As a seasoned crypto investor with a decade of experience navigating the digital asset market, I must admit that these recent market fluctuations have become as predictable as the tides for me. The liquidations we witnessed last Friday were a stark reminder of the rollercoaster ride we’re all on.

In simpler terms, significant losses were experienced by cryptocurrency investors, marking the largest sell-off in more than a week, as Bitcoin and many other alternative coins continued to drop in value.

Bitcoin and altcoins liquidations rise

According to data provided by CoinGlass, the total amount of liquidations on Friday, September 6th, surged to more than $221 million, marking a significant increase from the previous day’s figure of $72 million. This was the largest single-day increase since August 27th, when liquidations reached an impressive $281 million.

-

Bitcoin (BTC), the biggest cryptocurrency, led the liquidations with over $114 million;

Ethereum (ETH), $72 million worth and

Solana (SOL), $14 million.

Bitcoin, along with other digital currencies, saw a decline in value as investors shifted away from riskier assets and opted for safer investments instead. Notably, the Nasdaq 100 index fell by more than 500 points, while the Russell 2000 index plummeted over 1.96%.

After the United States released ambiguous employment data, suggesting a smaller interest rate reduction by the Federal Reserve (0.25%) rather than the anticipated 0.50%, this economic adjustment occurred. The statistics revealed that the unemployment rate dropped slightly to 4.2% and wage growth exhibited an improvement.

Following the heightened anticipation a month back, when experts significantly boosted their odds of an economic downturn, this morning’s (August) US employment data brings a sense of reassurance… but only if you weren’t completely certain that the Federal Reserve would lower interest rates.

— Mohamed A. El-Erian (@elerianm) September 6, 2024

The possibility exists that Bitcoin and various alternative coins might experience further declines in the upcoming weeks. To explain this, a wave of apprehension is sweeping across the market as the Fear & Greed Index has dropped to 30, which typically indicates fear among investors. Historically, cryptocurrencies tend to recede when investors exhibit fearful behaviors.

Institutional interest in Bitcoin and Ethereum is dwindling, as evidenced by the prolonged outflow of assets from their respective ETFs. In fact, Bitcoin ETFs have experienced a loss of assets for eight consecutive days now, while Ethereum funds have seen a total outflow of over $568 million since they were first established.

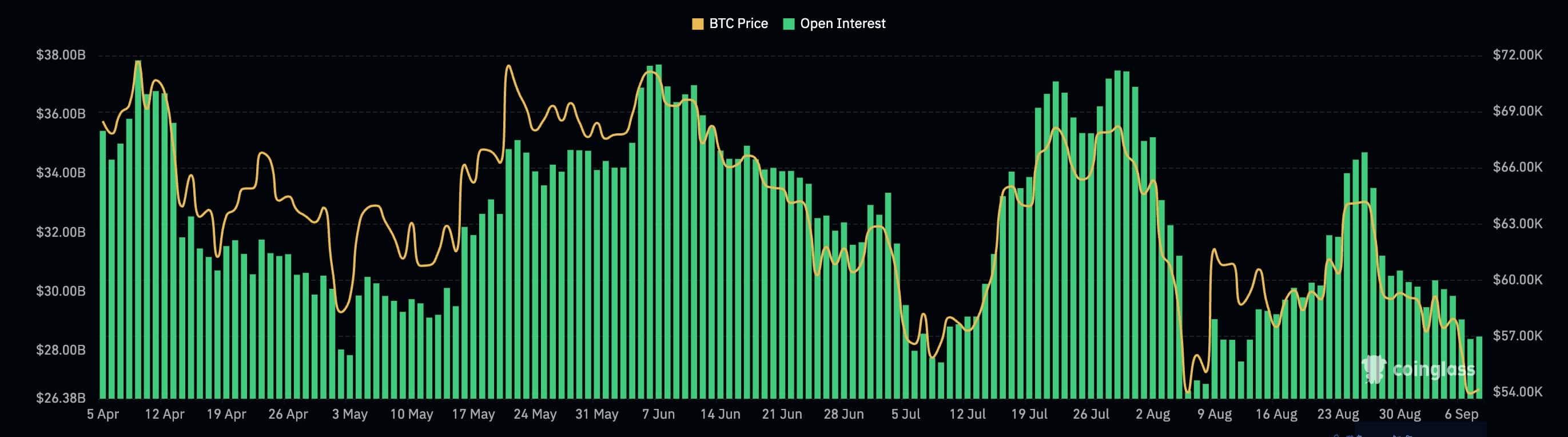

It appears that further examination of the data reveals a persistent decrease in futures open interest, currently reaching its lowest levels in more than a month. The open interest for Bitcoin has dipped to approximately $28.4 billion, marking a significant drop from its highest point this year, which was over $37 billion.

Bitcoin price has weak technicals

Bitcoin Death Cross?

