As a seasoned researcher with over two decades of experience in financial markets, I have witnessed numerous market cycles and trends. The recent surge in Bitcoin’s price has caught my attention, not just because it is a remarkable digital asset, but also due to its potential implications for global finance.

On October 7th, I observed an upward trend in the price of Bitcoin, which persisted for two successive days. This rise seemed to be driven by traders adopting a more optimistic outlook, or what is often referred to as a ‘risk-on’ mentality.

As an analyst, I observed a notable surge in the value of Bitcoin (BTC), reaching an intraday peak of $64,000 – a 6.62% rise from its lowest point last week. This upward trend occurred despite a general retreat in American equities, which could be attributed to a decrease in the likelihood of a more accommodative Federal Reserve. In the early trading hours, the Dow Jones, S&P 500, and Nasdaq 100 all dipped by more than 0.20%.

Some crypto experts and financial backers continue to be optimistic about Bitcoin. The most recent significant Bitcoin purchaser is MetaPlanet, a Japanese firm, who added approximately 6.7 million dollars’ worth of coins to their reserves. As per Bitcoin Treasuries, the company now possesses 530 Bitcoins valued at over 33 million dollars.

The organization is mimicking MicroStrategy’s approach, now holding the most significant number of Bitcoins at approximately 252,220 units. Notable Bitcoin holders also include companies such as Marathon Digital, Riot Blockchain, and Block (formerly Square).

In a recent post on social media, well-known cryptocurrency analyst Michael van de Poppe – who boasts over 728,000 followers – forecasted that Bitcoin could surge and touch its previous peak of $73,800. He anticipates a dip to around $62,000 before recovering, potentially reaching between $65,000 and $66,000. If it breaks through this level, he predicts another attempt at reaching the all-time high.

#Bitcoin has maintained its key support level near $60,000 and is showing signs of recovery. I anticipate that it may revisit the $62,000 range in lower timeframes before potentially pushing towards $65-66,000 later this week. If it breaks through there, a new record high test will follow.

— Michaël van de Poppe (@CryptoMichNL) October 7, 2024

The recovery of Bitcoin occurred concurrently with an impressive surge in the value of futures contracts. According to CoinGlass, this value increased to more than $34 billion, marking its peak since October 1. Generally, a larger open interest figure is typically a good indication for a coin.

This week, key factors that could impact Bitcoin include the release of the Federal Reserve’s meeting minutes on Wednesday and the US inflation report due out on Thursday. If the data indicates that inflation continues to decrease, it may lead the Fed to adopt a more accommodative stance, which could be favorable for Bitcoin and other high-risk investments.

Bitcoin price needs to flip $66,600

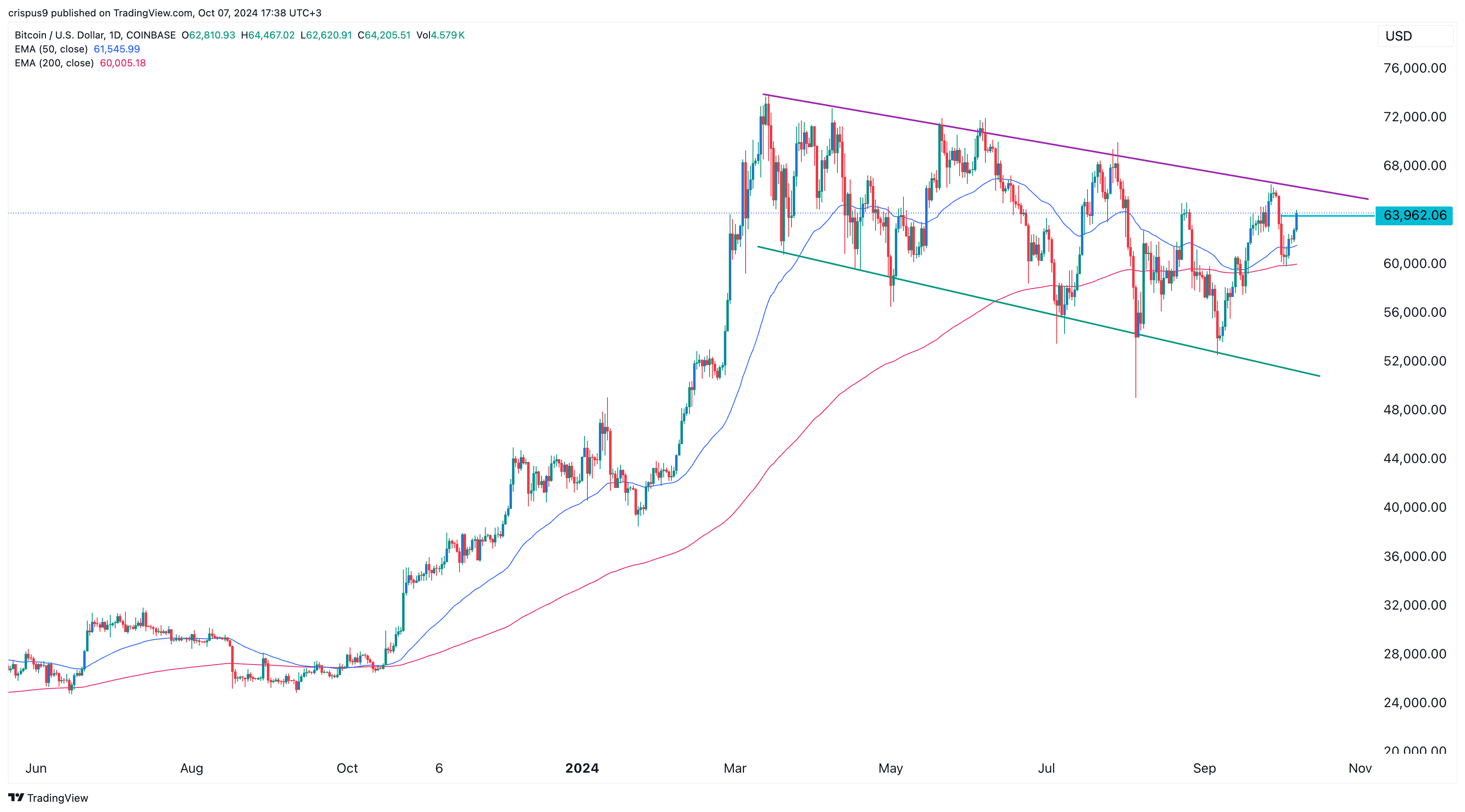

As a researcher, I’ve been tracking Bitcoin’s performance, and it appears that my daily analysis reveals persistent resistance, marked in purple. Remarkably, this resistance interlinks the most significant peaks experienced in March, May, June, July, and September.

In terms of financial charts, the trendline in a falling broadening wedge pattern serves as its upper boundary. This particular chart formation, commonly observed in price analysis, frequently leads to a bullish breakout. Interestingly, Bitcoin has surpassed both its 50-day and 200-day Exponential Moving Averages.

As a crypto investor, I’m optimistic that Bitcoin is on the verge of a bullish surge, potentially reaching its all-time high again. To achieve this, it appears crucial for Bitcoin to overcome the downward trendline and significant psychological resistance levels at around $70,000 and $72,000.

Read More

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- Gold Rate Forecast

- USD CNY PREDICTION

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Grimguard Tactics tier list – Ranking the main classes

- Arknights celebrates fifth anniversary in style with new limited-time event

- Gods & Demons codes (January 2025)

- Maiden Academy tier list

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-07 17:55