As an experienced analyst with a deep understanding of the global economic landscape and a keen interest in the crypto industry, I find Trump’s stance on Bitcoin intriguing. His recognition of Bitcoin’s potential as a modern asset, akin to artificial intelligence, aligns with my own observations. However, his proposal to create a strategic reserve of Bitcoin raises some concerns.

In his view, Presidential hopeful Donald Trump – who’s been an advocate for the crypto sector – thinks it would be inappropriate for the United States administration to own or deal with cryptocurrencies.

Table of Contents

In a conversation on a podcast with Adin Ross, he brought up the recent transaction of Bitcoin (BTC) made by the U.S. administration. He then posed a question to Trump: Would you endorse cryptocurrency if you were elected in November 2024?

Should I be elected, our administration’s stance would be to maintain a full ownership of all the Bitcoin that the U.S. government presently possesses, along with any additional Bitcoin acquired in the future.

Later, Trump shifted focus to praise for Bitcoin. He deemed the digital currency as “quite contemporary” and analogized it to the concept of Artificial Intelligence.

He added that if the U.S. will not innovate in the field of digital assets, other countries will, including China — the most significant geopolitical rival — which is already making progress in the cryptocurrency and artificial intelligence sectors.

How much Bitcoin does the U.S. have on its balance sheet?

