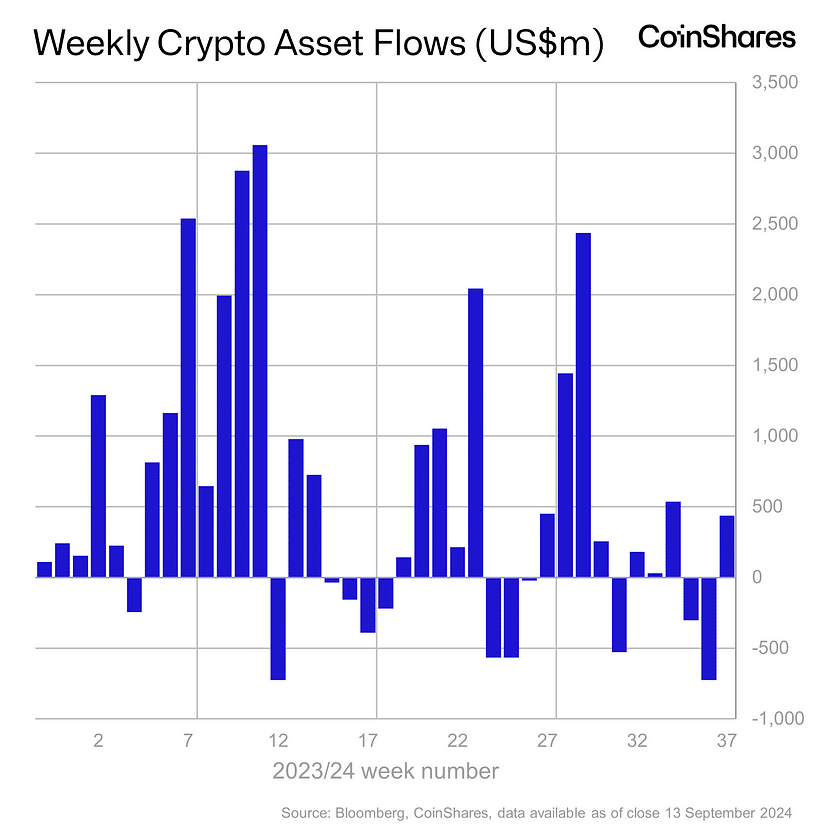

As a seasoned analyst with over two decades of market experience under my belt, I must say that the recent turnaround in crypto investment trends is certainly intriguing. The $436 million inflow into cryptocurrency investment products, following weeks of outflows totaling $1.2 billion, suggests a cautious optimism creeping back into the market.

According to data from CoinShares, there’s been a switch in the direction of cryptocurrency investments, as investors poured in approximately $436 million after a period of withdrawals.

For the past few weeks, there has been a change in the trend for cryptocurrency investment products as they saw an inflow of approximately $436 million, following a streak where investors withdrew around $1.2 billion.

Towards the end of last week, a significant increase in inflows was seen, which can be linked to changing market predictions about a possible 50 basis point interest rate reduction on September 18th. This observation comes from James Butterfill, head of research at CoinShares, who also mentioned that positive sentiments were stirred by comments made by former New York Fed President Bill Dudley.

Despite the wave of inflows, trading volumes in exchange-traded funds remained flat at $8 billion for the week, significantly below the year-to-date average of $14.2 billion. Regionally, the U.S. led with $416 million in inflows, while Switzerland and Germany contributed $27 million and $10.6 million, respectively.

Once again, Bitcoin (BTC) led the way, halting a 10-day run of outgoing funds totaling $1.18 billion by attracting $436 million in fresh investments. On the other hand, short positions on Bitcoin saw $8.5 million withdrawn after three straight weeks of inflows.

In recent times, Ethereum (ETH) has been grappling with ongoing issues, as it experienced an outflow of approximately $19 million, primarily due to doubts about layer-1 profitability following Dencun. On the other hand, Solana (SOL) registered inflows for the fourth week in a row, amounting to $3.8 million. Additionally, blockchain stocks also saw an increase, with a total of $105 million flowing into them due to the introduction of several new ETFs in the U.S. as per the data provided.

In the past few weeks, Bitcoin has experienced a significant reduction in exchange activity, as daily inflows decreased by approximately 68%, moving from 68,470 BTC to 21,742 BTC, and outflows dropped by around 65% from 65,847 BTC to 22,802 BTI, during the early part of September.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Silver Rate Forecast

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Castle Duels tier list – Best Legendary and Epic cards

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Black Myth: Wukong minimum & recommended system requirements for PC

2024-09-16 13:28