As a seasoned investor with over two decades of experience navigating through financial markets, I’ve seen my fair share of turbulence and recovery. The current wave of market instability is no exception, but it’s important to maintain an optimistic outlook based on historical patterns.

By looking at Bitcoin‘s historical performance after the Black Monday event, we can gain insights into its probable behavior following similar market crashes, focusing on recurring trends for forecasting purposes.

Table of Contents

On the 5th of August, investors found themselves navigating through a tumultuous day due to significant drops in global financial markets. A confluence of concerns – such as increasing interest rates, upcoming elections, escalating inflation, geopolitical unrest, and the impending specter of recession – culminated, causing a peak in anxiety.

1. In a significant decline, Japan’s primary index dropped approximately 12% – its steepest fall since 1987. Meanwhile, the Dow Jones experienced a drop of over 1,000 points (equating to a 2.6% decrease), and the Nasdaq saw a descent of 3.5%.

Remarkably, these tech titans – Alphabet, Amazon, Apple, Facebook (Meta), Microsoft, Nvidia, and Tesla – collectively experienced a substantial decrease in market value amounting to a whopping $650 billion.

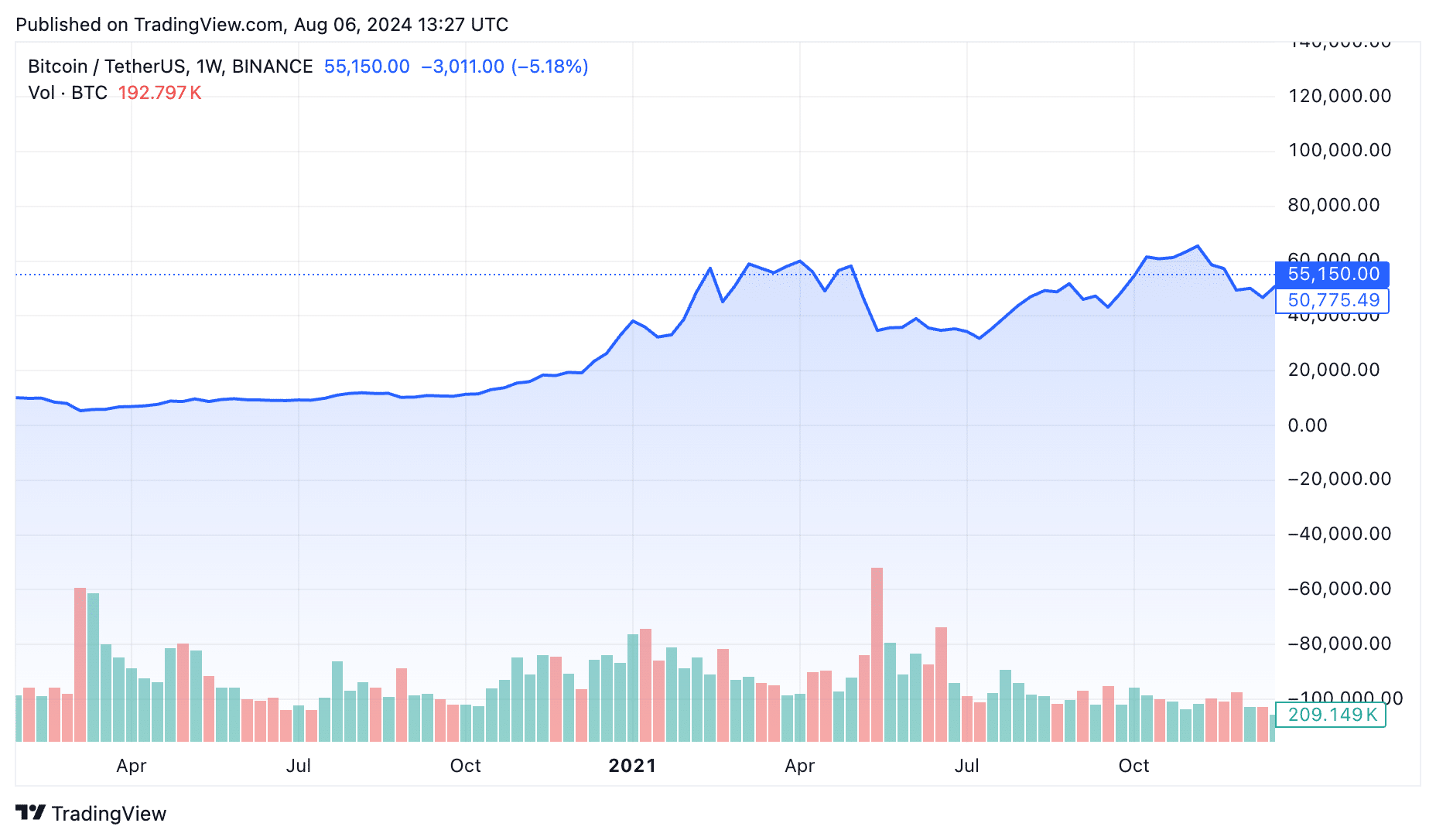

Just like other markets, the crypto sector also felt the brunt of the chaos. By mid-day, Bitcoin (BTC) plummeted below its previous mark to $49,578 – a level last seen in February 2024. But, surprisingly quick, BTC regained some ground and climbed up to $56,000 before settling around $55,000 by August 6.

In the past day up until August 6th, there was a significant increase in crypto purchases, causing the total market value to rise approximately 8%, reaching an impressive $1.96 trillion.

