his intention to claim all the 1.3 million remaining Bitcoins that can be mined within the US borders. There are indications that Joe Biden is also considering accepting crypto donations from supporters.

I’ve noticed that Coinbase is increasingly advocating for the cryptocurrency industry on its own behalf. Moreover, they are providing their clients with the necessary tools to amplify their voices in related matters.

Despite the volatile past few years, crypto is currently experiencing a remarkable recovery.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-06-13 20:21