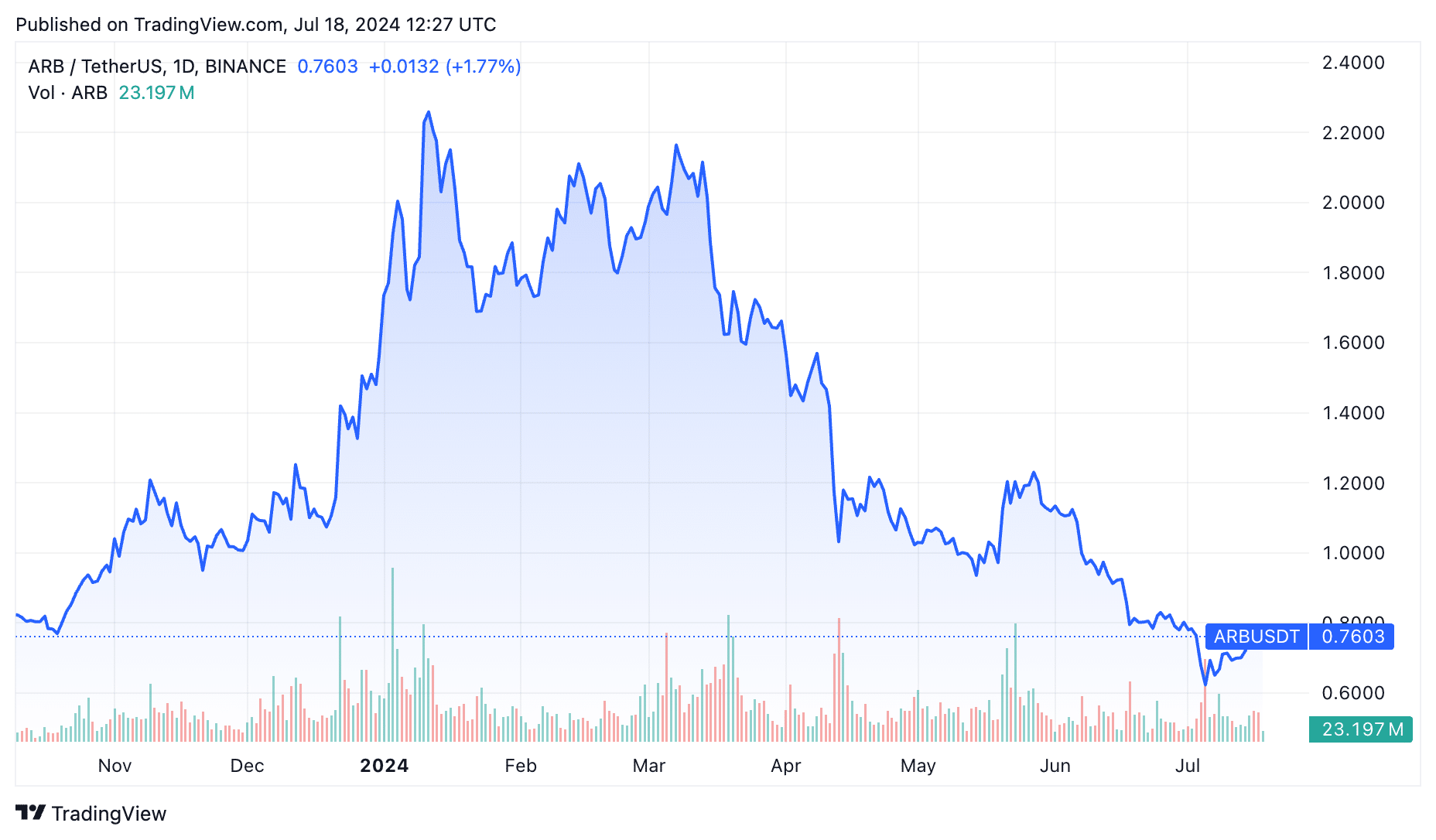

As a seasoned researcher with extensive experience in the blockchain industry, I have closely followed the price action of Arbitrum (ARB) token over the past few months. While I acknowledge that Arbitrum has experienced significant ecosystem growth and market share gains, it’s disheartening to see its token price drop by over 68% from its all-time high.

