As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed my fair share of market volatility and price surges. The recent surge in Sei, ORDI, and Arweave has piqued my interest and left me feeling somewhat optimistic about the crypto landscape.

Over the past day, Sei, ORDI, and Arweave have experienced significant gains, increasing by more than 10%, making them the highest climbers in the crypto market. Meanwhile, Bitcoin, the largest cryptocurrency by market value, also rose by approximately 3% during the same timeframe.

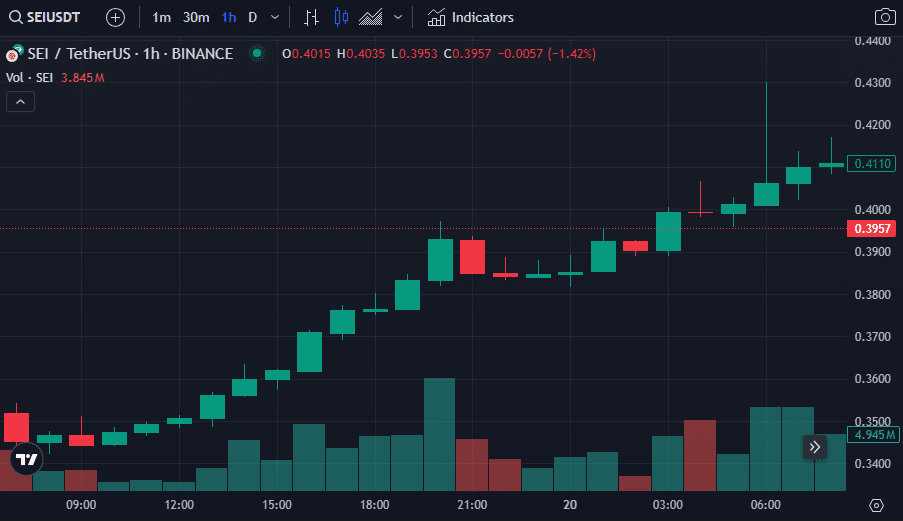

Sei

Sei led the charge among the top gainers.

The Sei Project’s coin experienced a 12.5% growth over the past 24 hours, as indicated by crypto.news data. Currently, SEI is valued at $0.397 based on the latest figures. Additionally, there was a significant surge in daily trading volume, amounting to approximately $179 million, representing a 36% increase.

The current market value of Sei’s capitalization is at a staggering $1.26 billion. Yet, its token value lags behind its peak price by a significant margin, sitting at just 65% or approximately $0.69 of the all-time high it reached on March 16, which was an impressive $1.14.

The significant rise in Sei’s value occurred concurrently with the unveiling of the “Sei v2 mainnet beta” by its pioneering team, headed by Jeffrey Feng and Jayendra Jog. They proudly claim it as “the most efficient Ethereum Virtual Machine (EVM) blockchain that has been constructed.”

A high-performance crypto trading network now supports Geth, a widely-used Ethereum application, enabling developers to construct decentralized apps and various web3 projects on this platform.

In August 2023, the beta version 1 of Sei’s mainnet, which is based on the Cosmos SDK, was debuted. This development came after two accomplished funding rounds, where investors including Jump Trading and Multicoin Capital collectively contributed $30 million.

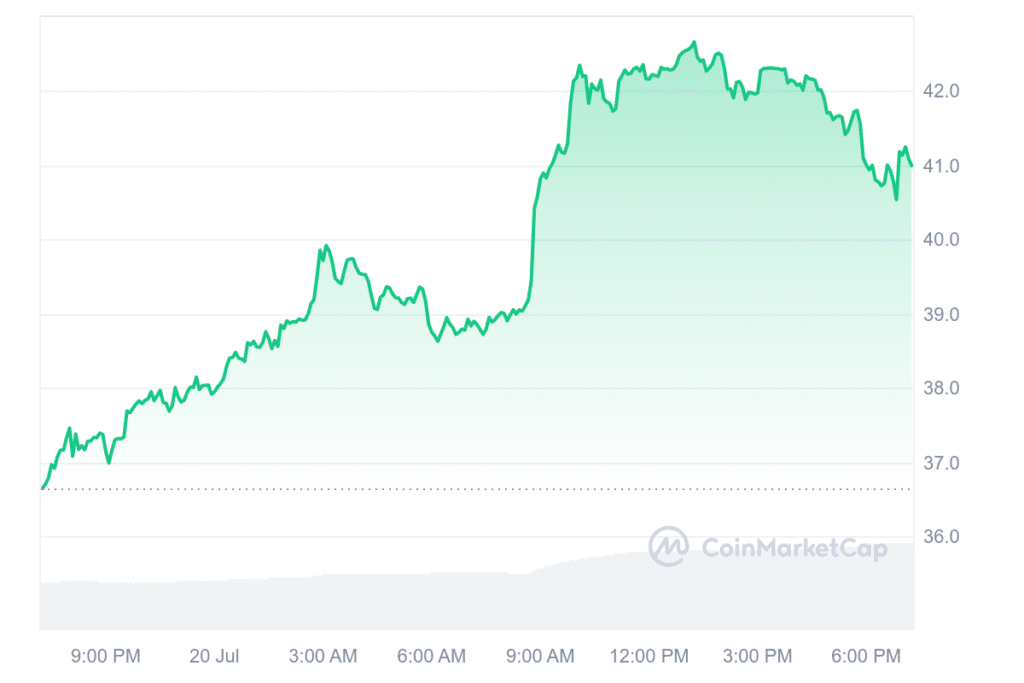

ORDI

Over the last 24 hours, ORDI experienced a 10% price hike and was valued at approximately $41 during the latest update. With a market capitalization placing it as the 84th largest cryptocurrency, its daily trading volume reached around $200 million.

