As an analyst with a background in financial technology and global economics, I’ve closely followed the development and implementation of Central Bank Digital Currencies (CBDCs) around the world. The recent trend of major economies rushing to launch their own CBDCs is undeniably exciting, but based on current data and trends, it seems that widespread adoption has been slower than anticipated.

As a crypto investor, I’ve noticed an intriguing trend across the globe. Regardless of whether we’re talking about the Bahamas or Nigeria, China or Jamaica, there seems to be a shared experience when it comes to Central Bank Digital Currencies (CBDCs). Few people are actively using them.

Across the globe, leading economies are in a pressing competition to introduce their own versions of digital currencies managed by their central banks.

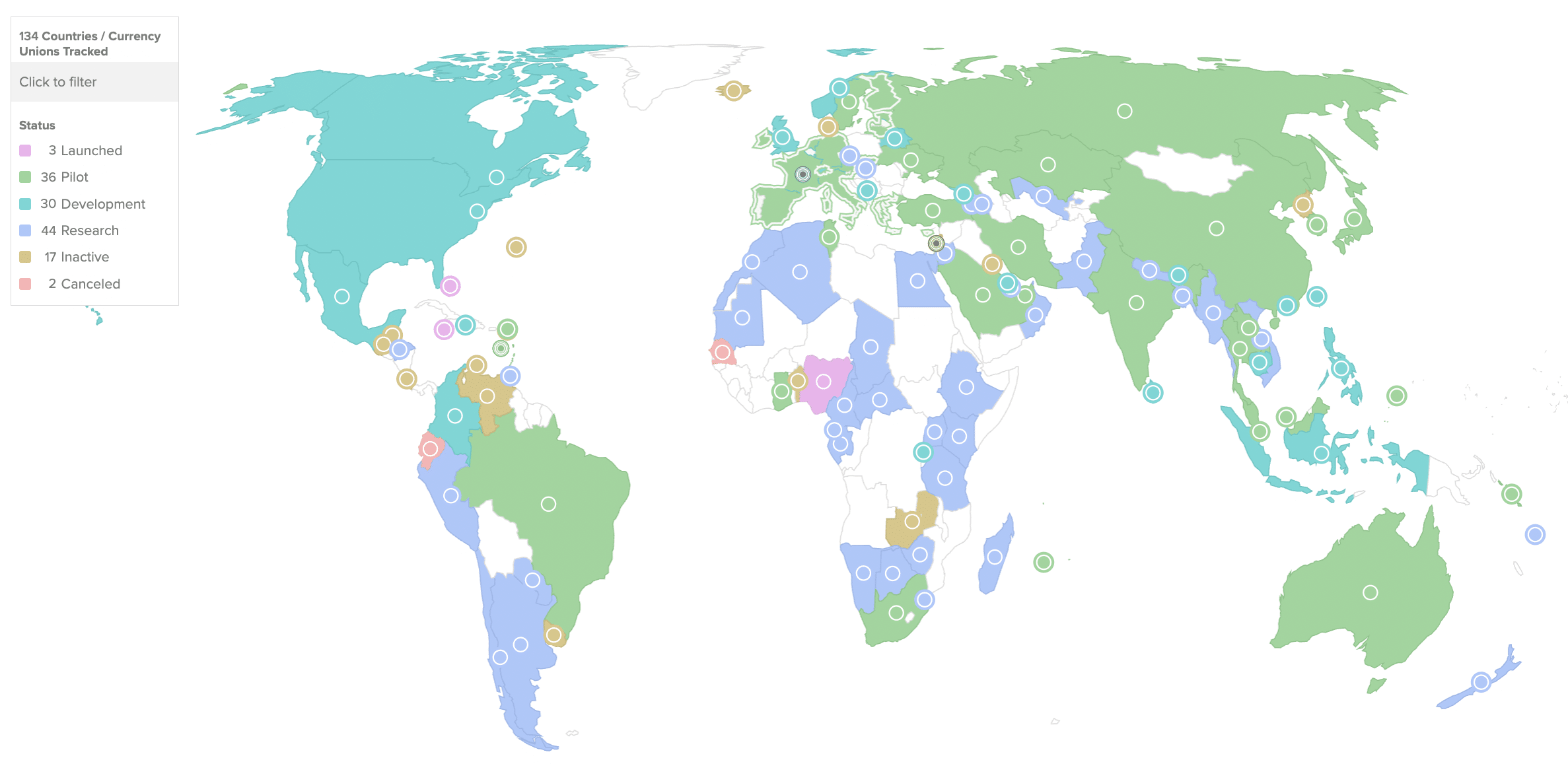

As an analyst, I’d rephrase that sentence to: I’ve analyzed data from the Atlantic Council indicating that a total of 134 countries worldwide, accounting for approximately 98% of global economic output, are currently engaged in some form of experimentation.