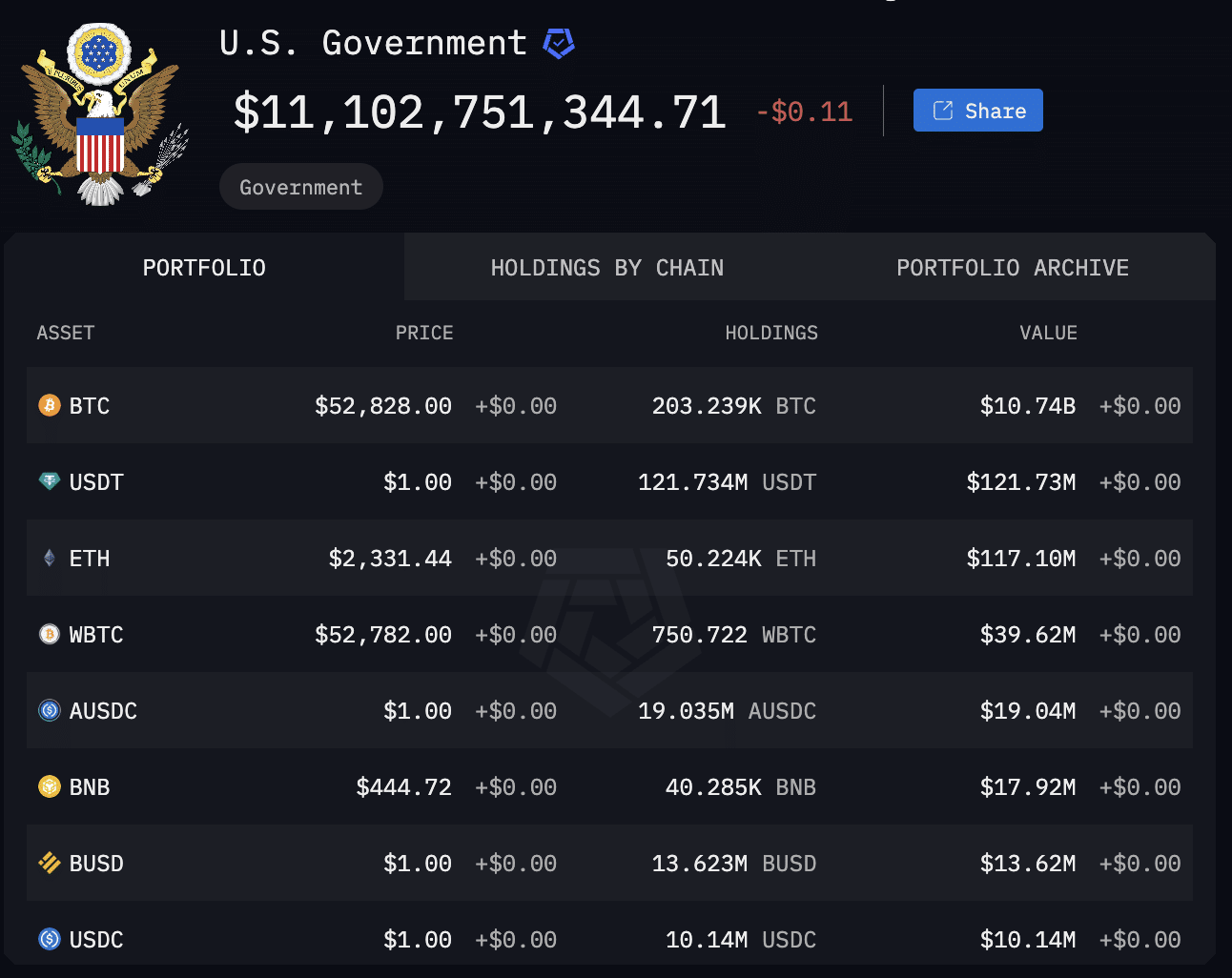

Based on reports from the Arkham Intelligence system, by the spring, the U.S. government was found to be among the top Bitcoin holders with over 210,000 Bitcoins in their possession.

Apart from Bitcoin, the U.S. government also held approximately $200 million worth of various digital currencies such as Ethereum (ETH), Tether (USDT), and Circle (USDC), which are known as stablecoins.

In June, an amount of $243 million worth of Bitcoin was moved from a U.S. government account to the Coinbase platform. This money had been seized from Banmeet Singh, a darknet market operator who admitted guilt in drug dealing and money laundering charges.

In late July, it was reported that the United States government transferred approximately 28,000 Bitcoins to an unidentified digital wallet. Subsequently, around 19,800 of these coins were sent to a single destination, while another 10,000 BTC were forwarded to a different address.

Currently, as per Arkham Intelligence’s latest report, it is known that a U.S. government-owned address holds approximately $11.1 billion in cryptocurrencies. This substantial amount includes over 203,000 Bitcoins.

How is the U.S. government-seized BTC sold?

Starting from 2014, the U.S. Marshals Service has been selling confiscated Bitcoins through closed auctions. But in late June, it was disclosed that the USMS, a division of the Justice Department handling asset forfeiture, decided to work with Coinbase Prime for securely holding and trading seized digital currencies.

The Coinbase Prime brokerage platform allows clients to store, buy, sell, and invest in cryptocurrencies. It is also the primary partner for most spot crypto ETFs.

Trump’s plans for government-seized BTC

During the Bitcoin 2024 gathering, Trump declared his plans to establish a strategic stockpile of Bitcoins. He underscored the significance of digital currencies for the nation’s economic advantage and vowed that confiscated Bitcoins by the U.S. administration would never be sold.

As a researcher, I would express it like this: “In alignment with former President Trump’s perspective, I, as a Researcher, am preparing to propose legislation that would authorize the acquisition of approximately 1 million Bitcoins by the U.S. Treasury. This proposed purchase represents around 5% of the total supply of Bitcoin in circulation.”

As a crypto investor, I must acknowledge that the ideas put forth by Senators Lummis and Trump about incorporating Bitcoin into government reserves are not entirely novel. In fact, Michael Saylor, the ex-CEO of MicroStrategy, has previously voiced similar sentiments. He suggested that the U.S. Treasury should consider acquiring a significant amount of Bitcoin, to be precise, 4 million BTC.

Furthermore, Cathie Wood, the CEO of ARK Invest, advocates for considering Bitcoin as part of a reserve. She points out that this would be significant only if Bitcoin functions as a financial asset rather than a tool used in U.S. monetary policy, and is merely held on the balance sheet.

Which countries have the most Bitcoins?

As a researcher examining the world of cryptocurrency, I’ve observed an interesting dynamic: While individual investors purchase Bitcoin using real money in open markets, governments typically acquire it through legal confiscation. This means that governments, as some of the largest entities in this space, hold significant amounts of Bitcoin due to seizures from criminal activities.

As a researcher, I’ve found an intriguing distinction in the global adoption of Bitcoin: Unlike major countries such as the United States, China, the United Kingdom, and Germany, El Salvador is the only nation that actively purchases and mines Bitcoin since 2021, leveraging its geothermal energy through the state-run Volcano Energy initiative. However, it’s essential to note that while these large countries have never officially purchased cryptocurrency, their governments have amassed crypto assets worth billions of dollars, primarily from confiscations linked to criminal activities.

