As a seasoned crypto investor with a keen interest in prediction markets, I find myself intrigued by this latest development involving Kalshi and the CFTC. Having closely followed the evolution of these platforms, it’s clear that they offer an exciting avenue for investing in future events, from politics to weather patterns.

In a recent decision by a U.S. Federal Court, it was determined that the Kalshi prediction market is legally valid, implying that wagers on the results of the upcoming presidential election are now sanctioned.

In a recent court decision, Kalshi emerged victorious in a legal dispute with the U.S. Commodity Futures Trading Commission (CFTC). The CFTC had previously prohibited wagering on American political occurrences, but this restriction was overturned following the lawsuit brought forth by Kalshi.

Contrarily, following the announcement, the regulatory body promptly requested an emergency hearing to uphold this decision. The company argues that it could lead to the platform’s imminent failure.

Table of Contents

What is known about Kalshi

Kalshi is a unique financial marketplace where investors can wager on the outcomes of future events across various fields such as economics, global politics, weather patterns, and even extraterrestrial life. Launched in 2019, Kalshi’s versatile markets span numerous topics. In 2021, the platform secured a $30 million Series A funding round, spearheaded by Sequoia Capital.

As per its creators, Kalshi represents the initial CFTC-approved platform for directly trading future event outcomes. On this platform, investors can place bets on whether an event will transpire by using a novel investment vehicle known as event contracts.

What is the essence of the Kalshi-CFTC conflict?

Starting in September 2023, the Commodity Futures Trading Commission (CFTC) prohibited Kalshi from entering into contracts regarding congressional elections. The CFTC justified this move by stating that such wagers go against the public’s best interests and are essentially illegal in several states.

The company that runs the platform went to court, and the regulator’s decision was called “capricious and arbitrary.”

As a crypto investor, I found myself elated on September 6th upon hearing the news that Judge Jia Cobb had made a ruling in favor of Kalshi. However, she declined to disclose her reasoning at that time, assuring us that a comprehensive written explanation would follow at a later date.

The CFTC’s response

On the day the court made its ruling, the regulator requested a 14-day delay in enforcing the decision following the judge’s statement. They did so because they wanted to thoroughly examine the documents for potential future appeals. If this emergency request is approved, the prohibition on contract placement will continue until the end of September.

The Commission finds itself in an unfortunate predicament, as they’ve discovered a loss without being provided with an explanation or rationale for it. It’s undeniable that the legal questions at hand in this case are significant and complex. Yet, at the moment, the Commodity Futures Trading Commission (CFTC) is unable to confidently predict the outcome of any potential future appeal, as the court has not yet published its written judgment.

Kalshi stated that such an event could be catastrophic for their platform. The platform recognized that the agency might prolong delays, turning one into multiple, potentially making it impossible to act in time. This situation would prove disastrous for Kalshi, as they have built their future on this court case and these specific markets.

In his observation, Kalshi stated that the commission suffered a fair loss and should not be permitted to seize a procedural triumph from the brink of defeat by postponing. The company, in its appeal, highlighted the increasing market shares of platforms like Polymarket and PredictIt, noting that neither of these platforms are regulated by the CFTC, unlike Kalshi.

Ban on betting on U.S. elections

In August, various U.S. lawmakers reached out to the Commodity Futures Trading Commission (CFTC), proposing a ban on wagers predicting the result of the presidential election. In their correspondence, these officials likened this type of action to gambling.

A group consisting of five senators and three representatives from the House of Representatives penned an open missive to Rostin Behnam, the leader of the Commodity Futures Trading Commission (CFTC). In this correspondence, they expressed their concerns that such markets might potentially erode public trust in the nation’s electoral process.

Lawmakers in Congress emphasized that elections should not be viewed as a “business venture.” They argue that such a perception undermines democratic practices within the U.S. Consequently, these legislators feel it’s the responsibility of the Commodity Futures Trading Commission (CFTC) to establish regulations aimed at eradicating this issue.

