As a seasoned analyst with years of experience in the volatile world of cryptocurrencies, I can confidently say that short-term investments can be both exciting and risky. Having navigated through market crashes and bull runs, I’ve learned to approach these investments with caution, yet with an open mind for opportunities.

In simpler terms, when you engage in short-term investment, you’re purchasing assets or digital currencies like cryptocurrencies and then quickly selling them off. The strategy here is based on speculation, where profits are made by capitalizing on small changes in prices over a brief timeframe. This method works well for individuals who are comfortable putting their money at some risk. Let’s dive right in!

Table of Contents

Short-term crypto trading strategies

What are the main short-term trading strategies, and who are they suitable for?

Day trading

Day trading in cryptocurrencies involves purchasing and swiftly reselling digital currencies within the same day or even a couple of hours. The objective is to capitalize on minor price fluctuations. Given its high-risk nature, consider these suggestions:

Stick to what you know. Trade cryptocurrencies you’re already familiar with.

Use technical indicators. They can help you spot trends and make smarter decisions.

Set stop-losses. These can help you limit your losses if things don’t go as planned.

Avoid trading when emotional. Try not to let feelings dictate your trades.

Start with a small investment that you can afford to lose.

Scalping

Rapidly purchasing and offloading cryptocurrencies to capitalize on minuscule price fluctuations is known as scalping. The objective of scalpers is to execute numerous transactions throughout the day, seeking modest profits with each one. Important things to bear in mind include:

Look for small price movements. Scalpers profit from minimal fluctuations in price.

Employ technical analysis tools such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and simple moving averages to identify suitable entry and exit timings.

Manage risks carefully. Setting stop-loss orders is crucial.

Opt for trading pairings that offer good market liquidity, allowing you to complete transactions swiftly with minimal significant price discrepancies.

Swing trading

Swing trading is about catching medium-term price moves by holding your positions for a few days or weeks. It blends technical and fundamental analysis. Here’s the scoop:

Pay attention to the market’s movements for optimal buying and selling opportunities. Ensure that your transactions align with the market’s general trajectory, whether it is on an upward or downward trend.

Set stop-losses. Protect yourself from big losses by setting stop-loss orders.

Instead of engaging in the fast-paced, high-stress environment of day trading, swing trading offers a more relaxed pace as it allows for extensive market analysis and thoughtful decision-making due to its extended time frames.

How to choose the best cryptocurrency to invest today for short term

As an analyst, I would advise selecting high-liquidity cryptocurrencies that exhibit significant short-term price fluctuations while maintaining a manageable level of risk for potential gains. The optimal coins should offer ease in buying and selling swiftly during market volatility, with tight spreads and minimal slippage to ensure the best possible transaction prices.

Here’s what to consider:

- Project sector. Take some time to understand what the cryptocurrency is all about — its mission, goals, and future plans. Some projects might skyrocket quickly, but that doesn’t always mean they’ll last. Knowing the project’s sector and its goals helps you assess whether it has staying power.

- Market capitalization. Think of market cap as a way to measure how “big” a cryptocurrency is. A bigger market cap usually means it’s easier to trade without causing big price swings. Plus, it’s a good indicator of investors’ interest and trust in the coin.

- Price history. Long-term charts can show you where the price usually bounces back or runs into trouble. By seeing how the price has changed in the past and what triggered those big shifts, you’ll get a better idea of what could happen next.

- News and updates. Staying updated on the latest news is crucial. Things like new regulations, tech updates, and general news can all affect how people view the coin.

Top 4 short-term cryptos

What are the best cryptos to buy now for the short term?

