As a researcher with experience in the crypto market, I have closely monitored Ripple’s (XRP) underperformance this year compared to other cryptocurrencies like Bitcoin and top ten digital assets. The disappointing performance is evident from XRP’s crash of over 20%, while Bitcoin has surged by almost 50%.

As a researcher studying the crypto market trends in 2024, I’ve noticed that Ripple (XRP) hasn’t kept pace with the broader crypto market this year. In contrast to Bitcoin‘s nearly 50% surge, XRP has taken a hit, dropping over 20%. Compared to other top ten cryptocurrencies like Toncoin, Ethereum, and Binance Coin, XRP has underperformed significantly in terms of price growth.

As a researcher studying the cryptocurrency market, I’ve observed that XRP‘s price growth has lagged significantly behind Bitcoin’s impressive surge of over 100% in the last 12 months. The underperformance of XRP versus newer meme coins like Floki, Pepe, Book of Meme, and Brett has left long-term investors feeling disappointed.

Despite the efforts made by Ripple’s developers to enhance its value, the cryptocurrency’s performance has trailed behind the market. One of their recent initiatives includes the launch of an XRPL EVM sidechain, which can process over a thousand transactions per second. Last week, they announced their plan to employ Axelar as the bridge protocol for this platform.

I, as a crypto investor, am making the switch to Axelar Network for its proven security and superior efficiency in handling cross-chain transactions. According to Ferran Prat, the CEO of Peersyst, Axelar serves as a robust and battle-tested bridge that allows XRP to function as a native currency on the XRPL EVM Sidechain.— RippleX 📍#XRPLApex (@RippleXDev) June 12, 2024

As a crypto investor, I’ve noticed that Ripple faces a significant hurdle in the Ethereum Virtual Machine (EVM) market, which has become incredibly congested with numerous competitors. Consequently, even established players like IOTA and EOS have struggled to hold their own.

Ripple intends to introduce its own stablecoin, which will be linked to the value of the US dollar. However, it’s important to note that the stablecoin market is fiercely competitive. Merely having a well-known brand name does not ensure success. For instance, PayPal’s PYUSD has a relatively small market capitalization of $414 million compared to USD Coin and Tether.

The XRP price has lagged behind due to limited interest from traders and users. Instead, the crypto market’s attention is largely drawn towards meme coins such as Pepe, Book of Meme, and Brett.

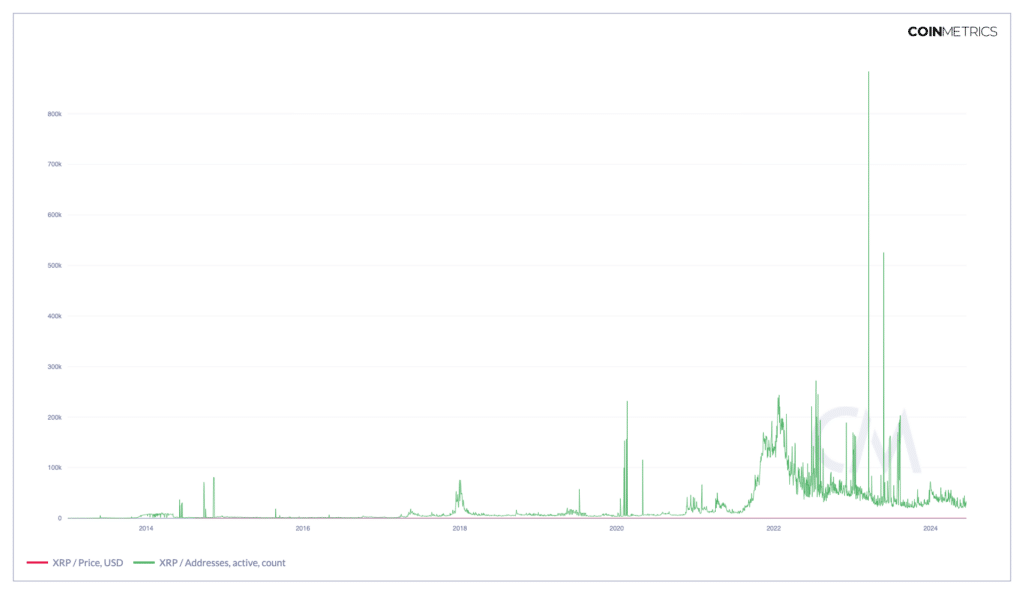

As a researcher studying blockchain data, I’ve observed a significant decline in both the number of active accounts and transactions taking place on the network this year.

