As a seasoned analyst with years of observing and navigating the ever-evolving landscape of the cryptocurrency market, I must admit that the recent events have been quite intriguing. The double-digit losses experienced by major altcoins like STRK, AR, LDO, and CORE on October 2 were a stark reminder of the market’s volatility.

On October 2nd, I witnessed substantial declines in several significant altcoins such as STRK, AR, LDO, and CORE, with each losing more than ten percent of their value. This downturn was triggered by escalating geopolitical tensions and a surge in long liquidations, which significantly impacted the crypto market.

As a researcher, I’ve observed that my recent exploration with Starknet (STRK) has seen a substantial dip, with a 13.4% decline over the past 24 hours. Despite this setback, trading volume has maintained a steady level at approximately $151 million. However, the market capitalization has contracted by 13.75%, now standing at a value of $772 million.

Likewise, Arweave experienced a 14.3% drop, reaching $19.98, while handling a daily trading volume of $226 million and boasting a market capitalization of $1.3 billion – marking its minimum value over the past week.

Similarly, the value of Lido DAO (LDO) dropped by 12.7%, currently at $1.16. The market capitalization of Lido has decreased to approximately $1.03 billion, with a daily trading volume of around $179 million. Meanwhile, Core (CORE) experienced a decrease of 12.4%, now priced at $0.9292. Its daily trading volume stands at $50.4 million, and the market capitalization has been reduced to $851 million.

Broader market conditions and Bitcoin’s role

The fall in these alternative coins happened at the same time as a general decrease in the cryptocurrency market, causing its total market value to drop by more than 5.5% to around $2.26 trillion. This downturn took place amid increasing political tension worldwide, such as Iran’s missile attacks on October 1, and a retreat in US stocks. These events added to the already negative sentiment among investors who were expecting a bullish “Uptober,” but it did not materialize.

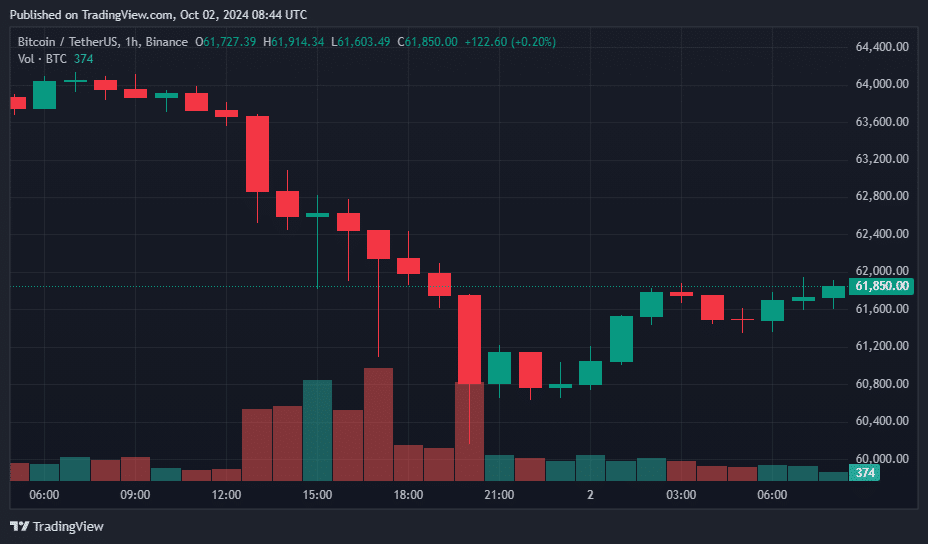

In the past 24 hours, Bitcoin (BTC), the main cryptocurrency, experienced a 3.2% drop and fell almost $4,000 to reach a two-week low of around $60,315 today, according to data from crypto.news. This decrease was partly influenced by international political events that triggered sell-offs in risky investments across various global markets.

Despite Bitcoin experiencing a minor uptick to $61,850, its price fluctuations differ significantly from those of conventional safe-havens like gold and oil. Gold saw an increase of 1.4%, reaching almost a record high at $2,665 per ounce, while crude oil jumped 7% to $72 per barrel.

The increasing worth of gold, oil, the U.S. dollar, and bonds underscores the contrast between Bitcoin and conventional safe-havens, leading to discussions about Bitcoin’s role as a value-preserving asset in turbulent periods.

Liquidations amplify market downturn

According to CoinGlass data, the market has experienced significant volatility in the last day, with a staggering $453 million worth of long positions being closed. Conversely, only $72 million in short positions were liquidated. This massive selling off of long positions, where investors anticipated price rises, intensified the downward pressure, speeding up the decline even more.

In turbulent markets, a chain reaction of liquidations and sales, often affecting alternative cryptocurrencies, can have a domino effect, causing the overall market value to decrease.

Bitcoin needs to secure $71K

Experienced investor Peter Brandt observed that even with Bitcoin’s recent surge in late September, it continues to adhere to a seven-month trend characterized by successive peaks and troughs moving downwards.

As per Brandt’s analysis, if Bitcoin’s price surpasses $71,000 and sets a fresh record high, it would indicate that the bullish trend that started in November 2022 is still holding strong.

This week, the Crypto Fear and Greed Index, a tool that gauges investor emotions, has decreased from 59 (indicating a neutral stance) to 42. This drop suggests that there’s been a shift in sentiment towards fear, as geopolitical uncertainties have caused investors to become apprehensive.

As a crypto investor, I’ve noticed that Bitcoin tends to become more volatile during tense times, such as when geopolitical events like the recent Israeli-Iranian conflict occur. This volatility often leads to significant price corrections, as was evident earlier this year.

Moving forward, the existing geopolitical climate may persistently impact the market, especially if tensions rise. Any escalation could trigger additional sell-offs, leading to increased market turbulence within the cryptocurrency sector as well.

Read More

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- USD CNY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Maiden Academy tier list

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

- Silver Rate Forecast

- USD MXN PREDICTION

2024-10-02 12:22