As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed the ups and downs of various cryptocurrencies, including Solana (SOL). And I must admit, Solana’s recent price action has been quite intriguing.

The price of Solana has recovered this week following the bounce back of cryptocurrencies and the presentation of strong on-chain statistics.

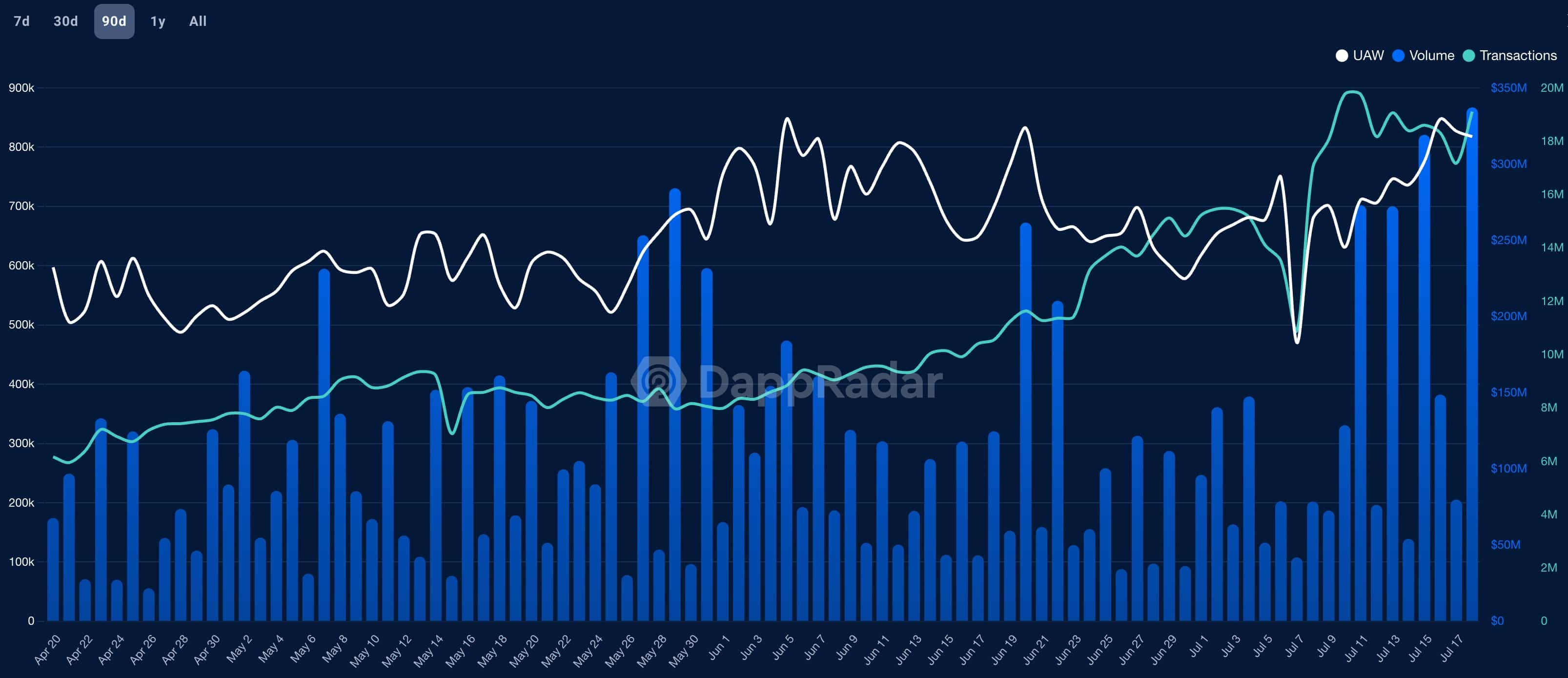

As a researcher studying the cryptocurrency market, I’ve noticed an intriguing development regarding Solana (SOL). On Friday, the SOL token reached its peak price of $163.8, marking its highest point since June 7th. Notably, this represents a significant rebound of 32% from its lowest point in October. The reason behind Solana’s recovery can be attributed to the robust performance of its network, as evidenced by on-chain data. Specifically, DappRadar’s data reveals that the number of unique active wallets, trading volume, and transactions on the Solana network have all increased this week.

Solana’s meme coins such as Dogwifhat and Bonk experienced a surge while the network maintained its leading position in the decentralized exchange (DEX) sector. For instance, WIF recorded a 24-hour trading volume of $842 million, surpassing Dogecoin‘s $682 million and Shiba Inu‘s $751 million.

Based on recent data, Solana Decentralized Exchange (DEX) networks processed approximately $13.2 billion in trading volume over the past week. In comparison, Ethereum‘s DEX trading volume reached around $11.9 billion during the same time frame. Some notable high-performing Solana DEX platforms include Raydium, Orca, and Jupiter.

Encouraging Solana price patterns

Currently, cryptocurrency investors remain hopeful about the upward trend of Solana’s price, pointing out various technical indicators as their reason for optimism.

First, Solana has formed a symmetrical triangle pattern that is nearing its confluence. Since this triangle came after the token rallied, it can be said to be a bullish pennant pattern. In most cases, an asset makes a bullish breakout when this pattern happens.

🚨 #Solana $SOL HUGE PENNANT on the 1D chart!Watch out for this price action! — CryptoBusy (@CryptoBusy) July 18, 2024

Second, Solana identified a robust double-bottom formation at the price mark of $120.50. This level proved resilient twice in April and once in June and July, preventing any downward breakthroughs. A double-bottom is generally considered an optimistic chart pattern as it suggests a potential reversal in price trend.

Thirdly, Solana consistently stays above its 200-day Exponential Moving Average (EMA), which is often used as a benchmark for support in technical analysis.

As an analyst, I’ve observed that the token’s price momentum indicates potential for further growth before reaching overbought levels. Specifically, the Relative Strength Index (RSI) has recently surpassed the neutral threshold of 50, while the Money Flow Index (MFI) is approaching the overbought mark at 80.

If Solana has reached the 61.8% Fibonacci Retracement level, and these technical patterns hold true, then it’s possible for the Solana price to surge towards its previous high of $200.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-07-19 17:21