As an analyst with years of experience navigating the volatile digital asset landscape, I can confidently say that the NFT market is experiencing a significant downturn this August. The decline in total sales, buyer and seller numbers, and transaction volume are undeniable indicators that demand for these unique assets has waned.

The non-fungible token industry remained under pressure in August as sales continued falling.

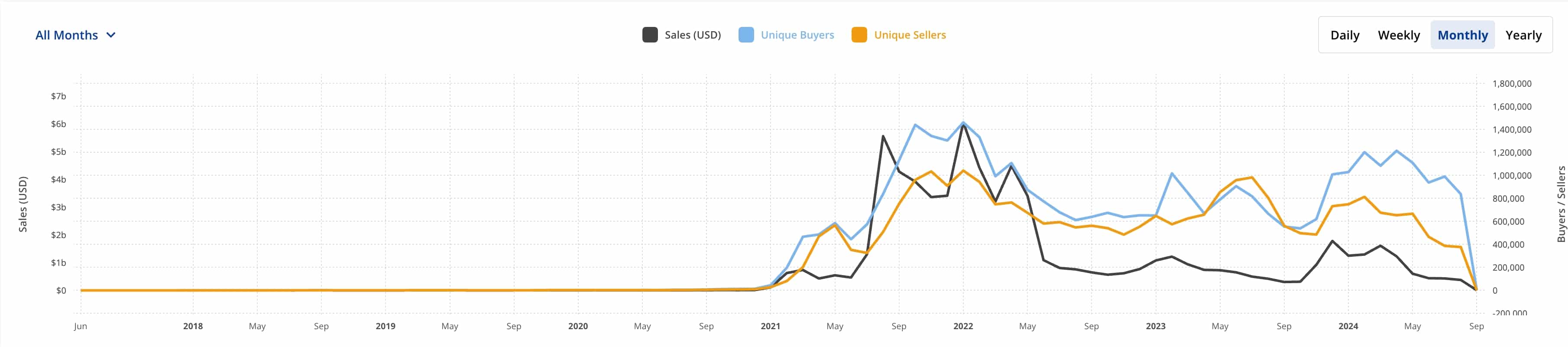

In August, total sales of Non-Fungible Tokens (NFTs) saw a significant decrease of approximately 41%, reaching around $376 million. The decline in transactions was due to a drop in both the number of buyers and sellers, with each group experiencing double-digit reductions.

According to data from CryptoSlam, the number of buyers decreased by 29%, going from approximately 168,459 to 127,913, and the number of sellers dropped by 17%, reducing from roughly 113,200 to 93,600.

Moreover, there was a decrease of about 50% in the number of NFT transactions, dropping to approximately 7.4 million. This suggests that interest or demand for these digital assets might be decreasing.

In January 2022, our monthly sales soared above $6.5 billion, with more than 1.5 million distinct purchasers and vendors participating.

In August, Ethereum (ETH) continued to be the preferred platform among NFT traders, processing transactions valued at approximately $129 million – a decrease of 38% compared to the preceding month.

Afterward, it was Solana (SOL) that managed a sum of approximately $78.9 million. On the other hand, Bitcoin‘s NFT sales decreased by half, amounting to around $57 million. Meanwhile, Polygon (MATIC) saw a decline of 52%, resulting in about $36 million.

In August, Mythos Chain experienced a boost. They managed transactions worth approximately $20 million, representing a 14% increase compared to the preceding month. This growth was primarily driven by DMarket, which witnessed a surge in sales of 17% for that particular month.

In recent times, some highly sought-after NFTs have experienced a decrease in both their market value and the number of transactions. To illustrate, the Bored Ape Yacht Club, which was transacting over $50 million per month in 2022, has now dropped to approximately $11 million in August.