The price of the Arbitrum (ARB) token has seen a significant decrease of more than 68%, even as the Arbitrum ecosystem experiences robust expansion and increased market presence.

As an analyst, I’ve noticed that the ARB token was priced at around $0.76 during Thursday’s trading session. Some market observers speculate this could be an early sign of a bull run, given the token reached its lowest point at $0.571 in the recent past.

Arbitrum’s market share gains

According to external sources, Arbitrum has emerged as a major force in the blockchain sector, outpacing the achievements of some well-established competitors.

Based on DeFi Llama’s data, Arbitrum Decentralized Exchanges rank third in trading volume. On a notable Thursday, these DEX applications facilitated transactions valued over $847 million, positioning Arbitrum as the second largest Decentralized Exchange blockchain following Solana and Ethereum.

The transaction volumes on Solana and Ethereum amounted to approximately $1.81 billion and $1.7 billion, respectively.

In the past week, Arbitrum handled trading volume amounting to $7.5 billion at Decentralized Exchanges (DEXs). This is less than the $13.17 billion recorded by Solana and Ethereum’s DEXs, with volumes of $13.17 billion and $11.7 billion respectively.

Arbitrum has outpaced other prominent blockchains in terms of Decentralized Exchange (DEX) transaction value during the past week. Specifically, BNB Chain recorded a total of $4 billion in token transactions, while Thorchain, Base, Optimism, Avalanche, and Sui handled less than $3.5 billion collectively.

Among the largest decentralized exchanges (DEXs) operating on the Arbitrum network are Uniswap, Balancer, Camelot, Ramses, and PancakeSwap. The appeal of Arbitrum lies in its swift transaction processing times and economical fees, averaging approximately $0.0012 per transaction.

As a crypto investor, I’ve noticed some compelling data about Arbitrum. The platform has seen impressive growth, with a significant number of users and developers joining the community. To be more specific, there are currently 665 Decentralized Finance (DeFi) applications on Arbitrum, and over 966,000 active addresses. These figures surpass those of Ethereum, which hosts approximately 359,000 active addresses, and BNB Chain, with around 890,000 active addresses.

The total value locked in Arbitrum’s Decentralized Finance (DeFi) sector exceeds $3.15 billion, positioning it as the fifth largest blockchain in this regard. Notably, the circulation of stablecoins within its ecosystem has reached an impressive $4.2 billion mark.

As a crypto investor, I’m excited to see Arbitrum’s ecosystem expanding as developers leverage its unique features. For instance, JuicyPerp, an engaging perpetual trading platform, has recently joined our thriving community. Similarly, Huddle, which functions as a real-time communication layer for AI, games, and the metaverse, is another valuable addition to Arbitrum’s growing ecosystem.

As a crypto investor involved with Huddle01 dRTC, I’m thrilled to share that we’ve taken a significant stride forward by unveiling our Layer 3 on Arbitrum. This collaboration with CalderaXYZ adds a layer of transparency and fairness to the way our Media Node operators function, which is essential for maintaining the network’s integrity.

— Huddle01 dRTC | Media Nodes 🔜 (@huddle01com) July 16, 2024

Why Arbitrum price has dropped

As an analyst, I’ve been observing the crypto market closely, and I cannot help but notice the significant disparity in valuation between Arbitrum and some of its competitors like Near and Cardano. While Arbitrum’s ARB token boasts a market capitalization of $2.5 billion, Near’s token stands at $6.4 billion, and Cardano’s ADA token is valued at an impressive $15 billion. Given the comparable size and developmental progress of their respective ecosystems, it seems that Arbitrum may be undervalued in the current market.

