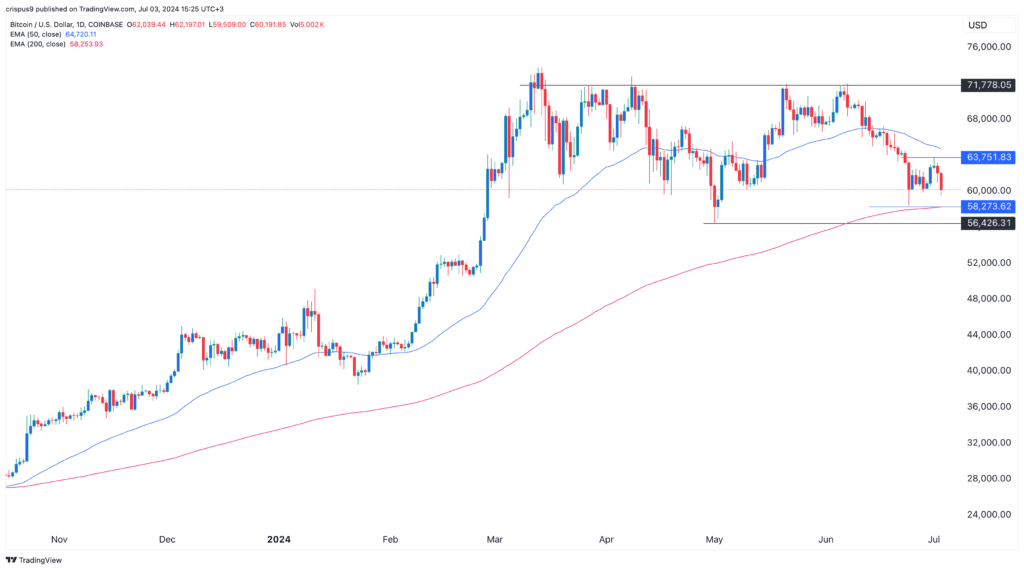

As a researcher with extensive experience in the cryptocurrency market, I cannot help but feel a sense of unease as Bitcoin (BTC) mining stocks like Riot Platforms (RIOT), Marathon Digital (MARA), and CleanSpark (CLSK) retreated in the pre-market session today. The sell-off resumed for Bitcoin after it pulled back from reaching an all-time high of $63,750 on Monday. The digital currency is now hovering dangerously close to the crucial support at $58,273, which is the 200-day Exponential Moving Average (EMA).

As a financial analyst, I’ve observed that stocks associated with Bitcoin (BTC) mining such as Riot Platforms (RIOT), Marathon Digital (MARA), and CleanSpark (CLSK) experienced a pullback in the pre-market session. This retreat can be attributed to Bitcoin itself dipping prior to the market opening.

Three cryptocurrency-linked companies, specifically RIOT, MARA, and CLSK, experienced declines exceeding 2%, whereas MicroStrategy (MSTR) and Coinbase (COIN) saw decreases of around 1.5% in their stock prices.

Bitcoin sell-off resumes

As a researcher studying the cryptocurrency market, I’ve observed that stocks tied to cryptocurrencies retreated on Wednesday following Bitcoin’s resumption of its downtrend. After reaching a peak at $63,750 on Monday, Bitcoin has since hovered around the $60,000 mark, leaving uncertainty as to whether it will rebound or continue its decline.

Bitcoin is currently hovering near a significant support level: the 200-day Exponential Moving Average (EMA), which stands at around $58,273. A drop below this point could be concerning for investors, as the next line of defense would be at $56,426 – the lowest Bitcoin price seen in May.

Bitcoin price chart

Should Bitcoin fall beneath that price, this would indicate that bears have gained control, potentially leading to further decreases towards the $50,000 mark or even lower.

As an analyst, I’ve observed that approximately 2,000 Bitcoins were transferred from a whale to Binance in two distinct transactions. Normally, deposits to cryptocurrency exchanges signify that traders are offloading their assets, thereby contributing to the decline in price.

A large Bitcoin investor, referred to as a whale, transferred approximately $62.2 million in BTC (1,023 coins) to Binance about 45 minutes ago. In the last 24 hours, this same investor deposited nearly $106 million in BTC (1,723 coins) to the exchange. Meanwhile, the value of Bitcoin has declined by around 3% over the past day. Here’s the wallet address for reference: 1J22CPni1EsmT15A9qveydfWMoPMRw9Lp3.— Lookonchain (@lookonchain) July 3, 2024

The simultaneous activity of whales in the market occurs during a timeframe where the German government is persistently disposing of its Bitcoins. On Tuesday alone, it moved coins valued at approximately $52 million to cryptocurrency exchanges.

Based on recent data from CoinGlass, there has been a noticeable increase in Bitcoin holdings in exchanges. Specifically, the quantity of Bitcoin held in these platforms grew from 2.47 million at the end of last month to reach 2.49 million on Tuesday.

Bitcoin balances in exchanges

Bitcoin mining companies at risk

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin’s ongoing sell-off could potentially jeopardize mining companies such as Marathon, CleanSpark, and Riot Platforms. Historically, these businesses have shown a strong correlation with Bitcoin’s price movements.

The reduction in the number of Bitcoins miners obtain occurs a few months following the halving event, resulting in fewer Bitcoins being dropped.

To make up for this decline, many companies have responded by increasing their mining capabilities. For instance, CleanSpark, with a hash rate of 20 EH/s, managed to mine 445 coins in June as opposed to the 417 coins mined in May. This significant growth was achieved after the acquisition of five mining sites located in Georgia.

As a researcher examining Marathon Digital’s mining performance, I discovered that they extracted approximately 590 digital coins in June 2024. This figure represents a significant decrease of around 40% compared to the same month in the previous year, and no change from the previous month, May 2024.

Instead of “Riot Platforms, on the other hand, has focused on acquiring Bitfarms, a company that mined 189 different coins in June,” you could say:

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Castle Duels tier list – Best Legendary and Epic cards

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

2024-07-03 16:07