As a seasoned financial analyst with extensive experience in the crypto market, I’ve witnessed numerous fluctuations and corrections throughout my career. However, the recent increase in crypto liquidations following the U.S. elections has piqued my interest due to its significant impact on the market.

Crypto liquidations increased significantly after the market-wide correction over the past day.

The crypto market responded swiftly to Joe Biden’s decision not to participate in the upcoming elections, leading to a minor decline in value. This shift occurred when Kamala Harris was named his running mate.

Based on information from Coinglass, there was a significant surge in crypto liquidations over the last 24 hours, amounting to approximately $174 million. This increase can be attributed primarily to the market-wide correction, which led to the liquidation of around $111 million worth of long positions.

The amount of short positions liquidated in the past day reached $62.8 million.

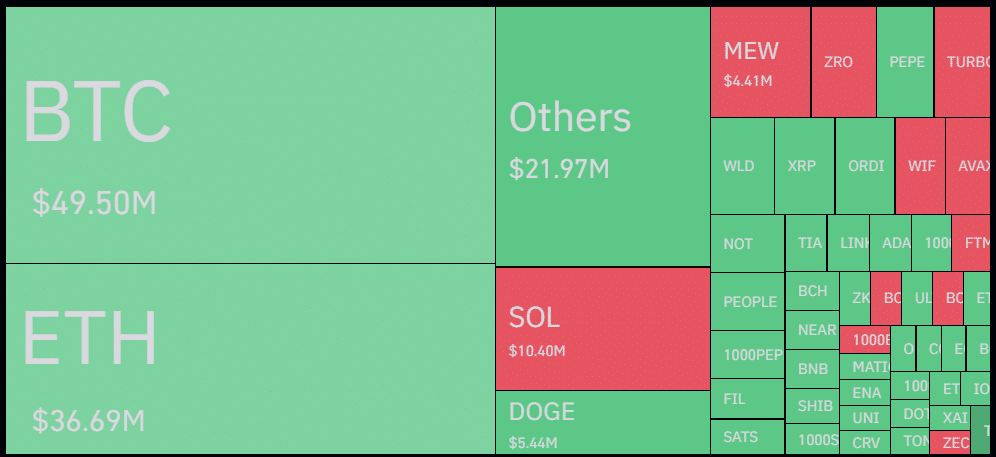

According to data from Coinglass, Bitcoin (BTC) currently holds the top spot with approximately $49.5 million in liquidations, including $27.9 million worth of long positions and $21.5 million worth of short positions. Ethereum (ETH) comes in second place, boasting around $36.6 million in liquidations, consisting of $27 million longs and $9.6 million shorts.

Significantly, the Bitcoin price reached a peak of $68,480 around 01:00 UTC, only to experience a correction that brought it down to $67,700. Currently, Bitcoin is being traded at $67,100.

As a researcher studying Bitcoin market activity, I’ve discovered that the largest liquidation in the past 24 hours, amounting to $10.95 million, took place on the Binance exchange.

Approximately 66.7% of the $83.9 million worth of liquidations on Binance in the last 24 hours came from long positions, making it the platform with the highest liquidation volume. OKX follows closely behind with approximately $54 million in liquidations.

Based on information from CoinGecko, the worldwide cryptocurrency market capitalization attained a peak of $2.6 trillion approximately at 00:30 UTC. This figure had previously been reached on June 12. Nevertheless, investors showed swift response, resulting in a decrease to $2.56 billion.

At present, there is much conjecture among investors and traders regarding Harris’ views on cryptocurrencies and the potential influence of her vice presidential selections on the crypto market.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-07-22 13:14