Ripple’s active addresses

As an analyst, I’ve noticed that despite Ripple’s legal victory against the Securities and Exchange Commission (SEC) last year, the company has not attracted a significant number of financial services firms to adopt its platform, specifically for its On Demand Liquidity (ODL) solution. The query among experts is whether there exists robust demand for Ripple’s ODL at a time when major banks like JPMorgan and ANZ are actively exploring tokenization projects of their own.

From my perspective as a crypto investor, the performance of Ripple’s XRP has been disappointing due to a lackluster interest from both individual traders and institutional buyers. Additionally, there are lingering concerns regarding the success of their growth initiatives such as the adoption of the Ethereum Virtual Machine (EVM) and the development of stablecoins.

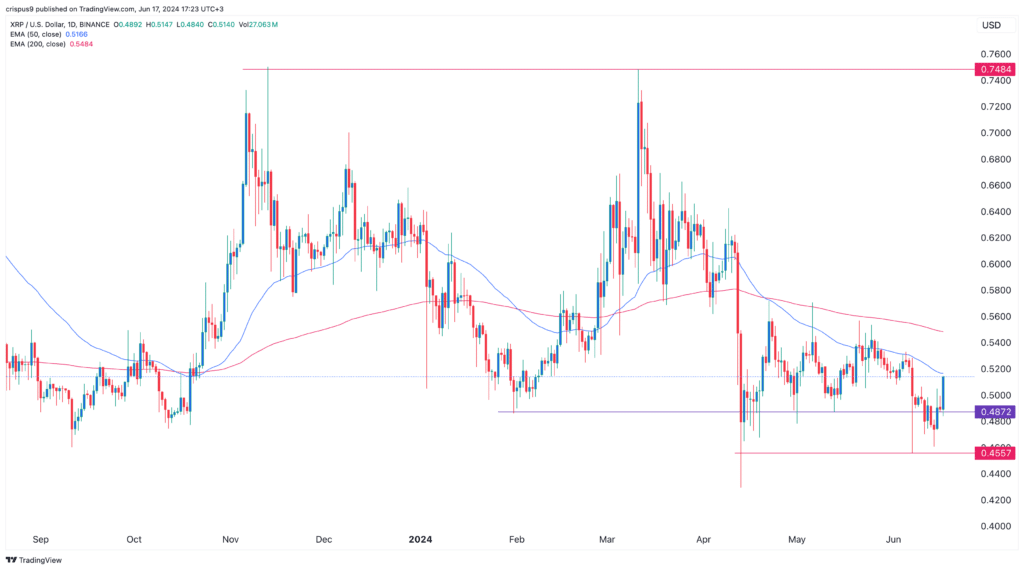

XRP price forecast

A significant cause for XRP‘s decline was the formation of a double-top pattern around $0.7484, which marked its peak prices on November 13th and March 13th. In technical analysis, a double-top is a bearish indicator signaling potential price drops. Currently, XRP hovers slightly above its neckline at $0.4872.

On April 14th, the graph of Ripple’s price displayed a death cross event. This occurs when the shorter-term 50-day Exponential Moving Average (EMA) falls below the longer-term 200-day EMA.

Although XRP has bounced back in the previous two days, its overall trend remains pessimistic. The upcoming resistance level to keep an eye on is at $0.4872. A decline beneath this mark will suggest further losses, with sellers aiming for the subsequent support at $0.4557.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-06-17 18:36