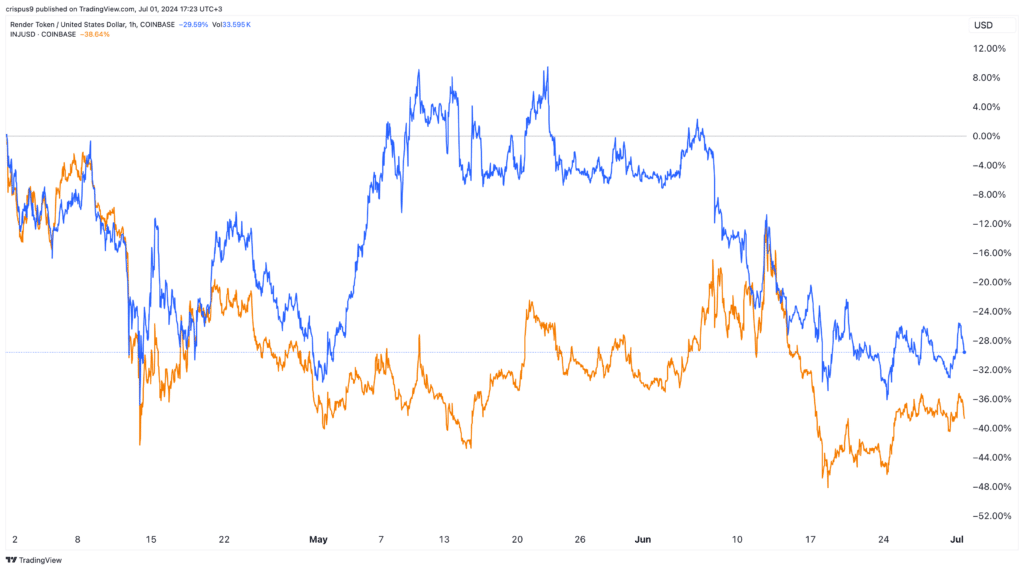

As a researcher with experience in the cryptocurrency market, I’ve observed the bearish trend of Injective (INJ) and Render Token (RNDR) prices since March. Both cryptocurrencies have dropped significantly, with INJ down over 56% from its year-to-date high and RNDR down by over 44%. These declines have brought their market caps to $2.14 billion for Injective and $2.9 billion for Render.

The prices of Injective (INJ) and Render Token (RNDR) have been in a prolonged downturn since March, with previous efforts to recover encountering significant resistance. As of Monday, the price of Render was $7.5605, representing a decline of more than 44% from its peak value this year. Consequently, their combined market capitalization exceeded $2.9 billion.

The venture-funded blockchain startup Injective, which gained significant attention in 2023, experienced a decline of more than 56% since reaching its highest point this year. As a result, its market capitalization has shrunk from approximately $4.86 billion in March to $2.14 billion.

As a cryptocurrency market analyst, I’ve observed that my holdings in certain digital currencies have mirrored the price movements of popular meme coins such as Cardano, Solana, and Chainlink.

Injective vs Render tokens

Analyst turns bullish on Render and Injective

An influential analyst, with a large following of over 33,000 people on X, has forecasted that both INJ and RNDR could experience significant price increases in the future. Specifically, Sensei anticipates that INJ will surge to reach $100, which represents an impressive potential gain of approximately 340% from its current value.

The analyst is similarly optimistic about the future value of Render token, predicting a significant increase to $150, representing a potential 2,000% growth from its current price. Additionally, he holds positive views towards Oasis Network (ROSE) and Bittensor (TAO), anticipating their prices to reach $2 and $1,000 respectively.

$ROSE is going to $2-3$TAO is going to $1,000$RNDR is going to $150$INJ is going to $100— Sensei (@SenseiBR_btc) July 1, 2024

As a crypto investor, I focus my analysis on both the fundamental and technical aspects of a token before making an investment decision. Regarding Render Token, I observed that its monthly chart displayed a cup and handle pattern. This technical formation is typically followed by a rebound or breakout, depending on whether the support at the upper side of the pattern holds firm. Therefore, I believe there’s a potential for a bounce back in the price of Render Token based on this pattern and support level.

INJ and RNDR have headwinds

Essentially, Injective and Render are encountering significant challenges. Injective, a finance industry blockchain network, has experienced a decrease in asset volume over the past few months. Following a peak of $204 million in March, its assets have dropped to $114 million, which is their lowest point since February 17th.

In the past month, notable figures such as Hydro Protocol, DojoSwap, and Mito Finance have experienced a decline of more than 10% in the value of their assets.

Despite handling over $59 million in transactions within the last 24 hours, Helix remains the leading Decentralized Exchange (DEX) with a staggering $1 billion worth of INJ tokens staked on its blockchain, as reported by developers.

Alternatively, Akash Network poses significant competition for Render Network, as it provides decentralized GPU capabilities.

Additionally, many alternative coins face the challenge of minimal market-impacting developments within the cryptocurrency sector. There’s growing apprehension that another crypto winter similar to the one experienced between November 2021 and November 2022 might be imminent.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Seven Deadly Sins Idle tier list and a reroll guide

- Hero Tale best builds – One for melee, one for ranged characters

2024-07-01 17:40