As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the recent surge in Binance Coin (BNB). The five consecutive daily gains, driven by rising active addresses and transactions on the network, are indeed captivating. However, it’s crucial to remember that history has taught us that what goes up must eventually come down.

For the fifth day in a row, Binance Coin experienced an uptrend, with increasing numbers of active addresses and transactions being recorded on its blockchain network, suggesting growing user engagement.

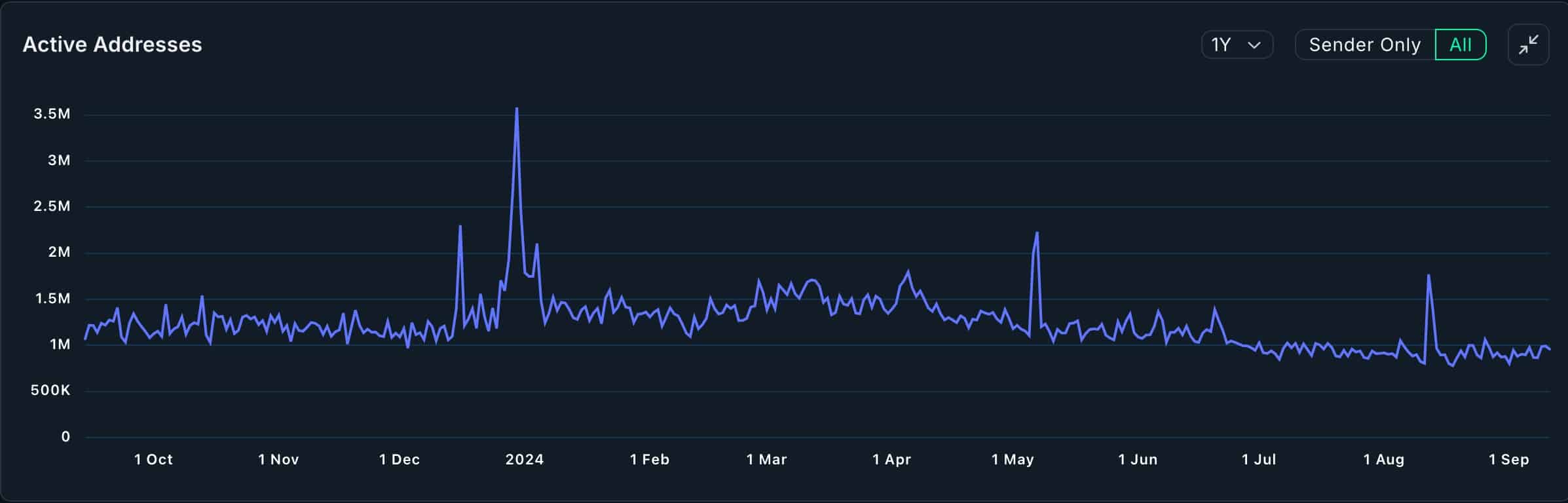

Binance chain active addresses are rising

Today, Binance Coin (BNB) reached a peak of $545, marking its highest point since August 27th. This is a 15% increase from its lowest point this month. Moreover, it has skyrocketed by more than 36% from its lows in August.

The recovery pattern of SUI (SUI) has been similar to other cryptocurrencies. Specifically, on August 24, SUI hit its peak, whereas Popcat (POPCAT) and BinaryX (BNX) attained their highest points in recent weeks.

The growth in BNB‘s price can be attributed to on-chain activity, as indicated by a surge in active addresses and transactions. In the past 24 hours, the number of active addresses jumped by 4%, reaching approximately 925,700, while transactions spiked by 15% to reach around 4.2 million. Data from Nansen reveals that these transactions peaked at a level not seen in almost a month.

On a broader perspective, the data indicates that the number of on-chain transactions and active participants has been underperforming. At its peak in December, there were around 3.58 million active addresses, but since then, this figure has decreased significantly, dropping more than 75%.

Transactions reached a high of 4.8 million in August, and they’ve dropped more than 75% since then. Meanwhile, transaction fees on BNB Smart Chain have been decreasing significantly – dropping from over $1.5 million in April to just $372,000 now.

As a researcher delving into the realm of Decentralized Finance (DeFi), I’ve recently observed that the total value locked within the DeFi ecosystem of the BNB Chain has exceeded $4.4 billion. Notably, Venus, PancakeSwap, and Lista DAO are the leading applications in this space. However, it’s worth noting that earlier this year, the TVL (Total Value Locked) was significantly higher at over $5.8 billion, indicating a slight decrease since then.

In the past week, decentralized exchange platforms on the Binance Smart Chain network managed approximately $3.6 billion worth of assets, placing it as the 4th largest blockchain platform behind Ethereum, Solana, and Arbitrum.