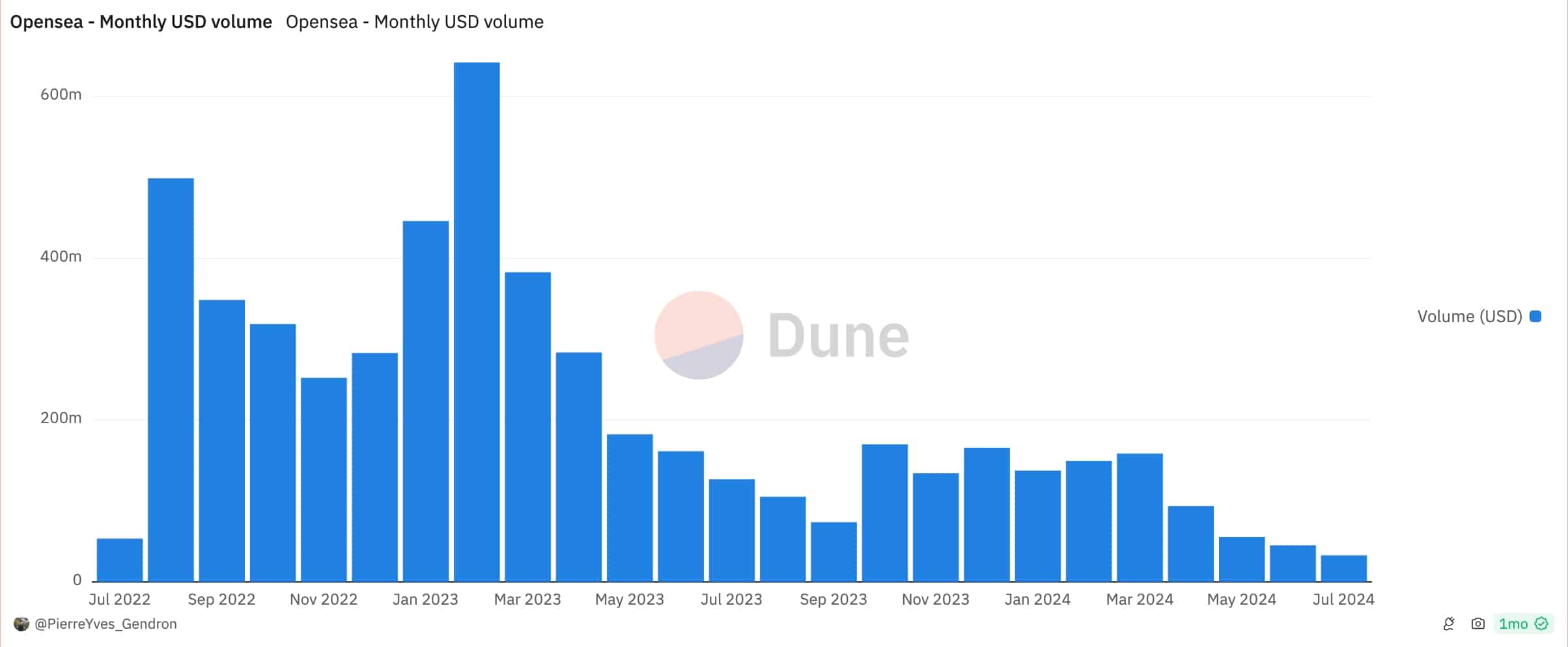

The significant drop in the number of NFT transactions each month has negatively impacted both investors and platforms such as OpenSea and Rarible. According to Dune Analytics, OpenSea’s monthly transaction volume in July was only $32 million, compared to a staggering $641 million in January of last year.

In recent months, other NFT trading platforms such as Blur, Magic Eden, and SuperRare have experienced a dip in transaction volumes and user activity.

The decline in NFT sales is due to dropping prices, as evident from CryptoPunks, the largest NFT collection, whose floor price currently stands at $88,839 – a 52% drop compared to the same time frame in 2023. Similarly, Bored Ape Yacht Club’s floor price has plummeted by 70% over the past year to reach $29,593, while Azuki has experienced a 20% decrease.

In that specific timeframe, both Pudgy Penguins and Milady experienced significant increases in their floor prices. Pudgy Penguins saw a jump of 166%, while Milady followed closely behind with an increase of 121%.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-09-01 19:44