As a seasoned analyst with over two decades of experience in the financial markets, I must say that the recent surge in net positive flows for Bitcoin ETFs and the end of the five-day outflow streak for Ethereum ETFs is quite intriguing. The data from SoSoValue suggests a renewed interest in these digital assets among institutional investors, which could potentially lead to further price movements.

In the United States, Bitcoin ETFs experienced an increase in positive investments, while Ether ETFs also recorded incoming investments, breaking a five-day streak of outflows.

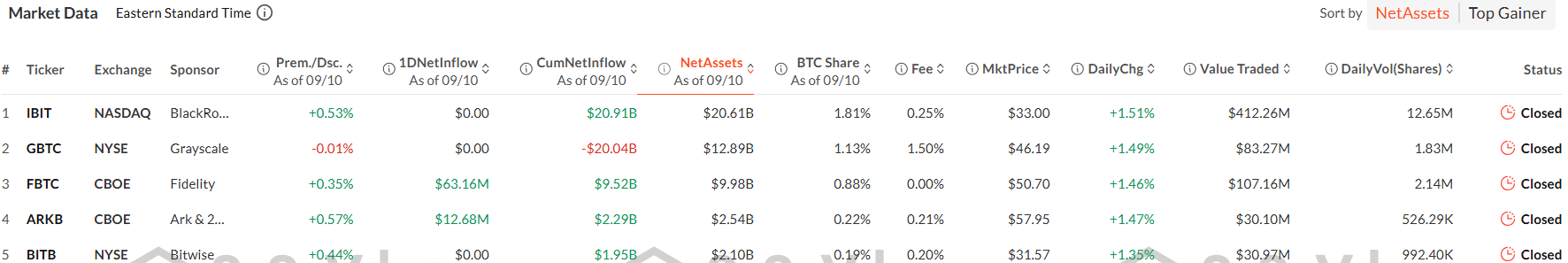

Based on information from SoSoValue, Bitcoin ETFs at position 12 experienced an influx of approximately $116.96 million on September 10th, marking a significant increase of over four times more than the $37.29 million that flowed in the day before.

On these two specific days, the funds flowing into these ETFs came after a stretch of eight straight days where money was leaving them, resulting in a decrease of over $1.18 billion in their combined management assets.

For the second day in a row, Fidelity’s FBTC saw the highest investment with an inflow of $63.2 million on September 10th. Grayscale Bitcoin Mini Trust and ARK 21Shares’s ARKB came next with reported inflows of $41.1 million and $12.7 million respectively, while the remaining nine Bitcoin ETFs showed no significant change in their positions.

Remarkably, it’s worth noting that no Bitcoin ETFs experienced withdrawals on that particular day – a phenomenon not observed since July 16th.

Yesterday’s combined daily trading volume for the 12 Bitcoin ETFs decreased to approximately $712 million on September 10th, representing a 56% decrease compared to the previous day’s volume of $1.61 billion. As I write this, Bitcoin (BTC) has dropped by 1% over the last 24 hours and is currently being traded at around $56,276, according to data from crypto.news.

On September 10th, nine Ethereum-focused ETFs experienced a total of $11.4 million in net investments, ending five straight days of negative inflows. Fidelity’s FETH was the primary recipient with an influx of $7.1 million, while BlackRock’s ETHA followed closely behind with an inflow of $4.3 million. The remaining seven Ethereum ETFs did not see any investments on that day.

On September 10th, the daily trading volume for these investment tools declined to approximately $102.87 million compared to the previous day, marking a decrease. So far, the Ether-focused ETFs have experienced a total outflow of about $562.06 million. At the time of writing, Ethereum (ETH) was also experiencing a 0.8% drop, trading at $2,326 per unit.

Although there has been an increase in investments into these ETFs, more recent events indicate a decrease in institutional enthusiasm towards Ethereum-related financial products. For instance, VanEck has shut down its Ethereum Strategy ETF after less than a year, and WisdomTree has withdrawn its application for a direct Ethereum ETF with the U.S. Securities and Exchange Commission.

Read More

- Gold Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Silver Rate Forecast

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- PUBG Mobile heads back to Riyadh for EWC 2025

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- Arknights celebrates fifth anniversary in style with new limited-time event

- USD CNY PREDICTION

- Every Upcoming Zac Efron Movie And TV Show

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-09-11 10:16