Let’s delve into how Bitcoin has behaved during comparable economic conditions previously, and see what predictions experts have for its trajectory as we navigate through this market instability.

Crypto’s resilience in the face of adversity

In March 2020, the world encountered an unprecedented financial turbulence due to the COVID-19 pandemic. This global crisis triggered a series of intense reactions across various markets, causing significant sell-offs and extreme market fluctuations. The downturn began in mid-February and intensified through mid-March, with numerous daily declines of a severe nature.

Despite central banks and financial institutions across the globe lowering interest rates and offering assistance to investors and markets, U.S. stock exchanges saw their steepest one-day percentage decline since 1987 on March 12. Furthermore, on March 16 – dubbed ‘Black Monday II’ – global markets experienced another significant drop of approximately 12-13%.

For this stretch of time, Bitcoin and the broader cryptocurrency market weren’t exempt from turmoil. Initially priced at approximately $10,000 in February 2020, Bitcoin dropped to $9,000 early in March, and by March 13, it had fallen to around $5,000. This dramatic drop mirrored the fear in traditional investment markets.

Despite facing challenges, Bitcoin’s comeback tale was astonishing. By mid-2020, it reclaimed the $10,000 mark and kept climbing, ending the year near $28,000.

2021 saw Bitcoin’s growth continue without pause, reaching unprecedented heights. Despite occasional ups and downs, it hit an all-time high of $69,000 in November – a staggering 14 times higher than its March 2020 low.

Looking back at the current scenario, I find myself bracing for another round of financial instability. Over the past few months, my concerns regarding various economic catalysts have been steadily growing. Unfortunately, these apprehensions were validated when global stock exchanges experienced a sudden and significant decline, reflecting the investors’ collective anxiety.

Yet, if we look at Bitcoin’s historical performance, we can see a pattern of recovery.

Despite the challenges posed by the COVID-19 pandemic, numerous projects persisted in their progress and introduced fresh functionalities, keeping engagement and financial backing alive.

Just as the expansion of Decentralized Finance (DeFi) platforms opened up fresh opportunities for investment and earnings, they played a significant role in the market’s revival process.

Consequently, even with the persistent hurdles, the resilience of the crypto market in adapting and bouncing back indicates that it is likely to ascend once more, persisting on its path of expansion and advancement.

What do experts think?

After the recent market downturn has subsided, analysts are sharing their thoughts about potential future developments.

Michael van de Poppe, a well-known cryptocurrency analyst, posits that while it may not be commonly recognized, quantitative easing (QE) is being carried out surreptitiously. QE refers to central banks purchasing government securities in order to inject additional funds into the economy.

It’s not entirely out in the public, but QE is happening.

Approximately $30 billion will be added every month through Treasury Buyback Operations.

Silently, Global Liquidity is getting increased.#Bitcoin is the answer.

— Michaël van de Poppe (@CryptoMichNL) August 6, 2024

According to van de Poppe, approximately $30 billion is anticipated to enter the financial system each month through Treasury Buyback Operations. This influx often leads to a decrease in interest rates and an increase in investment in speculative assets such as Bitcoin. As a result, Bitcoin may regain stability from its current volatile and uncertain state.

In a different viewpoint, Raoul Pal, co-founder and CEO of Real Vision, links the present market turmoil to shifts in supply from previous cycles and multiple entities dumping their assets. This is due to liquidations from FTX, Mt. Gox, Germany, GBTC, Jump, as well as new project releases and tokens.

Essentially, Pal maintains a positive outlook, implying that the market will ultimately handle these lingering issues, and conditions will improve once these past complications are resolved.

In the midst of it all, Vitalik Buterin, a key figure behind Ethereum (ETH), recently highlighted some encouraging advancements within the Ethereum community.

As a seasoned blockchain developer who has navigated through various complexities in the world of decentralized technologies, I am optimistic that the challenges associated with “cross-L2 interoperability issues” will be addressed more swiftly than anticipated. The rapid evolution of solutions within Ethereum’s ecosystem – from L1 to rollups, validiums, and even sidechains – promises a seamless user experience across the entire ethereum-verse in the near future. I have witnessed an impressive amount of enthusiasm and dedication among developers, which gives me confidence that we are on the cusp of solving these interoperability problems and unlocking the full potential of Ethereum’s vast ecosystem.

— vitalik.eth (@VitalikButerin) August 5, 2024

As an analyst, I am optimistic that we are nearing resolutions on the challenges associated with cross-Layer 2 interoperability within the Ethereum network. If these issues are effectively addressed, it could significantly enhance the user experience across all layers, including Layer 1, rollups, and even sidechains, resulting in a more seamless and efficient Ethereum ecosystem.

Now, here are important things to notice.

Initially, the careful introduction of Quantitative Easing (QE) might add essential funds to the market, possibly encouraging investments in digital currencies like cryptocurrencies.

2nd, the ongoing market instability due to resolving previous economic cycle problems may soon settle down, paving the way for the market to rebound.

In conclusion, the ongoing technological developments within prominent cryptocurrency platforms such as Ethereum have the potential to improve user experiences significantly, potentially leading to increased adoption rates.

Amidst the volatile market conditions, there’s a promising indication of future recuperation and expansion. Yet, it’s crucial to remember that the cryptocurrency market carries no guarantees, so make your trades and investments prudently. It’s essential to carry out independent research on each opportunity and never risk more funds than you can comfortably part with.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- USD MXN PREDICTION

2024-08-06 16:47