As a seasoned researcher with a keen interest in digital currencies and central banking, I find the Reserve Bank of Australia’s (RBA) approach to CBDC development particularly intriguing. Having closely followed the global discussions on this topic, it appears that the RBA is taking a cautious yet strategic approach, focusing on wholesale CBDC development first.

The Reserve Bank of Australia has disclosed plans to focus on creating a wholesale Central Bank Digital Currency (CBDC), stating that it offers more economic advantages and presents less complications than a retail counterpart.

It appears that the Reserve Bank of Australia is focusing more on developing a wholesale Central Bank Digital Currency (CBDC), as opposed to a retail one, due to potential advantages and fewer hurdles it might present for the nation’s financial infrastructure, according to their statements.

In my recent address at a September 18 conference, I, as an assistant governor at the Reserve Bank of Australia (RBA), underscored our emphasis on developing a Central Bank Digital Currency (CBDC) within the wholesale sector. I see this development not as a disruptive revolution but rather as a gradual evolution that complements and enhances our existing monetary systems, especially in relation to critical market segments.

[…] unlike a regular Central Bank Digital Currency (CBDC) meant for public usage, a wholesale CBDC signifies more of an advancement rather than a radical change in our monetary system.

Brad Jones

Jones unveiled a three-year research venture focused on central bank digital currencies (CBDC), with an aim to work closely with industry partners on this project. This initiative will delve into innovative distributed ledger technologies, examining aspects like programmability and instant settlement to evaluate potential benefits for Australia’s financial system infrastructure.

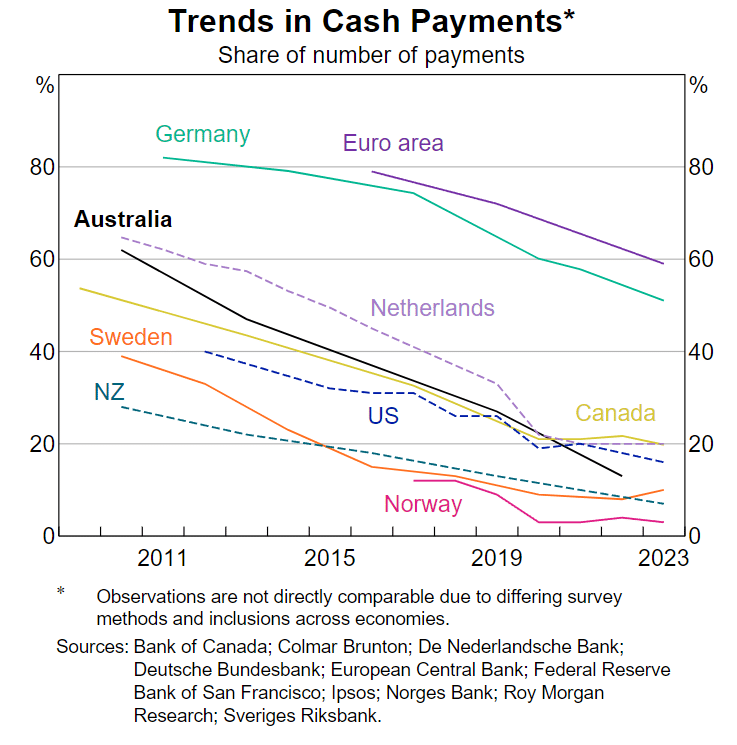

Instead, the RBA considers the advantages of a retail Central Bank Digital Currency (CBDC) as “relatively small or uncertain right now,” pointing out that it could bring about “substantial change” to Australia’s existing financial structures. Jones emphasized that many arguments in favor of retail CBDCs worldwide are either less applicable to Australia or “currently unclear, compared to the potential difficulties it might introduce.

Jones stated that the Reserve Bank of Australia is willing to consider the development of a retail Central Bank Digital Currency down the line. However, any action towards this would necessitate a clear public policy reason and legislative adjustments, following global standards. Consequently, it will be up to the Australian Government to decide whether or not to implement such a currency, emphasizing the importance of working closely with Treasury and other government departments in the process.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Black Myth: Wukong minimum & recommended system requirements for PC

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-09-18 10:02