As a seasoned financial analyst with over a decade of experience in the investment industry, I’ve witnessed numerous trends come and go, but none quite as intriguing as the surge in Bitcoin Exchange-Traded Funds (ETFs) this year. The data presented is particularly noteworthy, with institutional and retail investors flocking to these funds, contributing over $16 billion in inflows this year alone.

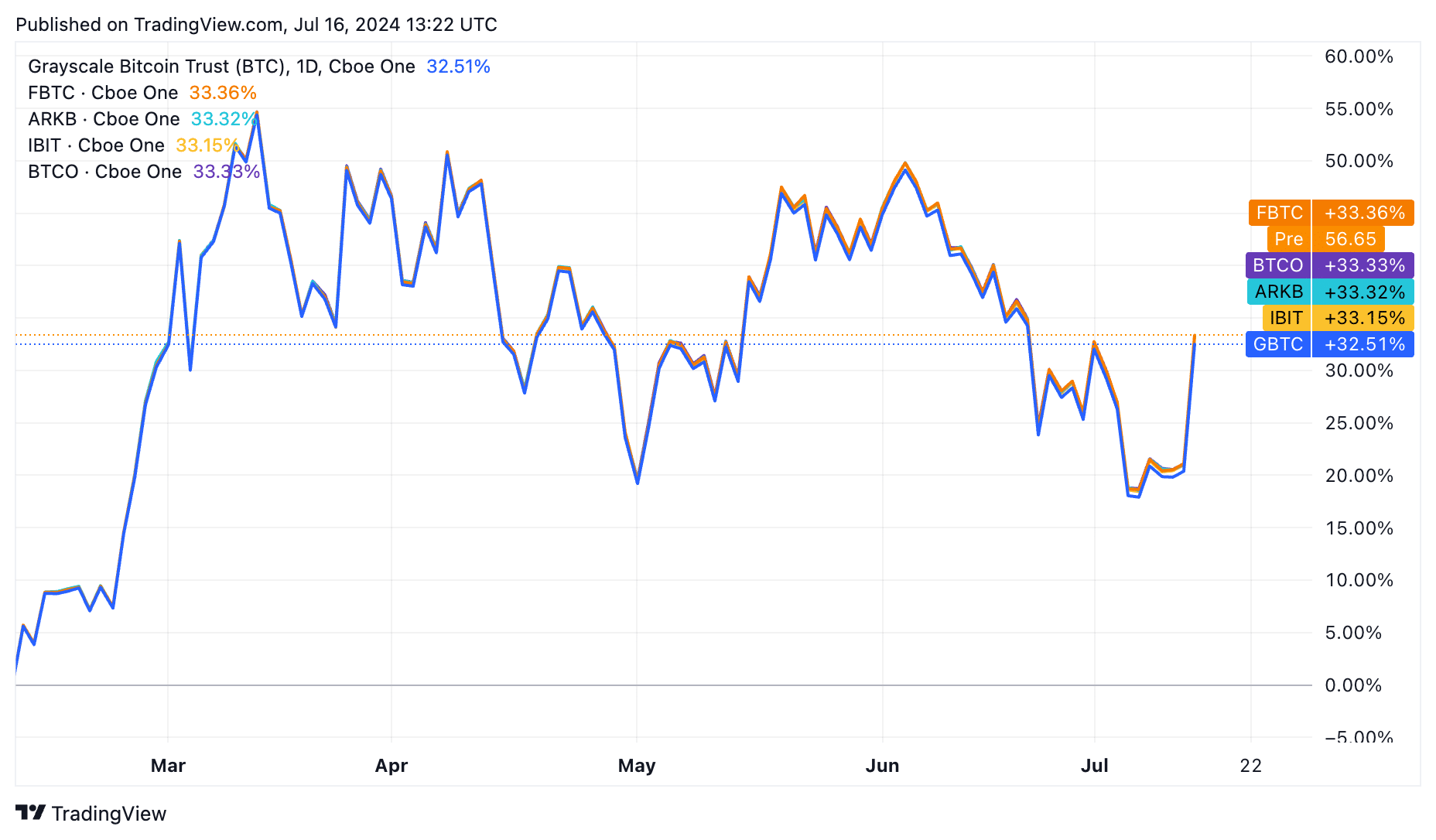

Bitcoin (BTC) Exchange-Traded Funds (ETFs) have seen an uptick in performance due to increasing inflows. This growth can be attributed to both institutional and individual investors.

