As a seasoned researcher with over two decades of experience in the financial markets, I find the recent developments at PayPal quite intriguing. The bullish momentum in PayPal stock and its stablecoin, PayPal USD (PYUSD), are noteworthy trends that have caught my attention.

PayPal stock has moved into a bull market, rising by over 26% from its lowest point this month.

PayPal USD stablecoin’s market cap

PayPal USD (PYUSD), the company’s stablecoin launched in August 2023, has been performing well.

Data shows that its market cap has jumped sharply in the past few weeks, crossing the psychological level of $907 million on Aug. 21. This marks significant growth for a stablecoin whose market cap started the year at $264 million.

Stablecoin providers such as PayPal primarily generate revenue through two primary avenues: earning interest on deposits and charging fees for transactions. Given that U.S. interest rates range from 5.25% to 5.5%, PayPal could potentially rake in more than $50 million per year just by accruing interest.

In Q1 of 2024, USDT (Tether), the largest stablecoin boasting over $117 billion in assets, reported earnings exceeding $4.5 billion for the quarter. The majority of this income was derived from interest payments, while additional profits stemmed from fluctuations in asset values such as Bitcoin and gold.

PayPal faces a tough contest as the market for stablecoins has grown very competitive. Besides Tether, Circle’s USD Coin (USDC) has gained popularity and now holds more than $34 billion in assets. Furthermore, Ripple is working on its own stablecoin, RLUSD, which will be directly tied to the US dollar.

Furthermore, Ethena introduced USDe, amassing over $3 billion in assets, compared to Ondo OUSD’s $340 million. These stablecoins are gaining traction due to their monthly returns feature. USDY offers a 5.35% return, generated from investments in U.S. Treasuries.

PayPal stock has soared

PayPal’s shares are experiencing a surge, reaching their highest point in more than 52 weeks, which translates to a market value exceeding $71 billion. However, it’s worth noting that this price is significantly lower compared to its peak during the pandemic at $309, where its market value soared over $300 billion.

The surge in the stock occurred following Daiwa’s analysts upgrading it from ‘neutral’ to ‘outperform’, suggesting that the company is expected to thrive even amidst fierce competition from tech giants such as Apple, Google, and Affirm.

According to analysts at Argus Research, they’ve adjusted their stance on the stock from “buy” to “hold”. Meanwhile, analysts at Mizuho, JPMorgan, and Barclays have kept their recommendation as “outperform”.

The financial recuperation transpired post the release of PayPal’s blended second-quarter earnings report. Revenue soared by 85%, reaching a total of $7.8 billion, while active accounts experienced another decline to approximately 429 million. Moreover, PayPal continued its practice of returning money to shareholders through stock repurchases.

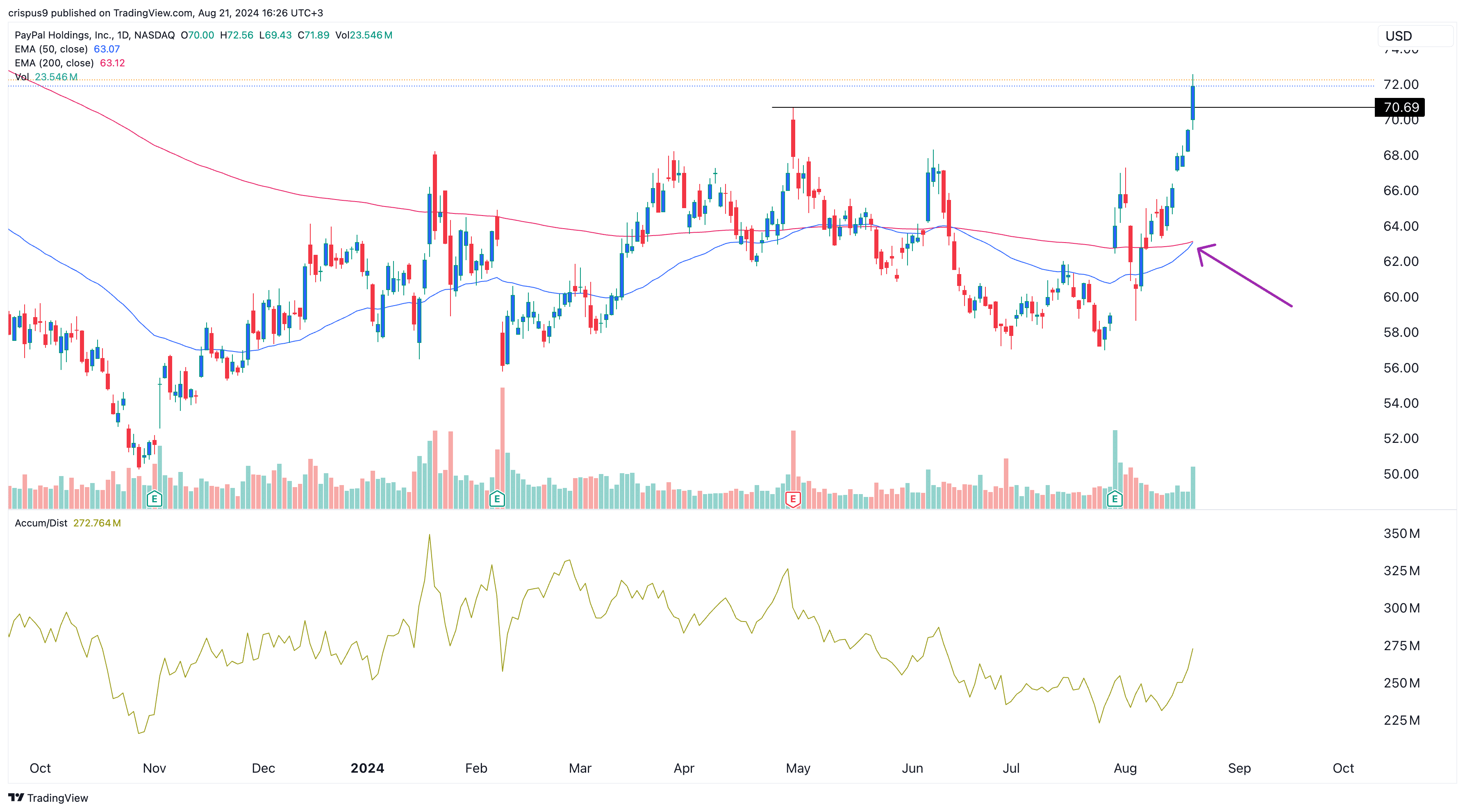

Even though we’re still in the early stages, there’s a possibility that the stock price could keep increasing due to the appearance of a golden cross chart pattern. This optimistic pattern typically emerges when the shorter-term 50-day and longer-term 200-day Exponential Moving Averages intersect.

Significantly, the stock has surpassed the significant resistance point of $70.69, which was the highest price so far this year. This upward movement occurs in a period of increased trading activity and the accumulation/distribution indicator is trending upwards as well.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

2024-08-21 17:31