With a market capitalization of $865 million, ORDI ranks as the 44th biggest crypto asset. However, its value remains 59% lower than its peak price of $96, which was hit on March 5th.

On the Bitcoin network, ORDI represents a meme coin, and it marked the introduction of the Bitcoin Reusable Token Standard (BRC-20) with the creation of its first token through the Ordinals protocol.

Software engineering innovator Casey Rodarmor is behind the Ordinals protocol, a groundbreaking development that enables data – including text, images, audio, and video – to be encoded onto each satoshi, the smallest Bitcoin unit. With this game-changing technology, non-fungible tokens (NFTs) and other digital tokens on Bitcoin take on new dimensions.

In the BRC-21 ecosystem, ORDI functions as a consistent asset with a capped supply of 21 million units. These units can be exchanged and used interchangeably with other assets in the BRC-20 standard.

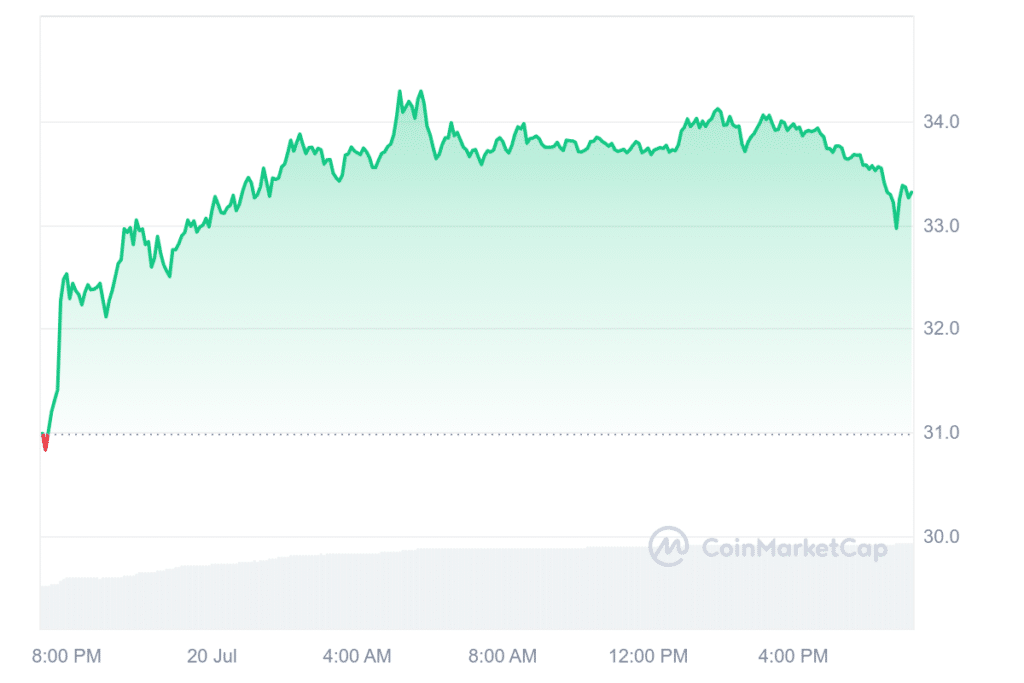

Arweave (AR)

Arweave’s native token, AR, rose 10% over the past day, trading at $33.3. Its daily trading volume doubled to around $106 million. The market cap of AR increased by 8.8% to surpass $2.1 billion, ranking it as the 46th largest cryptocurrency.

Arweave is known for its decentralized storage solution, operating on AI-enabled blockchains.

Sam Williams, a co-founder, unveiled the Arweave Advanced Operating Protocol (AO), an innovative computing system designed to support simultaneous executions for proof-of-stake computations. This framework caters to the expanding needs of social media and artificial intelligence applications on the blockchain.

Arweave files can be accessed using regular web browsers, removing the requirement for specific wallets or blockchain interfaces. Additionally, Arweave is working on implementing a user-voting system to regulate inappropriate content.

Bitcoin’s strong performance

The significant increase in these alternate coins was fueled by Bitcoin’s 3% price jump over the previous day, peaking at $66,732 on Saturday. Bitcoin’s minimum and maximum prices during this 24-hour period were $65,319 and $67,377 respectively.

Market experts explain that several reasons led to the recent surge in Bitcoin’s price. One significant factor was the conclusion of the German government’s Bitcoin sell-off. By disposing of their 49,858 Bitcoins, they generated around $2.8 billion in revenue.

Based on my extensive experience in the financial industry and my keen interest in the world of cryptocurrencies, I can confidently say that the recent surge in inflows to Bitcoin Exchange Traded Funds (ETFs) is a clear indication of renewed investor interest in the leading digital currency. According to Gemini’s latest note, this new wave of investments could be attributed to the recent price drop in Bitcoin, which may have attracted a fresh crop of investors who previously lacked exposure to the cryptocurrency market. As someone who has closely followed the crypto space for years, I can attest to its volatility and the potential rewards that come with investing in it at the right time. It will be interesting to see how this trend unfolds and what impact it may have on Bitcoin’s price trajectory moving forward.

At the same time, the overall value of the cryptocurrency market grew by 1.42%, reaching a grand total of $2.43 trillion.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-07-20 19:14