As an analyst with extensive experience in the crypto market, I believe that the current decline in Bitcoin’s value is only temporary and should be viewed with a long-term perspective. The recent approval of spot Bitcoin ETFs in January sparked significant interest from professional investors, leading to a surge in demand for Bitcoin. However, this euphoria was followed by a natural price correction after the rally.

As we approach the midpoint of the year 2024, uncertainty looms large among Bitcoin investors, as the cryptocurrency experiences a downturn following its record-breaking peak in March.

Table of Contents

Based on Bloomberg’s report, Bitcoin (BTC) has experienced a approximate 13% decrease in value since March, following significant gains of 67% and 57% in the preceding quarters. With Bitcoin’s price decline, concerns have arisen about whether these trends suggest a more cautious approach to risk-taking as investors brace for the possibility of increased interest rates and their longer-term implications on financial markets.

As a researcher studying the crypto market, I’d interpret Austin Reid’s perspective as believing that the current uncertainty is merely a transient phase. One potential solution he suggests for mitigating heightened interest is a deceleration in the demand for Bitcoin spot exchange-traded funds (ETFs).

Matthew O’Neill, the research co-director at Financial Technology Partners, is of the opinion that the green light given to spot Bitcoin ETFs in January ignited market excitement, leading to a subsequent price adjustment as the elation subsided.

As a seasoned crypto investor, I’ve observed a significant surge of interest among professional investors in Bitcoin ETFs. These investors sought a more institutional approach to gaining exposure to Bitcoin. Currently, with Bitcoin prices taking a dip, I view this as an opportune moment to add more BTC to my portfolio at attractive prices, anticipating further price increases in the future.

