As a seasoned researcher with years of experience in the cryptocurrency market, I have to admit that Justin Sun’s Tron (TRX) is currently in a fascinating position. On one hand, it’s holding its ground amidst the ongoing crypto sell-off and Bitcoin’s dip below $60,000. On the other, its ecosystem seems to be undergoing some turbulence, with most meme coins in the SunPump ecosystem taking a hit.

Currently, Justin Sun’s TRON token is holding steady within a narrow band amidst the ongoing cryptocurrency market downturn, during which Bitcoin has dipped below the $60,000 mark.

Currently, Tron (TRX) is trading slightly below its weekly high at approximately $0.1542. As per CoinGecko’s data, it ranks as the ninth largest cryptocurrency with a total market capitalization of about $13.3 billion.

In the past week, TRX has surpassed other top ten cryptocurrencies with a growth of 0.97%, whereas Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have experienced declines of 6.2%, 10.6%, and 10.5% respectively during the same timeframe.

In simple terms, the Tron ecosystem is facing some difficulties, as many of the meme coins launched within the SunPump ecosystem have seen declines of more than ten percent. The largest token in this ecosystem, Sundog (SUNDOG), has dropped by approximately 30% over the past week.

In a similar fashion, Tron Bull Coin, Muncat, Suncat, and Vikita have all dropped by more than 30% within the same timeframe. However, the only SunPump meme coins that seem to be thriving are Tron Bull and Tron Beer, with Tron Bull increasing by over 16% and Tron Beer surging by approximately 40%.

It appears that various components of the Tron system are experiencing some difficulties. To illustrate, the value locked within its DeFi sector has decreased by approximately 6.8% over the past month, currently standing at $7.6 billion. This positions it as the second-largest network after Ethereum in terms of total value.

Tron’s Decentralized Exchange (DEX) volume has climbed to an impressive $425 million, placing it as the 9th largest player within the industry. However, it has been surpassed by newer platforms such as Sui and Base, which processed a staggering $700 million and $4.5 billion respectively over the past week.

Still, Tron has many positives. It has become the market leader in the stablecoin payment industry. Data by TronScan shows that its Tether transactions rose by 9.75% on Oct. 2 to $70 billion.

In the realm of cryptocurrencies, Tron stands out as one of the highest earning networks, raking in approximately $1.37 billion in fees just this year alone. Even more impressive is its third-quarter earnings, which surpassed both Bitcoin and Ethereum, reaching an impressive $577 million.

Tron price has stalled

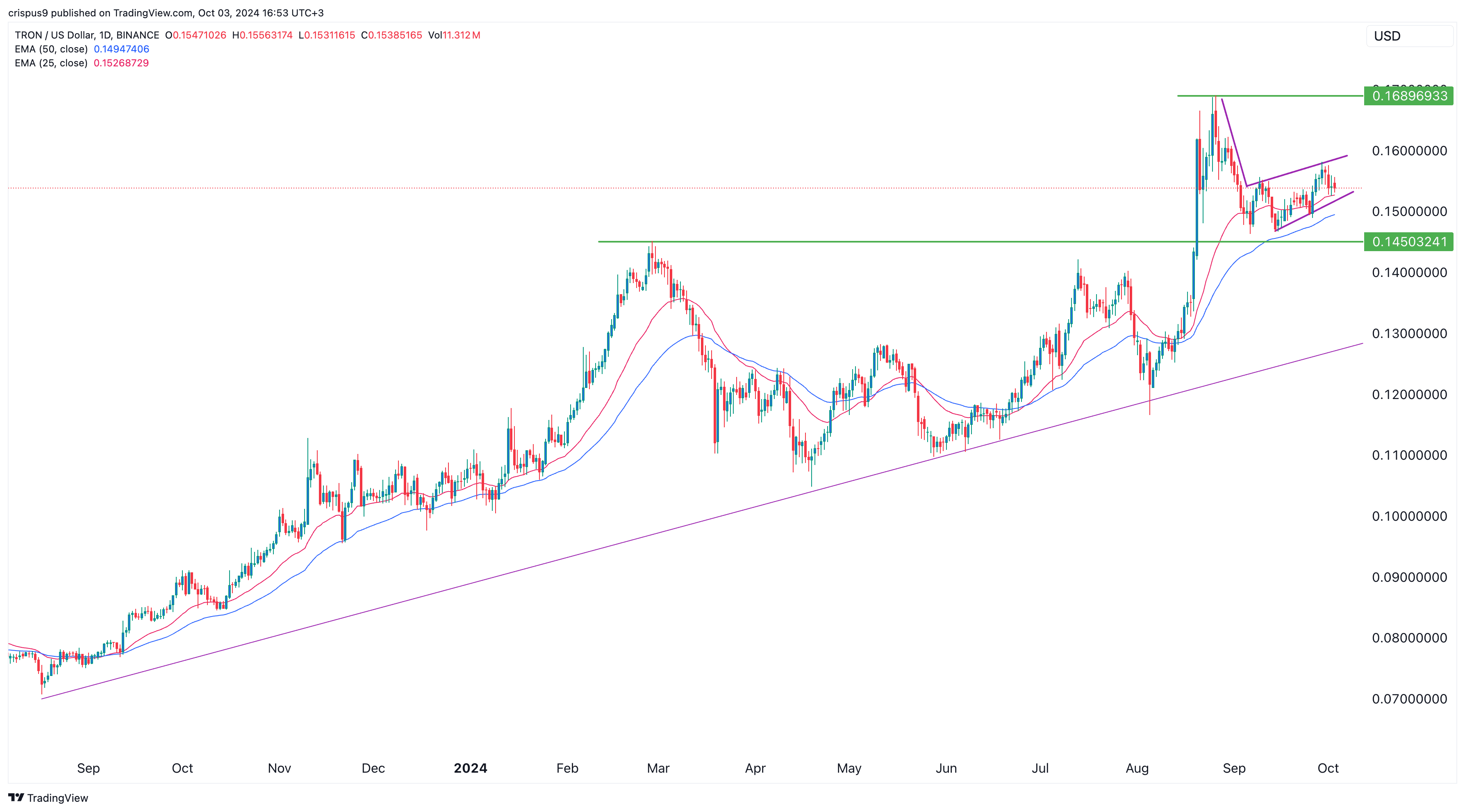

On August 26, Tron reached an all-time peak of $0.1690, but since then it’s seen a decrease of 8.83%. Despite this dip, the coin has managed to stay above both its 50-day and 25-day Exponential Moving Averages, indicating that the bulls currently have the upper hand.

As an analyst, I’ve noticed some indicators suggesting the formation of a bearish flag chart pattern for TRON. If this pattern plays out as expected, it could potentially lead to TRON dipping towards the significant support level at $0.1450 – a high point from February this year.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-03 17:18