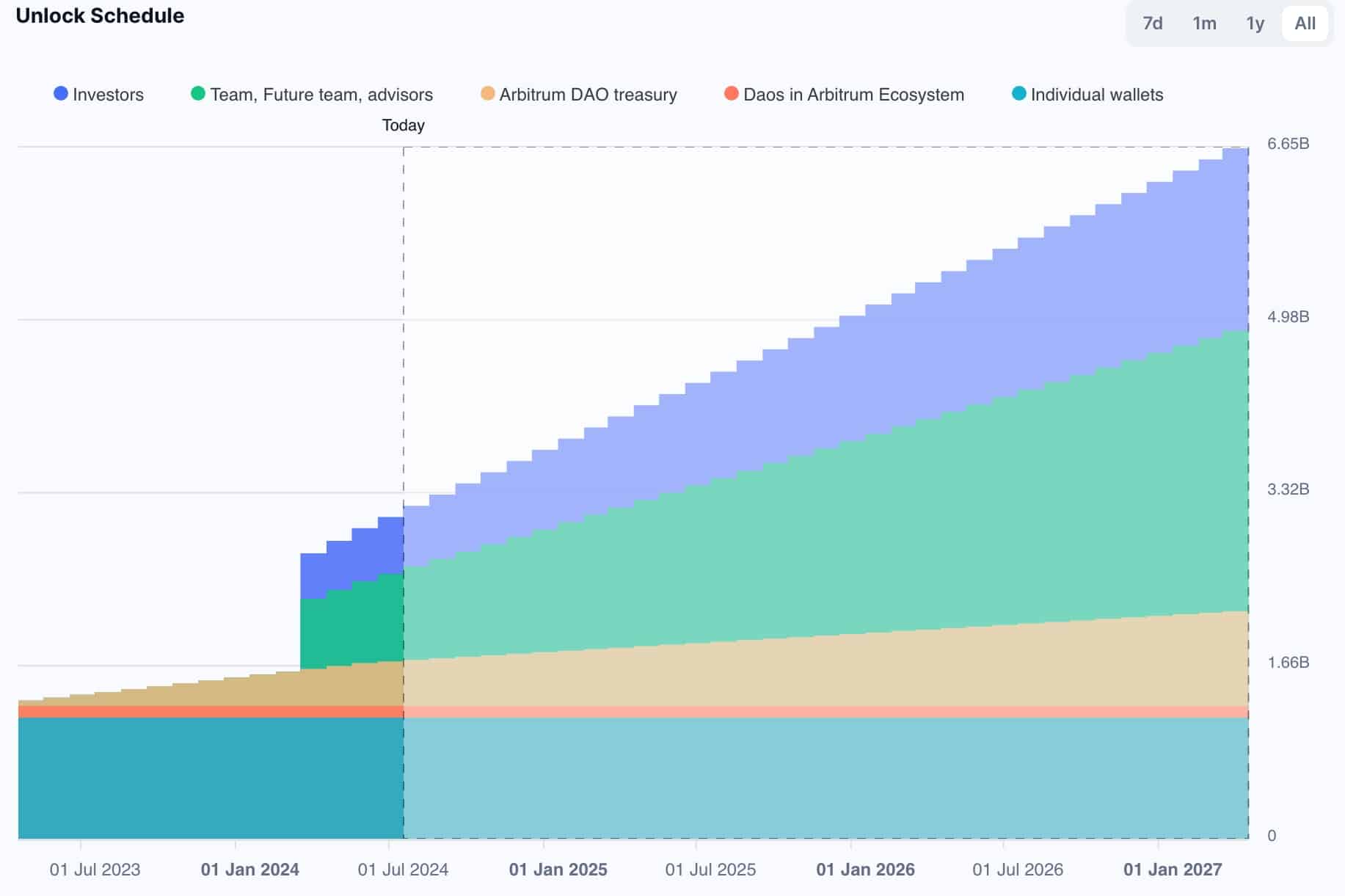

It’s plausible that Arbitrum token holders may experience further token dilution in the coming years, given that the current circulating supply is over 3.3 billion tokens out of a total supply of 10 billion ARB tokens.

The token’s unlock occurs on every 16th day of the month, distributing these tokens to the team, advisors, and investors.

Bitco’s recent price downturn has led to a decrease in Arbitrum as well. Bitcoin peaked at an all-time high of $73,400 in March but failed to sustain that level, remaining under $65,000 since then. In response, the value of Arbitrum followed suit and retreated along with other altcoins.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-07-18 16:36