What’s Happening with Election Bets

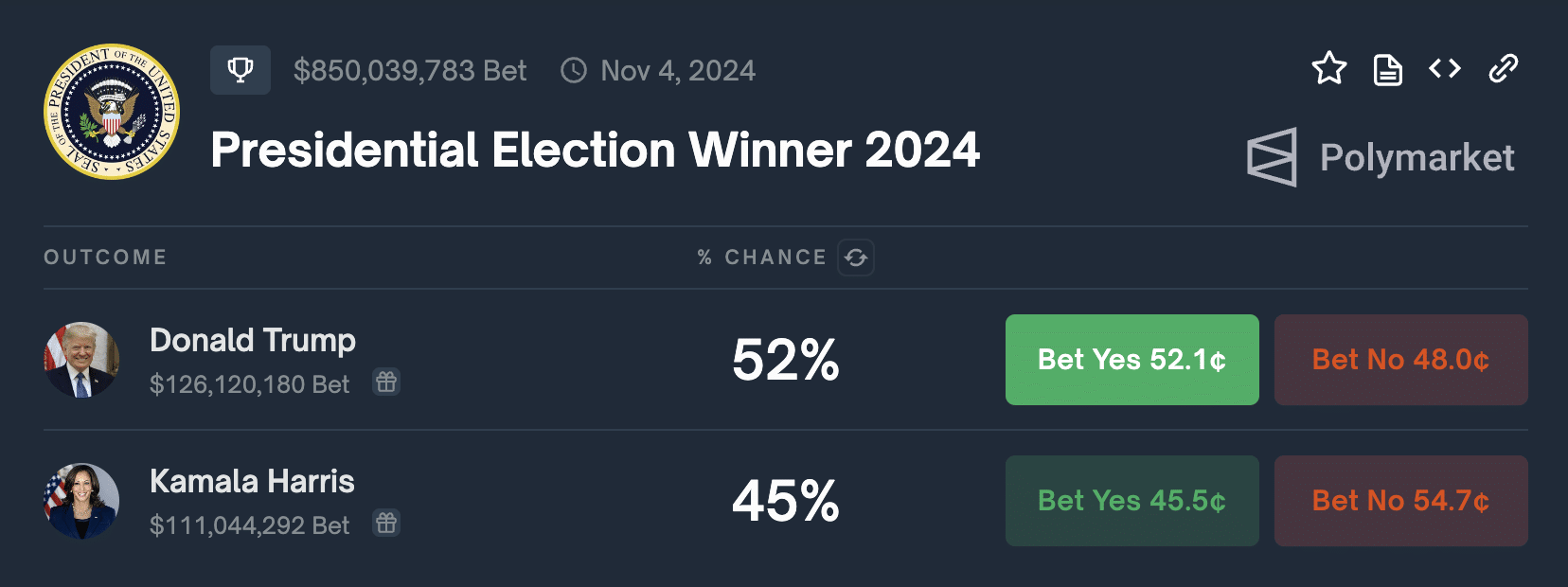

Currently, the Polymarket platform is hosting wagers on the 2024 presidential election that have surpassed $850 million. The platform indicates that entrepreneur Donald Trump is currently in the lead. Estimates show that he has a 52% chance of winning, while approximately 45% of bettors are backing Vice President Kamala Harris for victory. A total of $126 million and $111 million have been wagered on Trump’s and Harris’ victories respectively.

Simultaneously, the political sector on this platform holds over a billion dollars in funds. Participants are wagering on numerous events, totaling in the hundreds.

As a crypto investor, I’ve noticed that Polymarket’s predictions might not always be spot-on. Yet, the sheer magnitude of investments in predicting election outcomes via cryptocurrency platforms underscores the rising clout of the crypto community in shaping political perspectives and the readiness of its members to shoulder financial risks linked to political events.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- All New and Upcoming Characters in Zenless Zone Zero Explained

2024-09-10 16:32