As a seasoned financial analyst with over two decades of experience navigating global markets, I find myself intrigued by the recent surge in Bitcoin and Ethereum prices. The confluence of positive economic indicators and geopolitical events has created an interesting backdrop for these digital assets.

The price of Bitcoin increased for three straight days, with investors jumping on the opportunity to buy at a lower cost before the highly anticipated debate between Donald Trump and Kamala Harris, as well as the release of the closely monitored U.S. inflation report.

Bitcoin (BTC) rose to $55,700 while Ethereum (ETH) jumped to $2,320. The gains coincided with a positive performance in the stock market, where the Dow Jones, S&P 500, and Nasdaq 100 indices all rose by over 1%. These assets rebounded following the mixed jobs report, which showed that the jobless rate fell to 4.2%, while wage growth strengthened.

Bernstein is bullish on Bitcoin

As a crypto investor, I’ve been keeping an eye on predictions about Bitcoin’s future price movements. An analyst at Bernstein has suggested that if Trump wins in November, Bitcoin could potentially surge to a whopping $90,000 – a significant 62% increase from its current levels as of Sep. 8. On the other hand, if Harris were to win, the analyst expects the price of Bitcoin to dip down to around $30,000. These predictions serve as interesting food for thought in the world of cryptocurrency investment.

AllianceBernstein, where Bernstein is an essential contributor, boasts more than $700 billion in assets it manages, and its market value exceeds $3.8 billion on the stock exchange.

According to the analyst’s perspective, it is expected that Donald Trump will create a more welcoming regulatory landscape for cryptocurrencies, after the term of Gary Gensler, who faced criticism from the crypto sector due to his emphasis on regulatory oversight through enforcement actions. Notably, during Gensler’s tenure at the SEC, lawsuits were filed against companies like Coinbase, Binance, Kraken, and OpenSea.

Trump has pledged to dismiss Gensler and advocate for the growth of the cryptocurrency sector. For instance, he has declared that he would prevent the sale of Bitcoins owned by the government. Furthermore, his goal is to establish the United States as a top player in Bitcoin mining.

Bitcoin’s history demonstrates that it tends to thrive regardless of who occupies the White House. In fact, it has hit new heights under every president since its inception, including President Joe Biden and Gary Gensler during his tenure. Bitcoin even reached an all-time high of $73,800 while Biden was in office and under Gensler’s supervision.

This morning, it was a pleasure to delve into topics like Bitcoin and intelligent, swift, powerful finance with Joe Squawk, BeckyQuick, and AndrewRSorkin.

— Michael Saylor⚡️ (@saylor) September 9, 2024

Federal Reserve rate cuts

The potential cause for an increase in Bitcoin’s value may come from the Federal Reserve’s decisions, especially if this week’s data verifies a decrease in inflation rates. Economists anticipate that the figures will demonstrate a decrease in the annual Consumer Price Index to 2.6% in August.

If the information holds true, there’s a possibility that the Federal Reserve could reduce interest rates by 0.50% during their September gathering. Historically, riskier investments like Bitcoin often thrive when central banks lower their own rates.

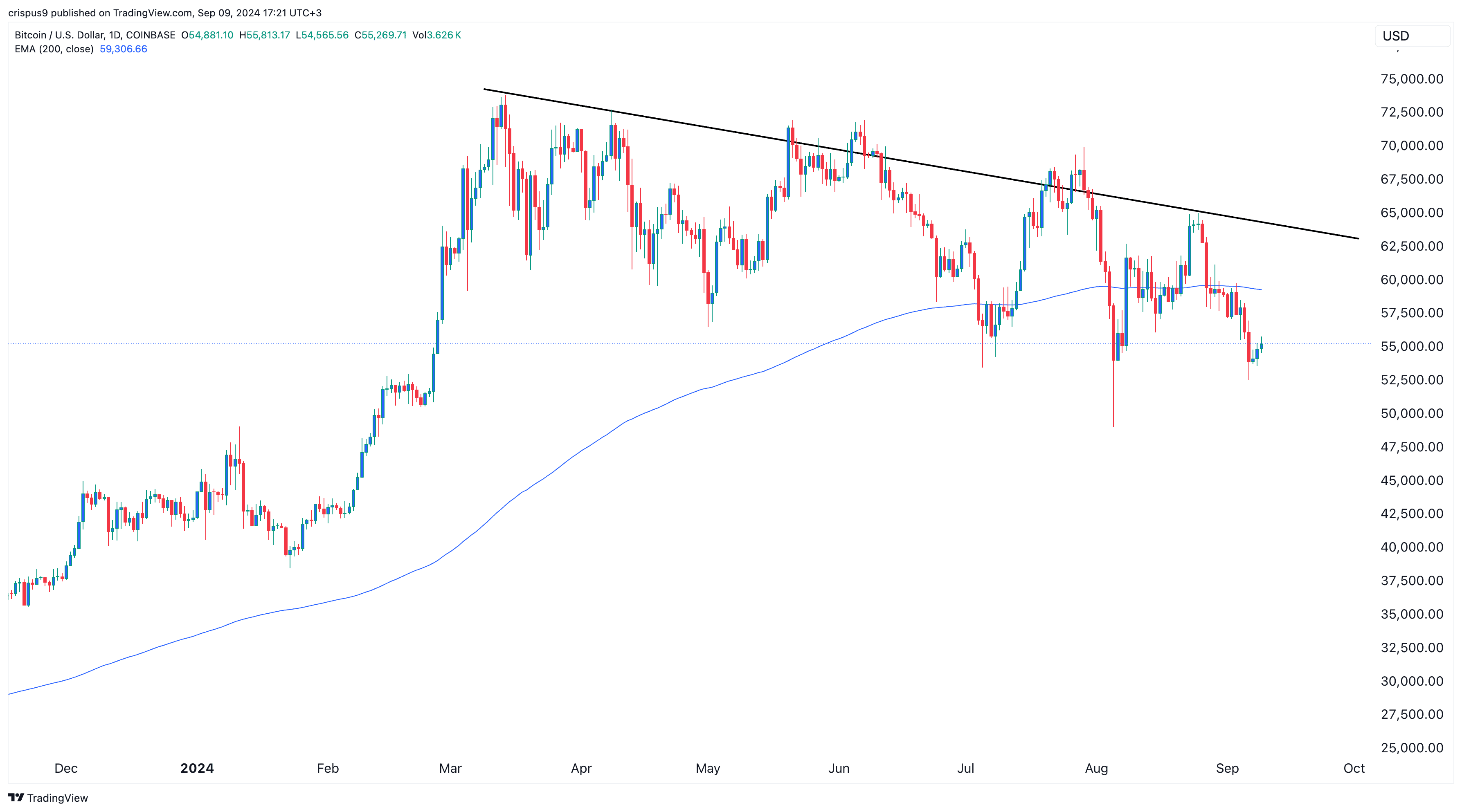

To hit $90,000, Bitcoin must surpass its 200-day Exponential Moving Average currently at $60,000 and break above the downward-sloping trendline linking its peak points from March onwards.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- 10 Most Anticipated Anime of 2025

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Hero Tale best builds – One for melee, one for ranged characters

- Gold Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-09-09 17:40