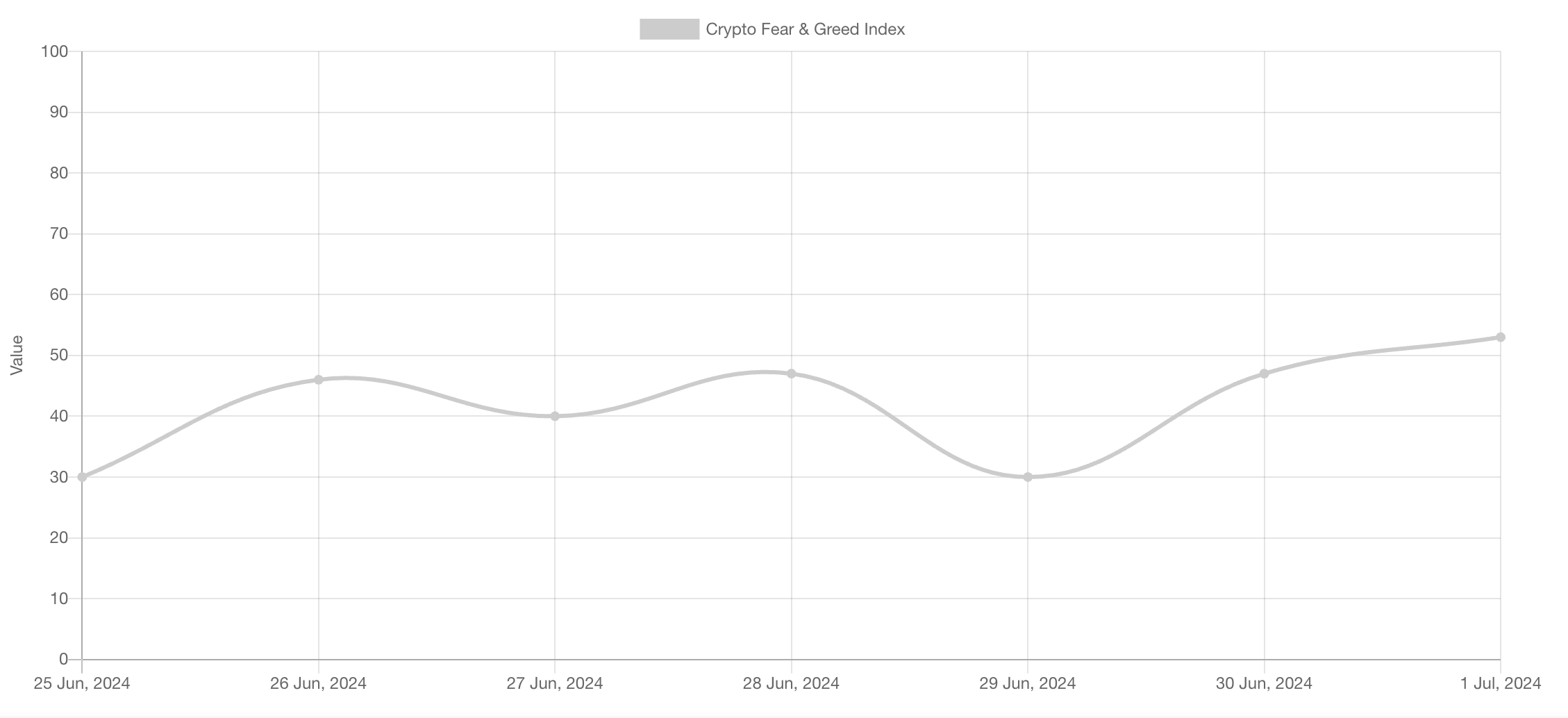

Fear and Greed Index records sharp decline

As a researcher studying the crypto market trends, I’ve noticed that last week, on June 25, the index measuring fear and greed experienced a significant drop to a level of 30 points – a figure not seen since September 2023.

As an analyst, I’ve noticed that the index took a turn towards fear during a broader crypto market downturn. Bitcoin plummeted from $62,500 to $59,100, pulling other assets along with it. This slide occurred following reports of clients receiving compensation for their losses in the Mt. Gox hack incident.

Expert note: Willy Wu, a seasoned blockchain analyst, identified a “progressive chain reaction of sell-offs” in Bitcoin (BTC). He attributed the recent plunge to new lows at a 53-day low to miner exhaustion following the Bitcoin halving event in April.

Speculators continued buying new contracts, amplifying the effect of existing ones and triggering more sell-offs in a chain reaction known as a long squeeze. We reached the grouping of 58,000 contracts that were recently liquidated.

— Willy Woo (@woonomic) June 24, 2024

As an expert in the field of cryptocurrencies, I have observed that miners have been offloading Bitcoin due to the unprofitability of using outdated equipment. I believe that the next noteworthy resistance level for Bitcoin lies at $54,000. If the cryptocurrency dips below this point, there’s a possibility that the market could shift into a bearish trend.

What will happen to the Bitcoin ETF?

Based on data from CoinShares, approximately $2.6 billion was invested in Bitcoin ETFs during the second quarter, marking an increase from the first quarter’s $13 billion inflow. Following a series of outflows, Bitcoin spot ETFs demonstrated positive growth towards the end of June.

Against the volatile backdrop of cryptocurrency investment products, there’s been a shift in market direction with over $1 billion being withdrawn in the last two weeks, according to CoinShares. However, increasing investments in spot Bitcoin Exchange-Traded Funds (ETFs) may indicate a revived interest from investors in this asset class and potentially mark the beginning of a new chapter in the cryptocurrency market landscape.

Currently, the majority of interest has shifted towards the Ethereum ETF. As per a recent assessment from Citi, there was an influx of over $13 billion into Bitcoin ETFs. This substantial investment led to a significant surge in Bitcoin’s price; according to their findings, for every $1 billion invested, Bitcoin’s value rose by approximately 6%.

Based on the bank’s estimation, the introduction of Ethereum Exchange-Traded Funds (ETFs) is projected to draw in investments ranging from $3.8 billion to $4.5 billion within the same timeframe. As a result, ETH‘s price might surge by approximately 23% to 28%. Consequently, ETH could reach a value of around $4,417 by November this year.

Will the situation improve?

Based on their analysis, the team of experts at CryptoQuant anticipate a bullish trend in the cryptocurrency market during the third quarter of 2024.

The decreasing selling pressure from Bitcoin miners implies that they may be holding back on selling their newly mined coins. If the market manages to absorb all of this selling volume, there’s a chance for another surge in the price increase. – By @DanCoinInvestor

— CryptoQuant.com (@cryptoquant_com) June 28, 2024

Analysts explained that the upward rally would continue again if miners completed the sale of BTC.

According to CryptoQuant’s analysis, the recent downward trend in the cryptocurrency market can be attributed, in part, to mining operations. Following the halving event, miners experienced a decrease in profitability from their activities, resulting in mass selling of their crypto holdings.

As a miner, I’ve noticed that due to certain circumstances, my mining activity has decreased. In order to meet the ongoing expenses associated with Bitcoin mining, I have started selling Bitcoins on the over-the-counter market.

Raoul Pal, a former CEO of Goldman Sachs, anticipates substantial cryptocurrency expansion towards the end of 2024. He explained that traditionally riskier assets such as Bitcoin tend to perform well during the political climate surrounding the United States presidential election.

Experts continue to predict a positive outlook for Bitcoin’s mid-term trajectory. Yet, there has been a deceleration in its growth during a brief market correction.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

2024-07-01 19:18