As a seasoned crypto investor with several years of experience under my belt, I have learned to keep a close eye on market trends and price movements. The recent rally in AAVE price, which has gone on for eight consecutive days, has been particularly intriguing. It reached its highest level since June 6th, adding over 45% to its value from its lowest point this month.

The price of AAVE surged for eight consecutive days, hitting its peak since June 6th. It has experienced a significant increase of more than 45% from its record low this month.

The price of AAVE surged as optimism was renewed within the crypto market following a major sell-off. Notably, Bitcoin crossed the $62,000 mark for the first time since July 1st. This recovery in Bitcoin’s value sparked positive sentiment towards most altcoins. However, what set Aave apart was the growing interest from large investors, or “whales,” in the network.

As an analyst, I recently came across a noteworthy observation from a report by Lookonchain. According to their findings, an influential investor, often referred to as a “whale,” purchased approximately $3 million worth of AAVE tokens last week. Upon examining this particular investor’s wallet address, I discovered that they now hold over 142,000 AAVE tokens, which equate to a significant value exceeding $14 million.

Today, a whale or institution made purchases of $AAVE and $UNI amounting to undisclosed sums from Kraken once more. He transferred a total of 4 million USD Coin (USDC) into Kraken’s holdings. Subsequently, he extracted 35,983 $AAVE ($3 million) and 123,183 $UNI ($1 million) from the same platform. Currently, his holdings consist of 142,296 $AAVE ($12.1 million) and a substantial amount of $UNI, equivalent to approximately 1.43 million units or $11.6 million.— Lookonchain (@lookonchain) July 10, 2024

Currently, information from the ecosystem indicates that Aave is thriving. As per DeFi Llama’s data, the network boasts more than $12 billion in total assets, with approximately $7.88 billion being utilized for borrowing.

The data reveal that AAVE is among the most financially successful networks within the blockchain sector. With a total fee generation of $196 million this year, as reported by TokenTerminal, it ranks seventh in terms of profitability, following Ethereum, Tron, Bitcoin, Lido Finance, Uniswap, and Solana.

Aave generates revenue through several channels in its system. These include collecting a portion of the interest rates, charging protocol fees, and earning from liquidation fees. Furthermore, the platform profits from transactions facilitated by flash loans within the network.

In recent years, the lending sector has seen significant competition with emerging players such as Compound, Maker, Morpho, and Venus leading the charge.

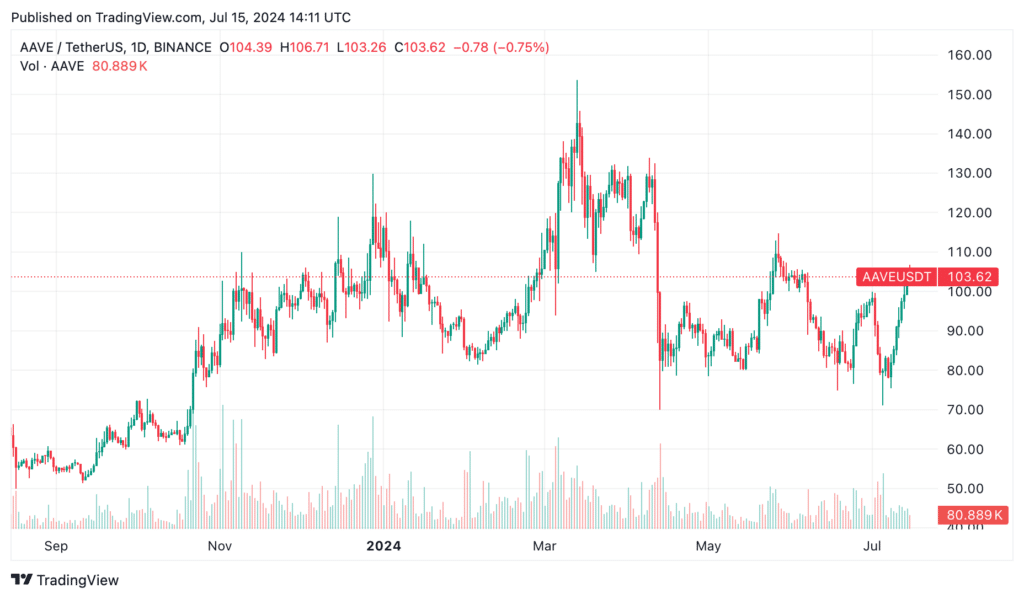

AAVE price is getting overbought

AAVE price chart

The rally for AAVE might begin to ease up in the near future based on technical analysis, which suggests the asset is approaching an overbought state.

The widely-used Relative Strength Index (RSI), which gauges the momentum of price changes in an asset, has climbed to 64, approaching the overbought threshold of 70.

Just like the ultimate oscillator, which incorporates short-, medium- and long-term price trends, is nearing an overbought state at a reading of 70. Meanwhile, the two stochastic oscillator lines have surpassed the overbought threshold.

Theoretically, an asset like AAVE should pull back when it reaches an overbought status. But in practice, an overbought condition can sometimes indicate strong bullish sentiment. Thus, if Bitcoin’s bull market persists, the AAVE token may keep climbing.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-07-15 18:08