As a seasoned researcher with extensive experience in analyzing cryptocurrency markets, I find the recent decline in Bitcoin whale and exchange activities quite intriguing. The data from Santiment indicates a significant drop in large transactions and exchange inflows, which could suggest that major investors and holders are holding back, possibly waiting for more favorable market conditions before making any significant moves.

Recent on-chain analysis reveals a noticeable drop in Bitcoin transactions by large holders and exchanges, with the cryptocurrency hovering around the $67,000 price point.

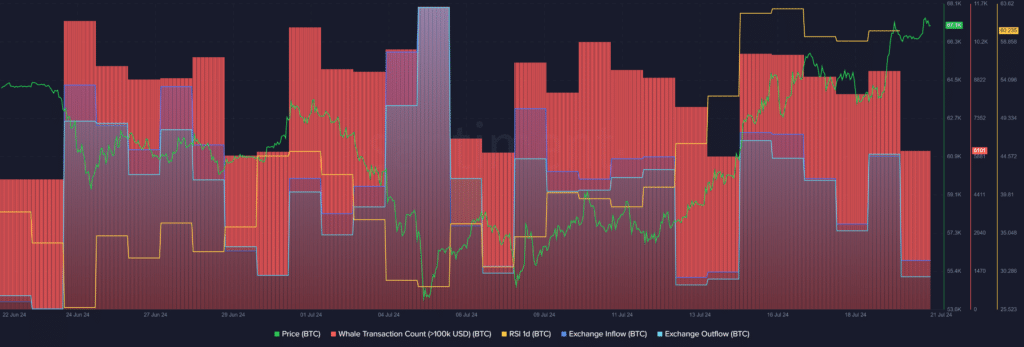

As a crypto investor, I’ve noticed an intriguing development based on recent data from Santiment. The frequency of significant Bitcoin (BTC) transactions, defined as those worth at least $100,000, has taken a noticeable downturn. In just the past 24 hours, we’ve seen a substantial drop, with the number of unique transactions decreasing by approximately one-third. Initially, there were 9,176 such transactions daily. However, this figure has now shrunk to 6,101 transactions per day.

In a comparable fashion, Bitcoin exchange transactions exhibited a significant decline based on data from Santiment. Specifically, there was a drop from 48,289 to 26,073 coins entering both centralized and decentralized exchanges within the last 24 hours.

As a researcher examining cryptocurrency trends, I’ve discovered some intriguing data from our market intelligence platform. Specifically, there has been a significant decrease in the number of Bitcoins moving from exchanges to self-custodial wallets. In just the past day, this figure dropped from approximately 52,616 tokens to around 23,355. This suggests that investors may be holding onto their Bitcoin more tightly or that there could be other explanations for this shift in behavior. Further analysis is needed to fully understand the implications of these findings.

Bitcoin holders, be they large or small, may be holding back on transactions due to anticipation of market shifts, as indicated by a decrease in on-chain activity for the asset.

Based on Santiment’s analysis, the Bitcoin RSI currently hovers around 60. This signifies that Bitcoin is slightly overbought at its current price level, suggesting some caution given the unpredictable market situation.

To keep Bitcoin in an uptrend, its Relative Strength Index (RSI) should relax below the 50 threshold. It’s important to mention that the Bitcoin RSI was displaying a value of 28 on July 5, indicating the asset was oversold at a price of $54,000.

In the previous 24 hours, Bitcoin experienced a 0.55% increase and was priced at approximately $67,000 during the last check on Sunday. The market capitalization of this token remains close to $1.32 trillion, while its daily trading volume amounts to around $18 billion.

One potential boosting factor for Bitcoin’s upward trend could be the continuous inflow of investments into spot Bitcoin ETFs based in the United States. This has contributed to a significant increase in the total market capitalization of these products, surpassing the $17 billion mark.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-07-21 17:10