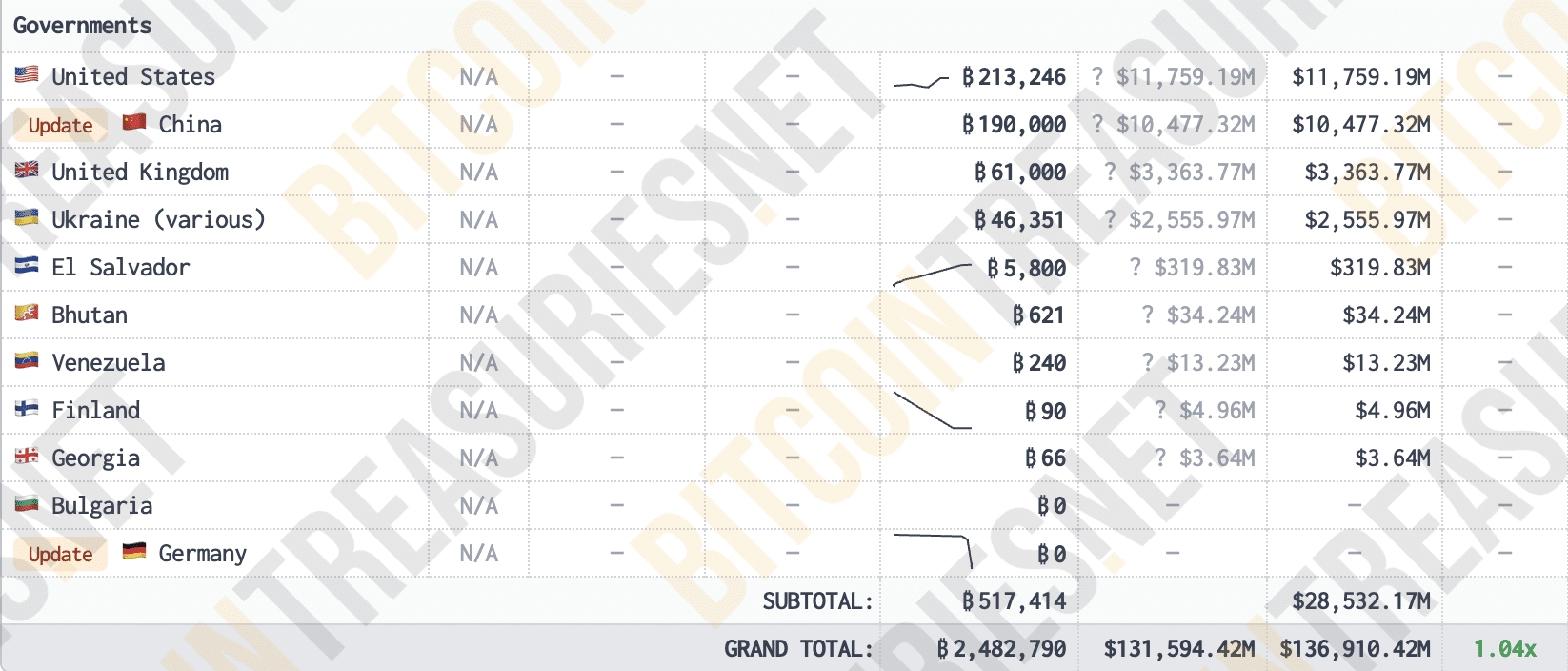

As per the Bitcointreasuries platform’s estimation, the collective Bitcoin holdings of various nations are approximately 517,000 Bitcoins, which equates to over $28 billion in value.

Among nations worldwide, the U.S. government is known to possess the most significant amount of Bitcoin. China follows closely with approximately 190,000 Bitcoins in their reserves, according to the Bitcointreasuries list. In the year 2020, authorities confiscated a total of 195,000 Bitcoins and other cryptocurrencies from the PlusToken financial scheme.

The United Kingdom ranks third in the Bitcoin Treasuries list, with an estimated Bitcoin reserve of approximately 61,000 BTC – this is the quantity of Bitcoins that were confiscated by the authorities during January.

Is Trump right?

Trump expresses conviction that holding Bitcoins could form the basis of a national strategic Bitcoin reserve, and he’s optimistic that Bitcoin’s market value could surpass that of both gold and silver.

As a crypto investor, I’ve observed that while Bitcoin holds immense potential, it comes with its own set of challenges. The most pressing one is extreme volatility. This is a predicament that the authorities of El Salvador have had to grapple with, as their Bitcoin reserves have plummeted by a third, largely due to a steep decline in Bitcoin’s value.

Despite this, holding Bitcoins as a reserve could prove advantageous for diversification purposes. Some nations might look to establish non-centralized financial assets as an alternative, especially when traditional systems are restricted. Moreover, certain countries might explore methods to execute international payments without adhering to the limitations on regular financial transactions.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-06 17:56