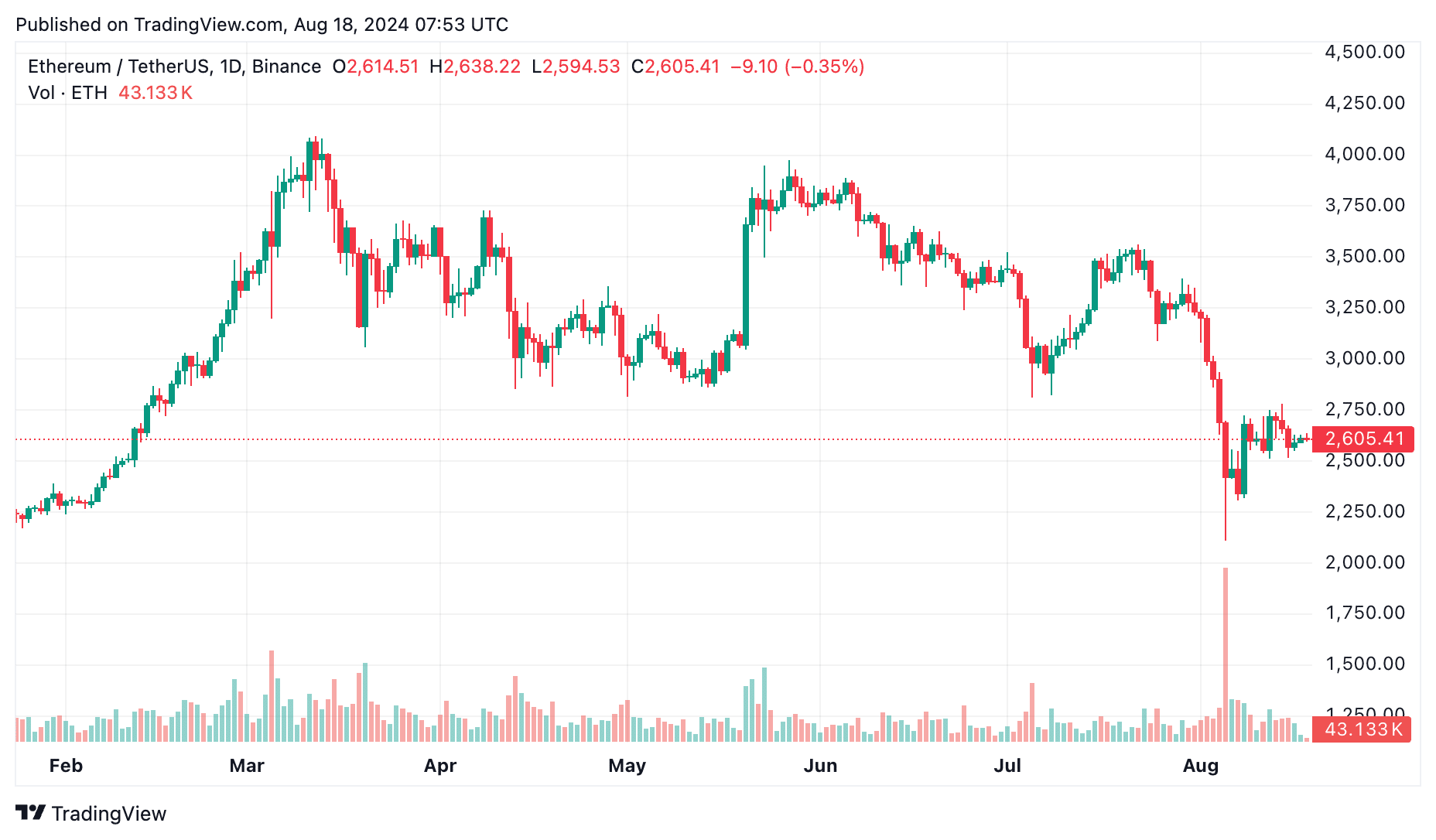

Ethereum

Ethereum ranks as the second widely-used cryptocurrency following Bitcoin. While Bitcoin pioneered the concept of decentralized currency, Ethereum took it a step further by establishing the foundation for the first decentralized economy. Its innovative smart contracts have significantly reshaped the crypto landscape, enhancing the dependability and creativity of business transactions. These self-governing smart contracts are controlled by their own programming code, any attempts to modify this code result in permanent changes that are deemed invalid by the blockchain network.

Chainlink

The LINK token is a crucial component within the Chainlink network, functioning as a decentralized oracle service. Chainlink serves as a connection between blockchains and real-world data sources, allowing smart contracts to interact with external information. By using the LINK token, users can access these oracle services and reward data providers for their contributions, ensuring accuracy and security. Chainlink and its associated LINK token play a significant role in facilitating smart contracts and are essential for various blockchain applications such as DeFi, financial markets, IoT, and more.

PlayDoge

Choosing PlayDoge as an investment in cryptocurrencies might be a captivating option for investors, considering its unique features. PLAY is a BEP-20 token operating within the Binance blockchain, ensuring quicker listing on its exchange compared to similar crypto games running on other platforms following the presale closure.

Drawing inspiration from the iconic Tamagotchi game of the ’90s, PlayDoge merges fun with financial gain using a Play-to-Earn approach. Users can collect digital pets and embark on exciting journeys within a miniature arcade atmosphere to earn rewards.

PepeUnchained

Pepe Unchained, a new meme coin, is currently in its pre-sale stage, and it’s been quite successful in fundraising. In just one week since its launch, the pre-sale managed to gather over $1 million in investments, and by the time of writing, this figure had surpassed $9 million.

The PEPU token, an advanced iteration, is poised to follow in the footsteps of the well-known PEPE. The team behind Pepe Unchained envisions a broad expansion for its ecosystem, with aspirations to develop DeFi and NFT initiatives, introduce new cryptocurrencies, and delve into AI-centric applications.

FAQs

What is the best crypto to buy now for the short term?

As a seasoned cryptocurrency investor with several years of experience under my belt, I find Ethereum, Chainlink, PlayDoge, and Pepe Unchained to be excellent choices at this moment. Each of these digital assets offers unique opportunities for short-term gains that could potentially yield significant returns. My personal preference leans towards Ethereum due to its widespread adoption and growing ecosystem, but I wouldn’t overlook the potential of the other three. It’s essential to do thorough research before investing in any cryptocurrency and always remember that the market is volatile, so it’s crucial to have a well-diversified portfolio.

How to choose the best crypto for short-term investments?

When it comes to brief-term financial commitments, opt for cryptocurrencies with high trading volume (liquidity). Additionally, examine the project’s history, market value, pricing trajectory, and most recent updates to ensure you make the wisest choice.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-08-18 11:06