The flow of funds into Exchange-Traded Funds (ETFs) this year has surpassed expectations, with approximately $16.16 billion being invested as of now. This figure exceeds Bloomberg’s projection of $12-$15 billion for the entire 12-month period.

The iShares Bitcoin Trust from Blackrock holds the largest quantity of Bitcoin in the market, with approximately 316,000 coins valued at around $18 billion. Fidelity’s Wise Origin Bitcoin Fund comes in second place, managing over 176,000 coins. Notable other Bitcoin ETFs include ARK Investment Management’s ARK Bitcoin ETF with 47,765 coins, Bitwise Asset Management’s Bitwise Bitcoin ETF having 39,420 coins, and Invesco QQQ Trust’s Bitcoin Strategy ETF possessing around 7,197 coins.

As a crypto investor, I’ve noticed a notable difference between my experience with Grayscale Bitcoin Trust (GBTC) and other Bitcoin investment vehicles this year. While GBTC was once the go-to option for many investors, it has seen a substantial decrease in holdings, shedding over 18,000 coins in 2023.

New information reveals that some prominent investment firms have recently purchased Bitcoin ETFs. A recent report disclosed that institutions such as Millenium Management, Susquehanna, Horizon Kinetics, Jane Street, Fortress Investment, Apollo Global, and Farallon Capital have made these acquisitions.

Million Dollars Fund, managed by billionaire Izzy Englander, boasts a staggering $68 billion asset size. On the other hand, Apollo Global ranks among the world’s leading private equity firms. Susquehanna, an influential investor, is owned by an associate of former President Trump and holds a significant stake in TikTok.

Approximately 17% of the total holdings in ETFs can be attributed to the 80 companies identified manually from SEC filings. A number of these entities can be classified as institutional investors. However, it’s important to note that not all inflows into ETFs should be viewed as retail investments alone.

— Ki Young Ju (@ki_young_ju) July 15, 2024

Will Ethereum ETFs see similar success

At this point, these figures emerge as investors anxiously anticipate the decision on proposing a spot Ethereum Exchange-Traded Fund (ETF). Experts predict that such approval is likely to occur this very month.

As a researcher studying investment vehicles, I’ve observed that ETFs following Ethereum’s price movement could potentially yield impressive returns based on historical trends. Over the last five years, Ethereum has experienced an extraordinary growth of over 1,654%, outpacing Bitcoin’s increase of 587% during the same timeframe.

Additionally, Ether ranks high among cryptocurrencies in terms of liquidity, and the Grayscale Ethereum Trust (ETHE) holds nearly $10 billion worth of assets. However, it’s important to note that this trust comes with a relatively steep management fee of 2.5%.

Previously announced, Ethereum ETFs are well-suited for institutional investors, as they alleviate the challenge these large entities face in handling the complexities of cold wallet keys.

As a researcher studying the world of cryptocurrency investments, I’ve come across an intriguing observation. If you, as a retail investor, decide to put your money into funds that track Ethereum, you’ll be faced with two disadvantages compared to directly investing in Ether. Firstly, you’ll have to pay a fee for this service, which is typically around 0.25%. Secondly, and perhaps more significantly, you won’t be able to earn staking rewards that come with holding Ethereum directly.

It’s plausible that exchange-traded funds (ETFs) focused on Ethereum (ETH) may trail behind Bitcoin in attracting investment flows.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-07-16 17:00