As a seasoned crypto investor with battle-tested nerves and a hearty appetite for market volatility, I find today’s dip in the crypto market to be just another exciting rollercoaster ride. Having navigated through multiple bull and bear cycles since my initial investment in Bitcoin back in 2013, I’ve learned that short-term price fluctuations are par for the course when it comes to this nascent asset class.

In the past day, Bitcoin, the most valuable digital currency globally, has seen a 4% decrease. This drop follows approximately $155.25 million worth of liquidations across the cryptocurrency market.

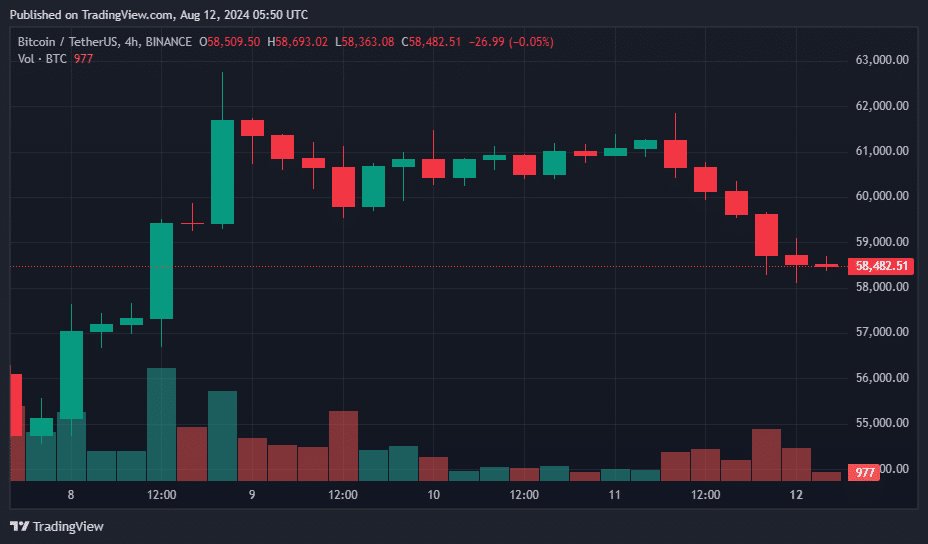

For four straight days, Bitcoin (BTC) remained above the $60,000 mark. However, on August 11, it dropped below this level, going as low as $58,269 during the day. Earlier in the day, it had reached a high of $61,562.

According to information from CoinGecko, the overall cryptocurrency market experienced a drop of approximately 4.32% in the last 24 hours, lowering its collective worth to about $2.05 trillion.

Although worldwide crypto trading volumes rose by 52% from the preceding day, it still fell short of the trading activity from the past week. This decline has increased Bitcoin’s weekly loss against the US dollar to 9.7%.

As I observe the market trends, it appears that Ethereum (ETH) has experienced a slight dip as well, dropping from its peak of $2,711 earlier today to currently trade at $2,553.

In the list of the ten largest cryptocurrencies based on market value, Toncoin experienced the steepest drop at 8.43%, closely followed by Solana with a decline of 8.12%. Dogecoin also saw a decrease of around 6.75%. As the evening of August 11 unfolded, the market prices exhibited instability and increased selling pressure.

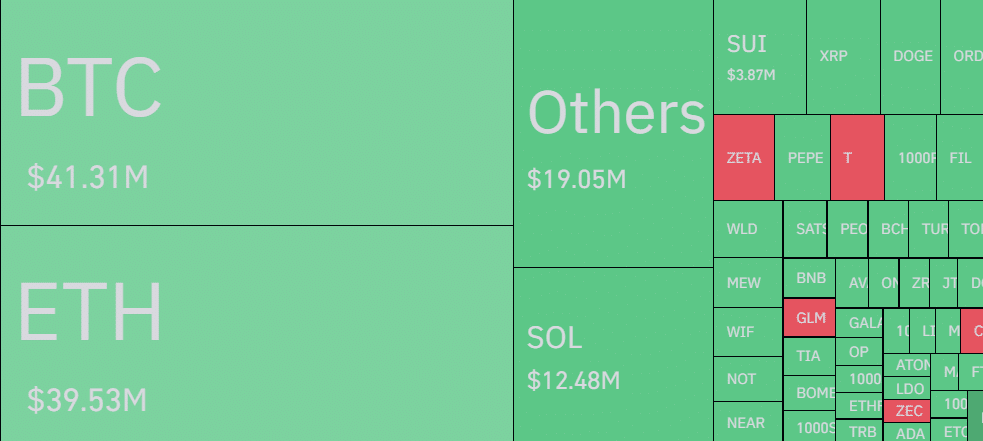

Today posed difficulties for cryptocurrency derivatives traders as a considerable number of long positions were forced to close, resulting in liquidations worth around $155.25 million over the past 24 hours according to Coinglass. Out of this total, about 80% or $124 million was tied to long trading positions, signifying traders who had predicted future price rises.

Over the past day, more than 61 thousand traders have had their positions closed (liquidated). The biggest single liquidation happened on the OKX platform, totaling approximately 2.17 million dollars.

In the latest round of liquidations, Bitcoin took the lead with a total of $41.31 million, and Ethereum came in second with approximately $39.53 million worth of liquidations.

As per Coinglass, Binance led the way with a total of $7.04 million in liquidated trades. This figure includes $2.42 million from traders holding long positions and $4.62 million from those holding short positions. OKX came in second with $3.48 million in liquidations, where $1.30 million was due to long positions being forced closed and $2.18 million from short positions.

Consequently, the cumulative value of all open cryptocurrency positions decreased by about 3.12%, now standing at approximately $27.5 billion, according to information from Coinglass.

Despite some ups and downs in the cryptocurrency market recently, analysts from Grayscale Research anticipate price rises in the upcoming months. They think that token values might rebound if the U.S. economy can pull off a “soft landing” (meaning avoiding a major downturn) and prevent a recession. Bitcoin, according to them, could reach its record high again by the end of this year under these circumstances.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-08-12 10:13