As a seasoned analyst with over two decades of experience in the financial markets and a keen interest in the crypto space, I must admit that the recent movement of hundreds of wallets containing nearly $2 billion in Ethereum linked to the PlusToken Ponzi scheme is causing a ripple of concern in the industry.

Approximately 2,800 tokens valued at nearly $2 billion in Ethereum tied to the Chinese PlusToken Ponzi scheme from 2020 have been actively transferred among hundreds of digital wallets.

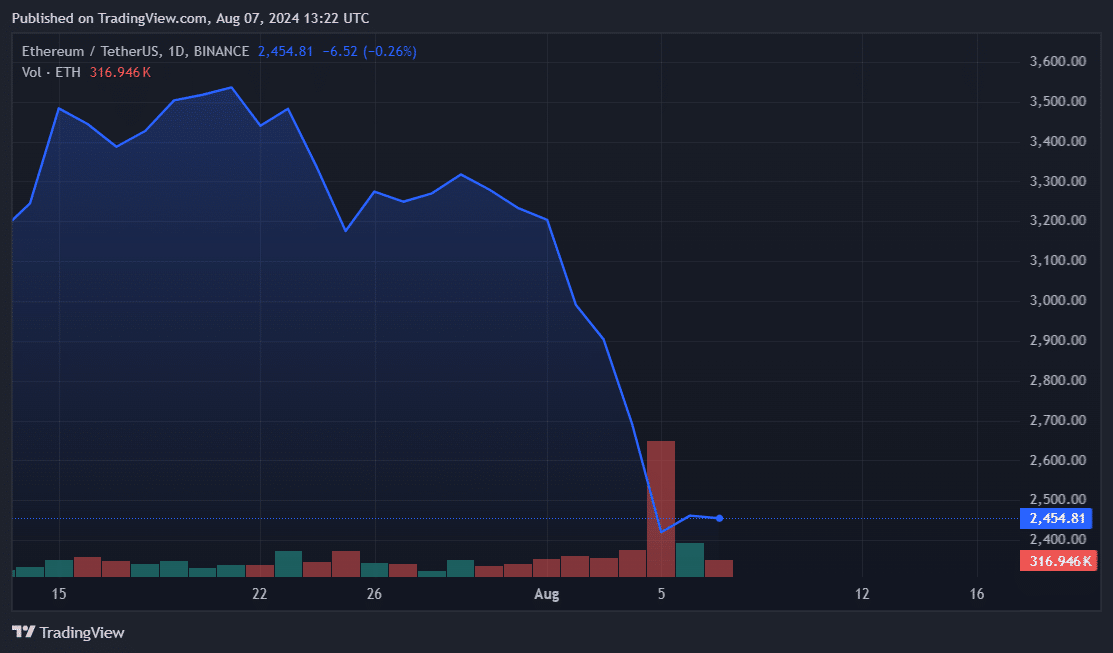

On August 7, Ethereum (ETH) dropped approximately 2% following transactions from a wallet containing 789,533 Ether, which had been inactive for over three years and recently received assets from a wallet labeled “Plus Token Ponzi 2” in April 2021. According to Etherscan, these transfers occurred early on Wednesday.

In the year 2020, Chinese law enforcement managed to shut down PlusToken, a massive Ponzi scheme that had accumulated billions of dollars. The authorities confiscated cryptocurrencies with an estimated current value of around $14 billion. This includes a staggering 194,775 Bitcoin (BTC) and 833,083 Ether (ETH), valued at approximately $11.2 billion in BTC and $2.11 billion in ETH.

Additionally, Chinese authorities seized a significant amount, ranging from tens to hundreds of millions in value, of various cryptocurrencies such as Ripple (XRP), Bitcoin Cash (BCH), Litecoin (LTC), EOS (EOS), Dash (DASH), Dogecoin (DOGE), and Tether (USDT).

In the city of Yancheng, China, a local court found guilty 15 people in relation to a case that allegedly affected approximately 2 million investors.

Will Ethereum buckle under sell pressure?

It’s possible that Ethereum is facing a situation similar to Mt. Gox, as recent data indicates significant movement of Ether across various platforms. As reported by crypto.news, market maker Jump Crypto transferred approximately $277 million worth of ETH to exchanges like Binance and Coinbase.

The Chicago-based company has additionally withdrawn a significant amount of Ether from Lido Finance, potentially indicating they are preparing to sell their assets.

Although there’s no news about Chinese authorities liquidating their Ethereum (ETH) or Jump Capital unloading the asset in exchange for stablecoins, such actions could potentially intensify selling pressure on Ethereum following a broad-based market sell-off.

Indeed, Ether shed 25% in the last seven days and had held above $2,400 for less than 48 hours at press time. ETH’s market price was fairly unchanged, showing a 0.7% increase in 24 hours.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-08-07 17:02