As a seasoned crypto investor with a keen interest in regulatory developments, I couldn’t agree more with Vitalik Buterin’s concerns regarding the current state of cryptocurrency regulation in the U.S. His recent comments on Warpcast highlight the inconsistencies and challenges faced by projects that aim to provide transparency and clarity about returns and rights.

Vitalik Buterin, a co-founder of Ethereum (ETH), has openly criticized the approach of the United States towards regulating cryptocurrencies.

During a conversation on Warpcast, Vitalik Buterin expressed his viewpoint that the existing regulatory framework tends to foster initiatives which make broad, unsubstantiated promises of profits.

As a crypto investor, I would interpret Buterin’s argument as follows: If the regulatory focus is on classifying crypto returns and rights as securities, then it becomes crucial for us to prioritize creating tokens with robust economic value. This approach can help ensure long-term success in the crypto market.

Furthermore, Ethereum’s co-founder emphasized that this transition necessitates earnest cooperation between regulatory bodies and the cryptocurrency sector.

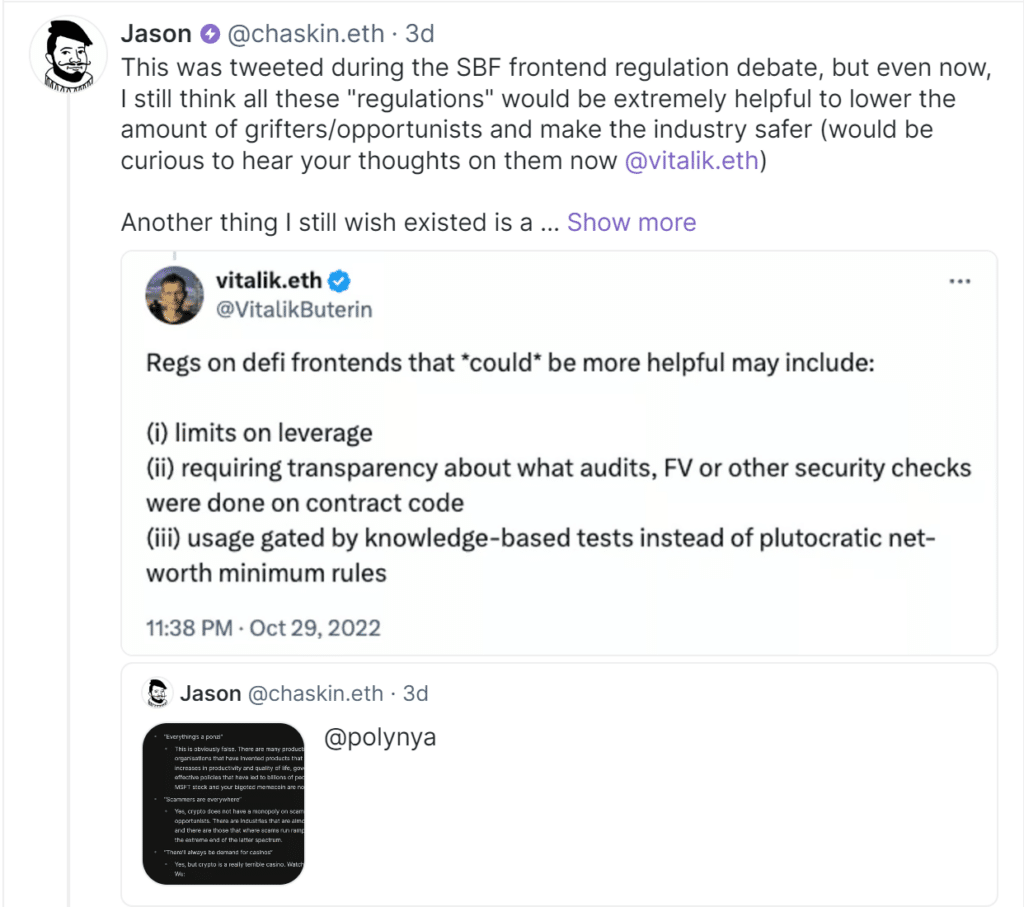

On June 28, a representative from the Ethereum Foundation named Jason initiated a discussion on Warpcast, referring back to a tweet by Vitalik Buterin from 2022 during the heated debate surrounding Sam Bankman-Fried’s suggested frontend regulations.

Buterin proposed some guidelines for the user interfaces of decentralized finance (DEFIs) in a tweet, which if implemented, could minimize the presence of unscrupulous actors and improve security within the industry.

The provisions encompassed setting boundaries for contractual borrowing power, requiring disclosures regarding audits and security assessments of coding, and access control through knowledge quizzes instead of wealth requirements.

When posting the content, Jason expressed his continued faith in Buterin’s regulatory proposals and requested an update from the Ethereum co-founder regarding his present views on the subject.

Jason proposed an additional feature – a pop-up providing real-time information about a coin’s token distribution and top holder transactions, with direct access to Etherscan for verification.

In my analysis as of June 29, I, Buterin, underscored the fundamental challenge of cryptocurrency regulation, specifically in the United States context.

Projects with unspecific promises can function without much oversight, but those that clearly disclose details about returns and investor rights typically fall under securities classification and are subject to more stringent regulations. This situation, as he described it, poses a harmful paradox for the crypto industry.

As a crypto investor, I’ve noticed that one of the most perplexing aspects of cryptocurrency regulation, particularly in the U.S., is the seemingly paradoxical nature of securities classification. It seems that if you engage in activities that appear vague or lack substance, you are essentially unregulated. However, once you offer a clear narrative about where potential returns originate and outline specific rights for your clients, you suddenly find yourself labeled as a security. This can be frustrating, as it places a significant burden on those who aim to provide transparency and certainty in their offerings.

Vitalik Buterin, Ethereum co-founder

As a analyst, I can tell you that, according to Buterin, it would be beneficial for there to be regulations in place that increase the risks associated with launching a token without a well-defined long-term value proposition.

As a researcher studying the crypto token market, I believe that offering a clear and long-term perspective, as well as sticking to established best practices, can bring about a sense of safety for these digital assets. However, achieving this goal relies heavily on active collaboration between regulatory bodies and the industry at large.

In response to a recent US court ruling on June 28th, which dismissed the SEC’s argument that transactions involving Binance‘s BNB token amounted to securities sales, Vitalik Buterin made some comments.

As a crypto investor, I’ve observed that the recent regulatory decision was significantly shaped by the SEC versus Ripple case. In this landmark ruling, the focus on the economic realities of transactions when applying the Howey Test became crystal clear to me. The SEC emphasized that the key consideration is not just whether there is an investment contract in place, but also whether the transaction involves a common enterprise and an expectation of profits derived from the efforts of others. This perspective has important implications for the crypto space, as it underscores the need to carefully assess the economic realities behind each transaction.

In a notable decision, the judge determined that transactions involving the sale of Binance Coin in secondary markets do not fall under the category of securities, bringing about a triumphant outcome for crypto traders.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-06-30 16:14