As an experienced analyst, I believe that UNI’s recent price surge can be attributed to a combination of factors. The enigmatic X post from Uniswap Labs hinting at the addition of a new Layer-2 blockchain to Uniswap has undoubtedly fueled speculation and excitement within the crypto community. While the specific L2 protocol has not been disclosed yet, there is strong speculation that it could be ZKsync, which has gained a reputation for scalable, low-cost Ethereum transactions.

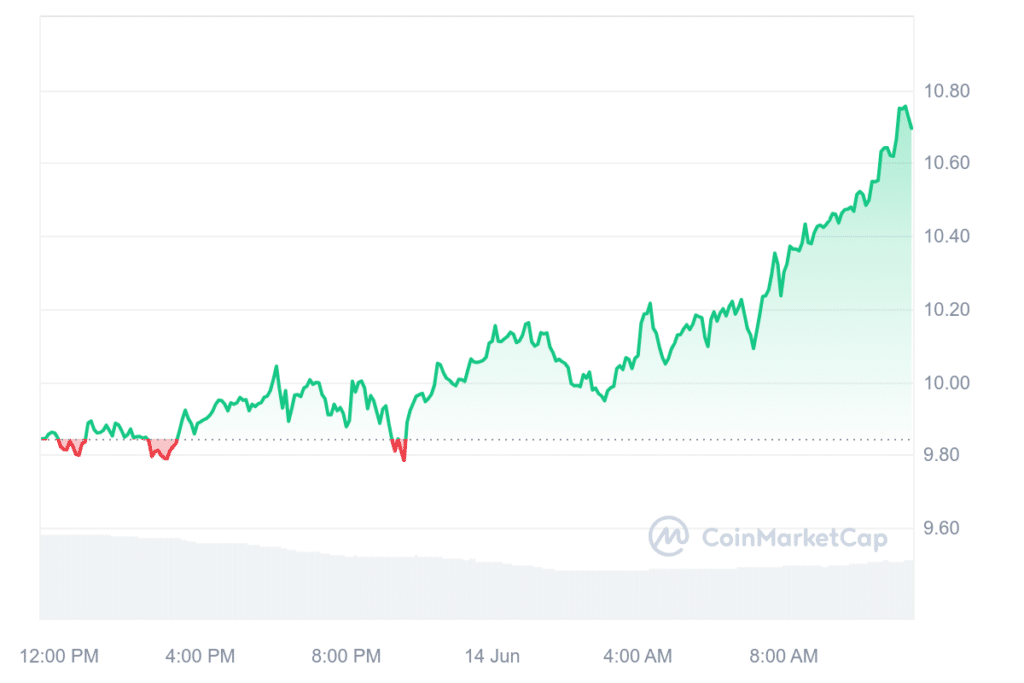

The native token of Decentralized Exchange (DEX) Uniswap, referred to as UNI, has experienced a 9% increase, making it the leading gainer within the crypto market today.

Currently, UNI is priced at $10.69 during my writing, marking an 8.5% increase in value over the last 24 hours. Simultaneously, UNI’s trading volume saw a significant decrease of approximately 31%, potentially signaling that existing investors are keeping their tokens, anticipating potential price growth.

At present, the market capitalization of Uniswap has grown to a staggering $6.4 billion according to CoinMarketCap’s figures, positioning its token as the 18th most valuable crypto asset in existence.

As an analyst, I’ve noticed an intriguing development in the price trend of the decentralized exchange recently. On June 14, they shared an enigmatic X post with the message “Locked in. Ready for the Endgame.” This cryptic statement was accompanied by an image of a man intently focused in his chair, a meme commonly used by gamers to indicate heightened seriousness or anticipation.

The post from June 1 indicated that Uniswap v2 was preparing to integrate with a new Layer-2 blockchain in the future.

Locked in.

Ready for the Endgame.

— Uniswap Labs 🦄 (@Uniswap) June 13, 2024

As a researcher delving into the intricacies of cryptocurrency, I’ve come across various theories within the community regarding the potential implementation of X on the Ethereum blockchain. One particularly promising contender is ZKsync – an acclaimed trustless Layer 2 solution. Known for delivering scalable and affordable transactions on Ethereum, ZKsync has garnered significant attention in this space.

At the same time, several individuals within the community voiced their concerns about the proposed implementation on ZKsync.

I’m an analyst, and I strongly advise against getting involved with this supposed project of yours. We once had high hopes for you due to your fairdrop distribution that pleased many users. However, the recent turn of events has revealed a long-term scam that has gone on for the past four years, and things have taken a turn for the worse in these last few days. #zkscam #zksyncscam

— behnamsasani (@BehnamSasani) June 14, 2024

As an analyst, I’ve identified another potential explanation for the recent spike in UNI’s price. Notably, there has been significant growth in the volume of transactions processed on the second layer (L2) of the Uniswap Protocol. This development was brought to light in a June 13 post on the Uniswap Labs blog.

I analyzed the data from Dune, the analytics platform used by Uniswap’s team, and found some intriguing patterns. It took 22 months for our platform to reach a market capitalization of $100 billion. Subsequently, we hit the $200 billion mark in only 10 months. Most remarkably, it took just 3 short months to surpass the $300 billion milestone. The exponential growth of Uniswap underscores the increasing utility and adoption of our decentralized finance (DeFi) services within the industry.

As a data analyst, I’ve come across some intriguing insights from a User X with the pseudonym “Kyledoops.” Notably, there has been a significant surge in the usage of Uniswap v2 pools on various Layer 2 (L2) solutions such as Optimism, Arbitrum, and Polygon.

Uniswap v2 swimming pools are gaining traction on Layer 2 platforms such as Optimism, Arbitrum, and Polygon. This surge can be attributed to the increasing need for scalability, reduced transaction fees, and enhanced user experience. Although Ethereum continues to dominate decentralized finance (DeFi), these L2 networks offer significant improvements in these areas.

— Kyledoops (@kyledoops) June 13, 2024

As a crypto investor, I’ve noticed a growing preference towards these platforms due to their potential for expansion, lower transaction costs, and improved user interfaces. This trend is adding fuel to the demand for Uniswap’s services.

As a researcher studying the decentralized finance (DeFi) landscape, it’s clear that Ethereum remains at the forefront of innovation. Nevertheless, I’ve observed an intriguing development: the integration of Layer 2 (L2) networks with Uniswap. This fusion is accelerating transaction speeds and reducing costs, making these networks increasingly competitive in the rapidly evolving crypto sphere.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-06-14 12:30