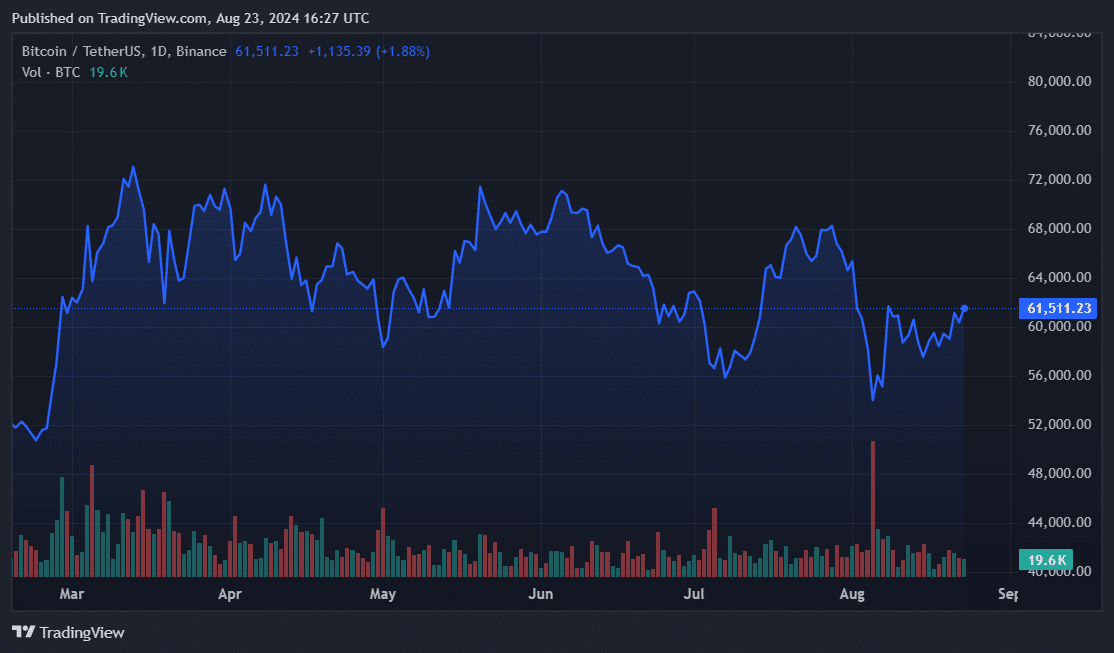

As a seasoned analyst with over two decades of experience in global financial markets under my belt, I must say that the recent surge in Bitcoin following Jerome Powell’s dovish remarks at Jackson Hole is nothing short of intriguing. The crypto market has always been volatile, but the speed and magnitude of this move are noteworthy.

In a span of merely 10 minutes, the value of Bitcoin skyrocketed by an impressive $1,100, following Federal Reserve Chair Jerome Powell’s optimistic comments during his speech at Jackson Hole.

In simple terms, “Jerome Powell, the head of the Federal Reserve, indicated on August 23 (at Jackson Hole) that it’s now necessary to change our current policies,” and his statement showed that they are optimistic about achieving a 2% inflation rate. This could mean potential reductions in interest rates are on the horizon.

For a moment, the value of Bitcoin (BTC) exceeded $62,000, but then it dropped again as the overall cryptocurrency market recovered some of its initial gains. Many people believe that the temporary rise in Bitcoin’s price was caused by remarks made by Powell.

As a researcher, I’m closely monitoring the evolving data that will ultimately shape the Federal Reserve’s decision regarding looser monetary policies, as per Powell’s statements. If interest rates are indeed reduced, as reported by crypto.news, it could potentially boost Bitcoin’s price and positively impact the broader cryptocurrency market.

Fed rate cut could boost Bitcoin market

Normally, when funding rates decrease, this can result in better cash flow and an increased interest in riskier investments, such as Bitcoin and other digital currencies. Given that the U.S. stock market and gold are currently at record highs, there’s a belief that money looking for fresh opportunities might find its way into Bitcoin.

After the significant dip of Bitcoin to $49,000 following the events of Black Monday this month, I’ve noticed that its price has been confined within an extended period of fluctuation, oscillating between roughly $53,000 and $61,000 for several weeks now.

At the moment, Bitcoin exchange-traded funds have been experiencing different inflows, but they’ve been drawing in more money for six consecutive days in a row.

Due to April’s halving that decreased block rewards by 50%, increased EFT purchases, and potential interest rate reductions, Bitcoin’s bullish argument may be strengthened. Following Powell’s Jackson Hole speech, the asset was traded at around $61,500.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- USD CNY PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- The 15 Highest-Grossing Movies Of 2024

2024-08-23 20:08