As a seasoned analyst with years of experience observing the cryptocurrency market, I find the recent trends surrounding Bitcoin quite intriguing. The surge above $60,000 and the subsequent outflows from centralized exchanges are reminiscent of the gold rush days, only this time it’s digital gold we’re chasing.

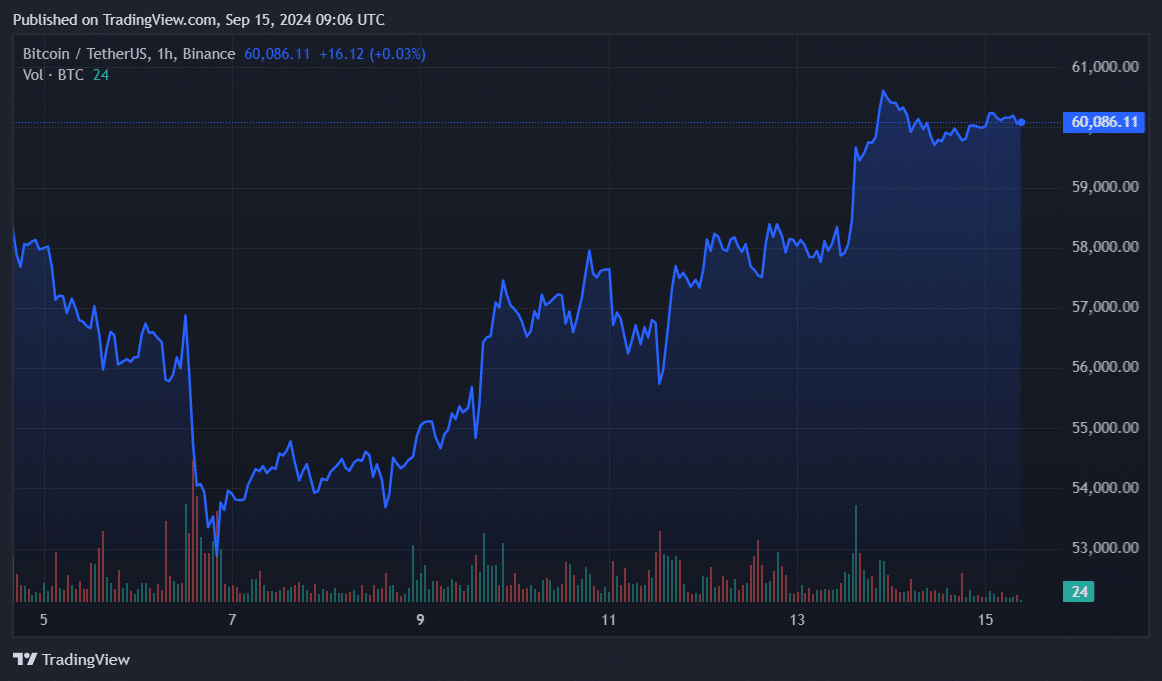

The increase in Bitcoin‘s price over the $60,000 mark has led to a rise in withdrawals from centralized exchange platforms, as investors anticipate additional positive market trends.