A potential concern for Binance Coin is its concentration among Binance and key personnel, as a mass sell-off from these groups might pose problems. According to CoinCarp’s data, the top ten holders account for approximately 75.6% of all existing tokens.

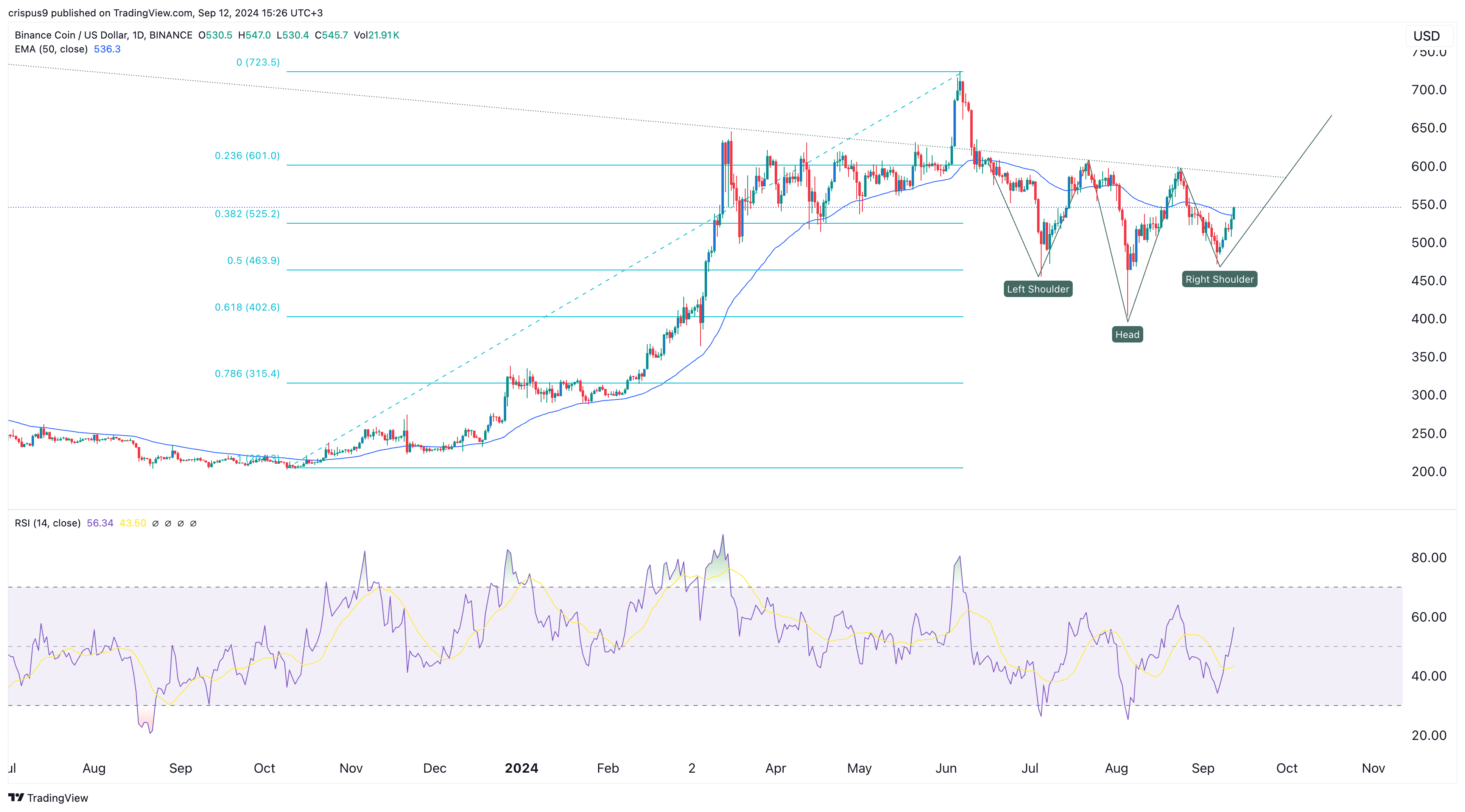

BNB has formed a bullish pattern

Today’s graph indicates that Binance Coin has developed an uncommon, bullish inverse head and shoulder pattern – a sign often associated with rising prices. The latest price increase is considered to be a component of the right shoulder in this pattern.

As a crypto investor, I’ve noticed an encouraging shift in the BNB market. It has surged beyond its 50-day moving average and breached the 38.2% Fibonacci Retracement level. Moreover, the Relative Strength Index (RSI) has crossed the neutral threshold of 50, hinting that it’s picking up steam. This could potentially indicate a positive momentum for BNB in the near future.

Consequently, the value of the coin might keep increasing since traders aim to break through the neckline of the head-and-shoulders pattern, which is approximately $600.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

2024-09-12 16:22