As a seasoned researcher with a knack for deciphering market trends, I find myself intrigued by the current state of Ethereum (ETH). The declining whale activity around the asset is often a sign of a maturing market, but it’s the paradoxical bullish indicators that have piqued my interest.

On-chain indicators look bullish for Ethereum as the whale activity around the asset declines.

In the last 24 hours, Ethereum (ETH) dropped by approximately 3.8% and is being traded at around $2,620 as we speak. At present, its total market capitalization stands at a staggering $315 billion. Interestingly, despite the price drop, Ethereum’s daily trading volume experienced a slight increase of about 3%, amounting to roughly $15.6 billion.

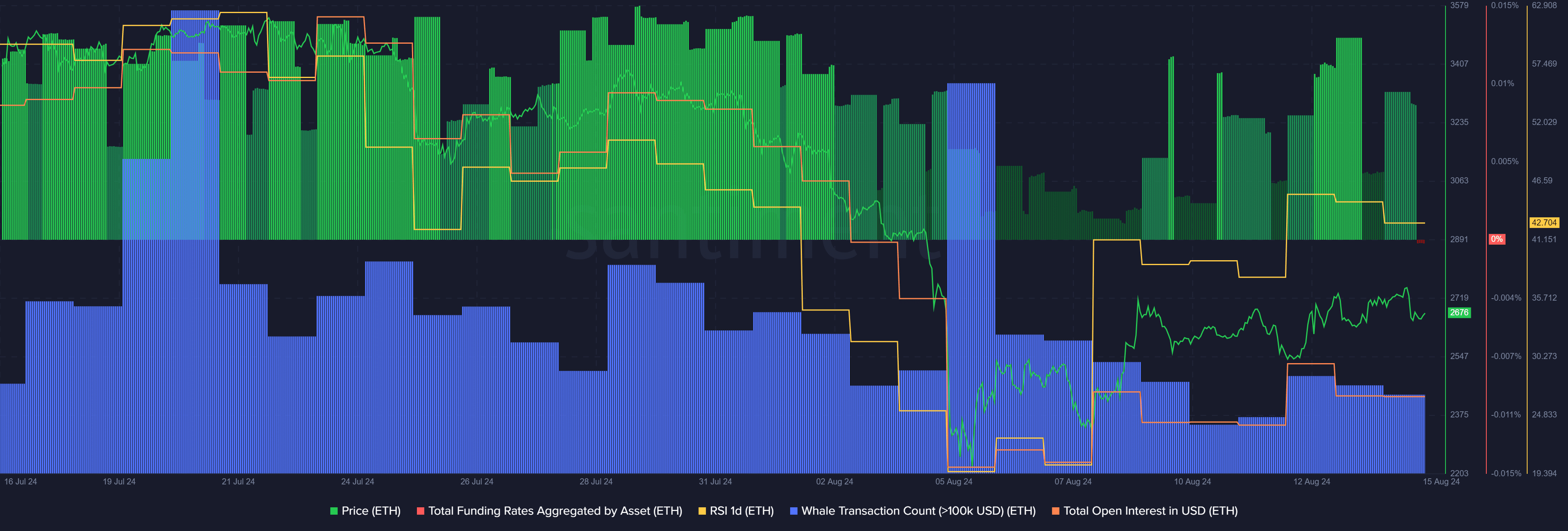

Based on Santiment’s data, the total value of Ethereum positions (open interest) dropped from approximately $5.28 billion on August 12th to about $5.05 billion at the current reporting time. Typically, a decrease in an asset’s open interest might indicate reduced price volatility, as fewer liquidations tend to occur when there is less exposure to the market.

Market data indicates that the cumulative lending rate for Ethereum has dipped below zero for the first time since October 2023, reaching a current level of -0.0002%. In simpler terms, people are now borrowing more Ethereum than they are lending, resulting in negative returns on ETH deposits.

Historically, when the funding rate for Ethereum has been negative, it has often led to a brief period of increasing prices (bull market) contrary to what traders might have predicted, as they usually anticipate a decrease in price.

Over the past three days, as a researcher observing the Ethereum (ETH) market, I’ve noticed a consistent downward trend in the number of whale transactions valued at least $100,000. On Aug. 12, there were 5,371 unique such transactions, but over the past day, this figure has dropped to 4,346.

Additionally, it’s worth mentioning that the Ethereum Relative Strength Index indicates a slight overselling condition, with a reading of around 42. This suggests that there might be more selling pressure, potentially causing fear, uncertainty, and doubt (FUD) among investors, which could further lower the ETH price.

A significant factor contributing to the recent drop in ETH‘s value is due to the massive sell-off by Jump Trading. This influential firm has amassed approximately $64 million worth of ETH tokens across various platforms, suggesting they are now preparing to offload these tokens.

Read More

- Silver Rate Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD CNY PREDICTION

- Gods & Demons codes (January 2025)

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Maiden Academy tier list

- Superman: DCU Movie Has Already Broken 3 Box Office Records

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-15 10:25