As a researcher with experience in the cryptocurrency market, I believe that the Bitcoin bull cycle will continue until early next year. However, for those trading in spot, it would be wise to dollar-cost average (DCA) while keeping in mind that it could drop to $47k from here. If you are not an experienced futures trader, do not open high-leverage long or short positions.

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin‘s price has experienced a significant decline and entered a bear market in recent weeks. Numerous factors have contributed to this trend, including but not limited to regulatory crackdowns, negative sentiment from major players, and economic instability.

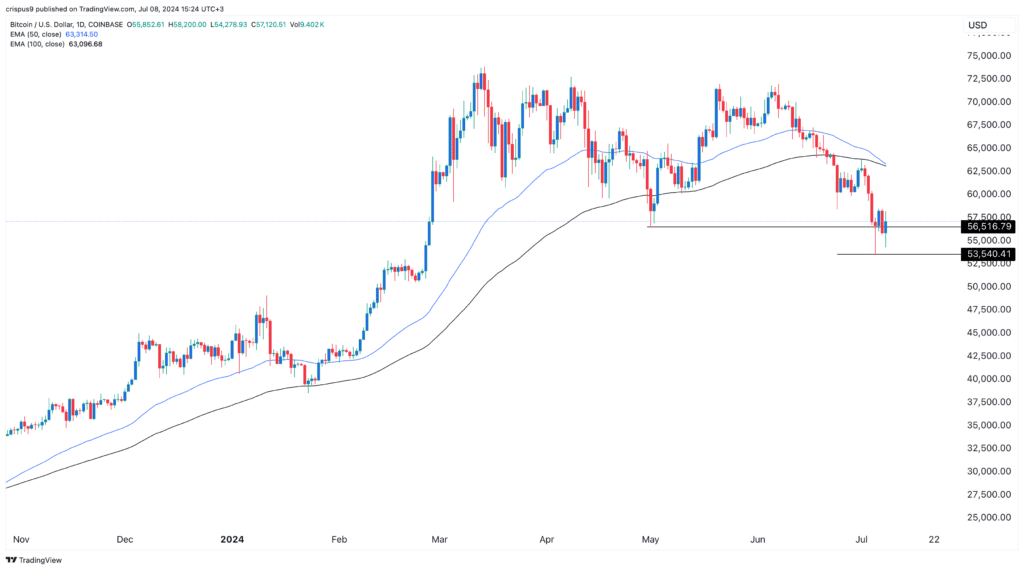

Last week, Bitcoin plunged to a low of $53,540 – its cheapest point since February. However, it has since bounced back slightly, with a current value of $57,200 as of Monday. This volatile price action in Bitcoin has sparked debates among cryptocurrency analysts. While some remain optimistic about the coin’s continued bullish trend, others believe that the recent downturn is a sign of things to come.

As a financial analyst at Standard Chartered, I believe Bitcoin is on track to surpass the $100,000 mark by year-end. This projection represents a potential increase of roughly 75% from its current value.

Analysts base their perspective on the persistent institutional interest and the strong likelihood of Donald Trump’s victory in the upcoming US presidency. Trump has been attracting the crypto community with his pledge to adopt favorable regulations for the sector.

He has secured financial support for his campaign from the Winklevoss Twins and Jesse Powell, the creator of Kraken.

Ki Young Ju, founder of CryptoQuant, a renowned on-chain analytics firm, commented that the ongoing bullish trend in cryptocurrencies remains robust. Despite predicting a potential dip to $47k, he is optimistic that the bull market will persist into next year, reaching a peak of $112k.

I’m confident that the #Bitcoin bull market will persist until the beginning of next year. For those dealing in spot trading, it would be prudent to implement Dollar Cost Averaging (DCA), while being aware that the price could dip as low as $47K before then. If you’re not an experienced futures trader, I strongly advise against opening high-leverage long or short positions.

— Ki Young Ju (@ki_young_ju) July 5, 2024

Experts have identified additional factors that could cause Bitcoin’s price to surge again. One such factor is the strong possibility that the Federal Reserve will reduce interest rates following the release of last week’s employment figures.

As a crypto investor, I’ve reviewed the latest employment report, and it indicated that our economy managed to create over 200,000 new jobs last month. However, the unemployment rate took an unexpected turn and increased to 4.1%. This surprising data shift has caused some analysts at renowned financial institutions like Citigroup and ING to forecast the Federal Reserve’s decision to initiate interest rate cuts as early as September.

The reduction in federal interest rates is beneficial for Bitcoin investment, with significant implications. Approximately $6.15 trillion is currently held in money market funds, representing risk-averse investors. In due course, these investors might consider shifting their investments towards riskier assets, such as tech stocks and Bitcoin.

Bitcoin price crash could continue

Some cryptocurrency analysts hold a contrasting view, predicting that Bitcoin’s price may still decrease. The prevailing reason given is that the coin has dipped below the neckline of the double top chart pattern, suggesting further declines as investors aim for the significant support level at $44,000.

As an analyst, I’ve been observing the Bitcoin price action closely. Based on the chart patterns, it does appear that we may have seen a double top formation if the recent high around $65,000 is confirmed as such by a subsequent decline below the previous high at $64,800. Should this occur, a potential target for the correction could be around the $44,000 level. However, it’s important to note that technical analysis should not be the sole determinant of investment decisions and other factors such as market sentiment and news events can also significantly impact price movements. Therefore, I would recommend conducting thorough research before making any investment decisions based on this analysis.

— Peter Brandt (@PeterLBrandt) July 7, 2024

Bears drew attention to several factors contributing to the ongoing Bitcoin price drop. Among them were the German government’s liquidations, transactions from large Mt. Gox wallets, and signs of miner capitulation. For instance, according to LookOnChain, a significant Bitcoin whale transferred approximately $45.18 million to Binance on Monday, and since June 27th, they have moved coins valued at around $468 million.

One hour ago, the whale transferred 809 Bitcoins worth approximately $45.18 million to Binance. Since June 27th, this entity has moved a total of 7,790 Bitcoins, equivalent to around $468 million, into Binance. At present, the whale’s balance on Binance comprises roughly 6,559 Bitcoins or approximately $379 million.

— Lookonchain (@lookonchain) July 8, 2024

As a crypto investor keeping an eye on the market trends, I’ve noticed that the German government has been actively transferring coins to exchanges. This action has led to a surge in Bitcoin balances held in these platforms, a situation that typically indicates bearish sentiments among investors.

BTC price action

Bitcoin price chart

The graphs indicate that Bitcoin is facing multiple threats, most notably the double-top formation at $72,000. It has also dipped beneath its 200-day moving average and recently touched the neckline of this pattern at $56,000.

The latest surge in Bitcoin’s price might just be a temporary bounce back before another downturn causes it to fall further down to approximately $44,000 in the coming days. However, there is a strong possibility that the cryptocurrency will recover and surpass $100,000 eventually.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-07-08 16:30