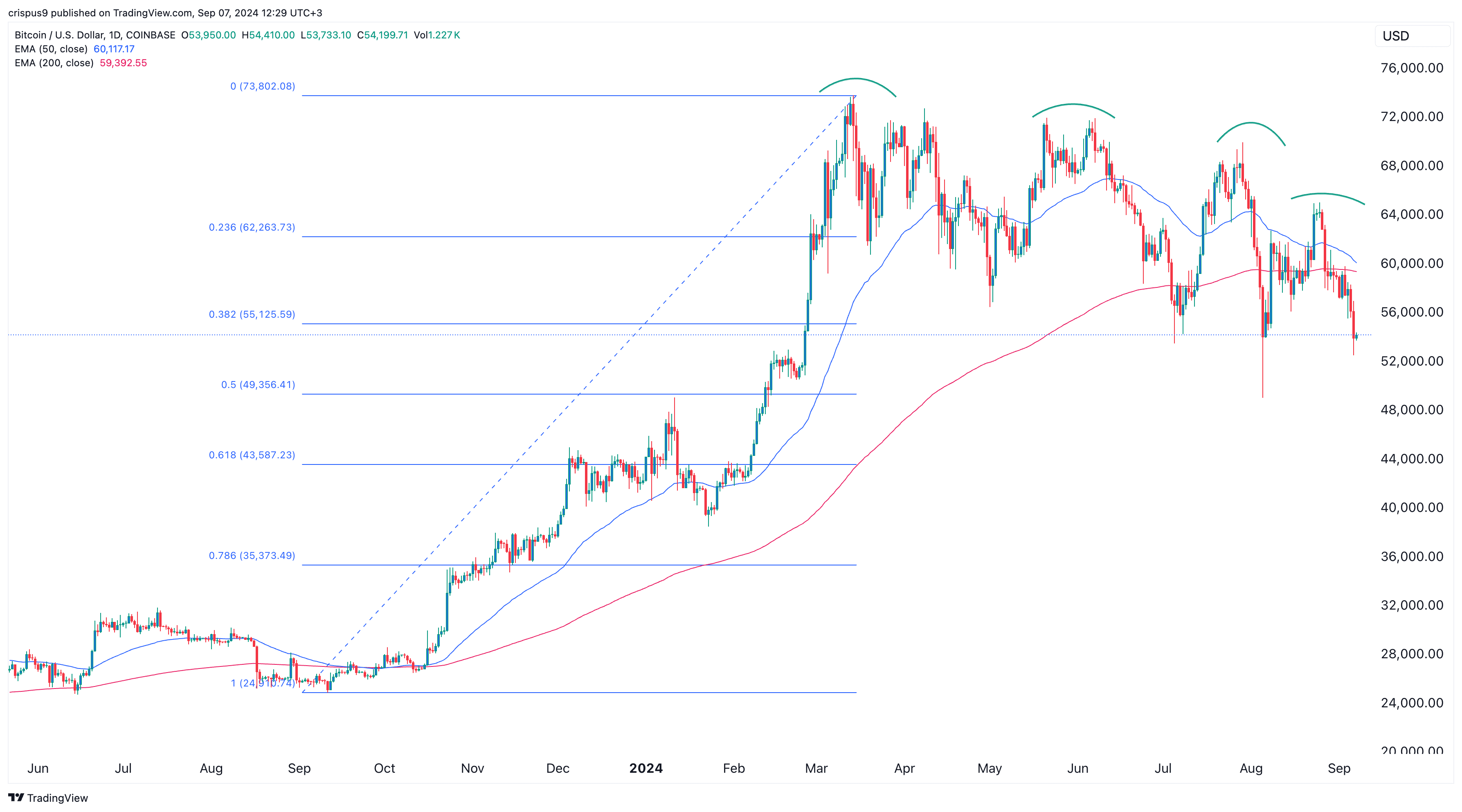

From my perspective as an analyst, it’s worth noting that Bitcoin’s moving averages are showing signs of potential trouble. Specifically, the gap between its 200-day and 50-day Exponential Moving Averages is shrinking, which could indicate the formation of a “death cross” pattern – a scenario where the shorter-term average crosses below the longer-term one, often viewed as bearish by traders. However, it’s important to remember that while this technical analysis suggests caution, it doesn’t guarantee future price action. Always do your own research and consider multiple factors before making investment decisions.

The last time Bitcoin formed a death cross was in 2022. The event led to a 65% crash.

Bitcoin’s current dip has taken it below the 38.2% Fibonacci Retracement line, suggesting a possible fall to the 50% mark of around $49,000 – its lowest point from last month. If it dips below this level, further decline is likely. Typically, other cryptocurrencies tend to plummet when Bitcoin’s performance is poor.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Maiden Academy tier list

- Hero Tale best builds – One for melee, one for ranged characters

2024-09-07 15:44