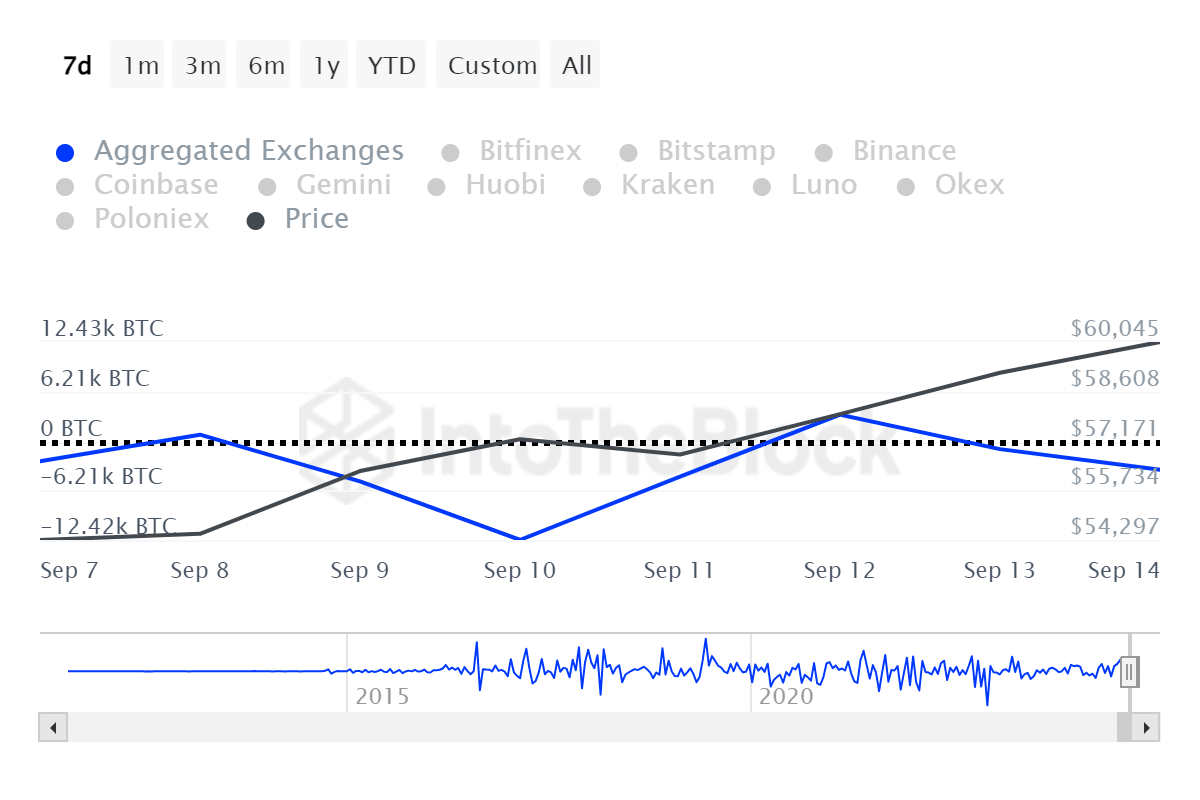

Based on information from IntoTheBlock, there was a total of approximately $1.29 billion withdrawn from cryptocurrency exchanges (CEXs) involving Bitcoin (BTC) over the last week. This trend suggests that more people are hoarding or accumulating Bitcoin, as most on-chain indicators currently point towards a bullish outlook for the leading digital currency.

Approximately 12,420 Bitcoin were largely withdrawn on September 10, according to ITB data, as the asset’s value dipped below the $57,000 level.

It’s worth mentioning that when Bitcoin’s price hit $60,000 on September 13, there was a significant increase in large holders selling their Bitcoins to exchanges, as indicated by the net flow ratio. This suggests that these large holders began cashing out or profit-taking after the price had recovered from a recent low of $52,600.

On a single day, there was a significant transfer of 9,180 Bitcoins from large holders to other addresses, indicating a substantial selling action by the whales. This on-chain activity pushed the value of Bitcoin below the $60,000 mark.

Expect lower price volatility

Based on a recent update from crypto.news published on Friday, MicroStrategy has bought approximately 18,300 Bitcoins at around $1.11 billion, even as large Bitcoin holders (whales) were offloading their coins.

On Saturday, September 14, the trend reversed once more towards accumulation, as the ratio hit 0.43% based on ITB’s data.

The large holders’ net flows bounced to the positive zone, with 3,240 BTC in net inflows yesterday.

In the last 24 hours, Bitcoin experienced a 0.2% increase and is now being traded at approximately $60,100. Its market capitalization stands at an impressive $1.86 trillion. However, it’s worth noting that the daily trading volume for this cryptocurrency dropped by 57%, amounting to around $13.7 billion.

Right now, it’s likely that Bitcoin’s price fluctuations will decrease since it’s hovering around the significant $60,000 mark. But if it drops below $59,000, this could cause a large number of sell-offs, potentially leading to another price drop.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-09-15 14:22