Among them, only three have been officially released, whereas 36 others are undergoing testing in trial phases.

As an analyst, I’ve observed that while there’s been much discussion about the benefits of faster cross-border transactions, lower fees for businesses, and innovative new payment methods, a stark reality has emerged for many countries that have invested significant resources into creating this infrastructure: the demand hasn’t been as robust as expected.

The Federal Reserve Bank of Kansas City published an intriguing study on the performance of three retail Central Bank Digital Currencies (CBDCs) in the Caribbean region since their introduction. The report revealed that none of these CBDCs have gained significant traction amongst consumers.

By May 2023, only 105,000 consumers and 1,500 merchants had adopted the Bahamian Sand Dollar as their means of transaction, amounting to a paltry 0.19% of the country’s overall currency supply in value. This is not an encouraging sign.

The Eastern Caribbean Currency Union’s DCash and Jamaica’s JAM-DEX represent only a tiny fraction of the total market share, accounting for 0.16% and 0.11%, respectively.

On the other side of the world, in Asia, there have been similar teething troubles.

As a crypto investor, I’ve been following the news about India’s planned digital rupee with great interest. One of the most intriguing aspects for me is the ability to conduct offline transactions in areas with limited or no internet connectivity. This feature could be a game-changer for people living in such regions, making financial transactions more convenient and accessible. Additionally, the programmable payment functionality is another exciting prospect. Imagine being able to set up rules for your payments, such as automatic bill payments or setting spending limits. These features could make managing finances much simpler and more efficient.

As an analyst, I’ve recently uncovered some intriguing data from a Reuters report. Within a short six-month timespan, the utilization of this Central Bank Digital Currency (CBDC) dropped dramatically, reaching only one tenth of the usage levels witnessed in December 2023. This significant decline can be attributed to the termination of incentives that were previously provided to early adopters.

As a crypto investor, I’ve kept a close eye on the digital yuan developments in China. Recently, I was dismayed to learn about an unfortunate incident where some government employees, instead of holding onto their newly received digital currency paychecks, exchanged them for physical cash right away.

As an analyst, I would rephrase it as follows: Based on the IMF’s latest report, the usage of Nigeria’s eNaira digital currency has been underwhelming, with only 1.5% of the created wallets being actively used in the year following its launch. To generate more interest and boost adoption, a collaborative effort from relevant authorities is essential.

Making CBDCs cool (again?)

As a researcher studying the adoption of central bank digital currencies (CBDCs), I’ve identified several reasons that may be hindering their widespread use. These factors include, but are not limited to:

One potential issue is that some individuals may not fully understand what they represent, and there exists a technological gap for older consumers who are more used to dealing with actual currency.

As a researcher exploring Central Bank Digital Currencies (CBDCs), I’ve encountered various objections to their adoption despite growing awareness. One major concern is the perceived lack of privacy in CBDC transactions compared to cash. Critics argue that CBDCs may not provide the same level of anonymity, raising questions about how secure and confidential these digital assets truly are.

Central bank digital currencies pose a threat to the traditional business models of commercial banks, causing some apprehension within the industry.

As a crypto investor, I believe that for Central Bank Digital Currencies (CBDCs) to make a significant impact and gain widespread adoption, they must provide undeniable advantages over traditional payment methods. It’s no secret that countries like China boast massive super-apps that seamlessly integrate various services from messaging to grocery shopping. Consequently, offering attractive perks that these all-in-one platforms cannot match is essential for CBDCs to capture the public’s attention and trust.

As a financial analyst, I’ve noticed an emerging trend among certain countries to enforce the adoption of Central Bank Digital Currencies (CBDCs) through new regulations. For instance, the Bahamas is devising legislation that will compel central banks to provide access to their CBDCs, such as the Sand Dollar. This approach can be seen as a combination of incentives and penalties. If successful, this move could set a precedent for other economies considering a similar shift towards digital currencies.

It’s no surprise that cryptocurrency advocates express delight upon learning about the challenges and slow adoption rate of Central Bank Digital Currencies (CBDCs) to date.

As a researcher studying the adoption of central bank digital currencies (CBDCs) in major economies, I can’t help but acknowledge the uncertainty surrounding the future rollout of these currencies in countries like the U.K., U.S., and EU. With no clear timeline for their introduction and no certainty that they will materialize at all, there is a very real possibility that some regions may decide to abandon this policy altogether.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-10 15:10