As a seasoned crypto investor with a knack for deciphering market trends and an eye on institutional activity, I find the recent developments in Bitcoin and Ethereum ETFs quite intriguing. The consistent inflows into Bitcoin ETFs, particularly BlackRock’s IBIT, which has amassed a staggering $20.53 billion since its launch, paint a bullish picture for Bitcoin’s future. However, the ongoing outflows from Ethereum ETFs, led by Grayscale’s ETHE, suggest a more cautious approach towards Ethereum might be warranted.

As a seasoned investor with over two decades of experience in the financial markets, I have witnessed numerous trends come and go. However, the recent developments in the world of Bitcoin and Ether Exchange Traded Funds (ETFs) have piqued my interest more than most. This week, for instance, I’ve noticed an interesting pattern: Spot Bitcoin ETFs have enjoyed two consecutive days of inflows, a positive sign for those bullish on cryptocurrency. On the other hand, spot Ether ETFs have seen a drop in outflows during a four-day streak of negative flow, indicating some level of cautious optimism among investors.

Based on SoSoValue’s data, Bitcoin exchange-traded funds that ranked 12th saw an inflow of approximately $88.06 million on August 21st. This is a 42% rise compared to the net inflows recorded on August 20th.

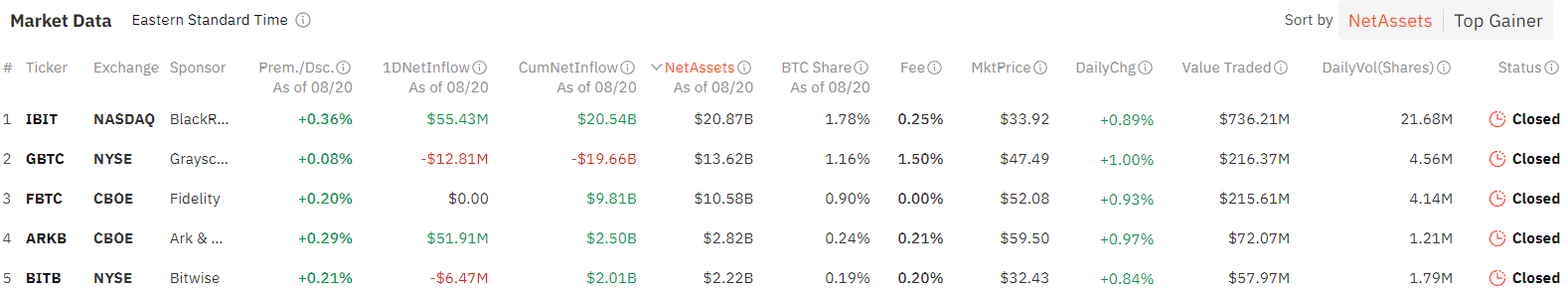

As a researcher, I’m excited to report that BlackRock’s IBIT Fund has once again made headlines, recording an impressive $55.4 million in inflows on the second day in a row. This brings its total inflow since launch to a staggering $20.53 billion. Interestingly, it seems to be the only fund experiencing such consistent growth. On the other hand, ARK 21Shares’s ARKB Fund saw inflows of $51.9 million after a day of no activity.

On this particular day, Grayscale’s GBTC and Biwise’s BITB recorded outflows of $12.8 million and $6.5 million respectively, acting as counterbalances to the inflows we had seen earlier. Notably, it was the first time in history that GBTC didn’t experience any flows on the preceding day. The other 8 Bitcoin ETFs maintained a neutral stance during this period.

As a researcher studying the BTC ETF market, I noticed an impressive surge in trading volume on August 21st, reaching a staggering $1.35 billion – a 73% increase from the previous day’s $779 million. Since their inception, these funds have amassed a cumulative net inflow of $17.52 billion. At the moment of my writing, Bitcoin (BTC) was experiencing a 1.7% decrease, trading at $59,842 according to data from crypto.news.

As a researcher, I’ve observed an interesting trend: By the close of Q2 2024, institutional ownership of U.S. spot Bitcoin ETFs escalated to a significant 24%. This rise occurred amidst a tough market and falling Bitcoin prices, indicating resilience among these investors. Notably, heavyweights like Goldman Sachs and Morgan Stanley are holding substantial shares, with the former possessing $412 million and the latter, $188 million. However, it’s important to note that some of these assets might be held on behalf of their clients.

Ongoing outflows persist in Ether ETFs

Contrarily, a total of $6.49 million was withdrawn from the group of Ethereum ETFs on August 21, making it the fourth straight day these funds experienced withdrawals.

In recent developments, Grayscale’s ETHE experienced another round of outflows, amounting to $37 million, adding to its total outflow since inception on July 23, which now stands at a significant $1.47 billion. On the flip side, BlackRock’s ETHA and Biwise’s ETHW were the exceptions, reporting inflows of $26.8 million and $3.7 million respectively. The remaining six Ethereum ETFs did not register any flows on that particular day.

Today’s trading volume for these investment tools has surged to approximately $194.6 million, marking a substantial increase compared to the day before. Meanwhile, Spot Ether ETFs have accumulated a total net withdrawal of around $440.11 million so far. As for Ethereum (ETH), at the time of this writing, it was dropping by 2.6%, and could be found trading at roughly $2,600.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-08-21 11:40