As a seasoned crypto investor with over a decade of experience in this dynamic digital market, I have witnessed the rise and fall of numerous coins and tokens, but few have made as significant an impact as Tether (USDT). The documentary “Stability and Freedom in Chaos” offers an intriguing glimpse into the journey of USDT, which has become a lifeline for countless individuals fighting inflation and promoting financial freedom worldwide.

To celebrate its ten-year milestone, Tether is set to unveil a documentary detailing the role of USDT (Tether’s stablecoin) and its influence in the battle against inflation.

Table of Contents

In simpler terms, the documentary titled “Stability and Freedom in Chaos” narrates the journey of USDT, which is now seen as a crucial support system for individuals battling inflation and advocating for financial independence on a global scale.

📺 Today is the 10-year anniversary of USD-C! 🎉 To commemorate this milestone, we’re set to release our documentary titled ‘Stability and Opportunity in Tumultuous Times’. Explore the incredible story of how USD-T has turned into a vital resource for countless individuals, battling inflation and promoting financial independence globally. 🌎💪

— Tether (@Tether_to) October 6, 2024

In reference to the documentary’s launch, Tether CEO Paolo Ardoino stated that their objective is to facilitate financial services for billions of individuals residing in underdeveloped regions who lack access to traditional banking systems.

Tether’s business is founded on a straightforward goal: providing financial access to those residing in underdeveloped regions, who often lack bank accounts due to insufficient income or live in nations with high inflation, by creating a system that caters to their needs which are overlooked by traditional banking institutions.

In his view, Tether symbolizes the concepts of bypassing intermediaries, sustainability, and stability. It empowers not just individuals but also communities, cities, and even entire nations.

10 years towards financial freedom

Back in 2014, Brock Pierce, Reeve Collins, and Craig Sellars initiated the Realcoin endeavor, which later became known as Tether. The essence of this project was to develop a digital currency that mirrored the value of traditional money (fiat currency) to ensure stability and make cryptocurrency transactions more straightforward.

Back in October 2014, USDT – a digital currency tied to the value of the U.S. dollar – made its debut. Since then, Tether has been consistently growing its network. Later on, USDT became available on Ethereum, TRON, and TON blockchains, enabling its use across numerous decentralized applications.

Furthermore, USDT is extensively used across numerous decentralized applications (dApps) and smart contracts, enhancing its significance within the realm of decentralized finance.

USDT has become a must-have coin for key areas in crypto and blockchain

Swiftly gaining favor among traders due to its role as a reliable currency during turbulent crypto market periods, Tether enabled easy access to steady funds. Its integration across numerous cryptocurrency platforms boosted its fluidity, making transactions smoother.

The significant impact of Tether’s stability on the crypto market is evident, enabling traders and investors to swiftly transfer funds between different cryptocurrencies and traditional currencies while minimizing substantial losses caused by price volatility.

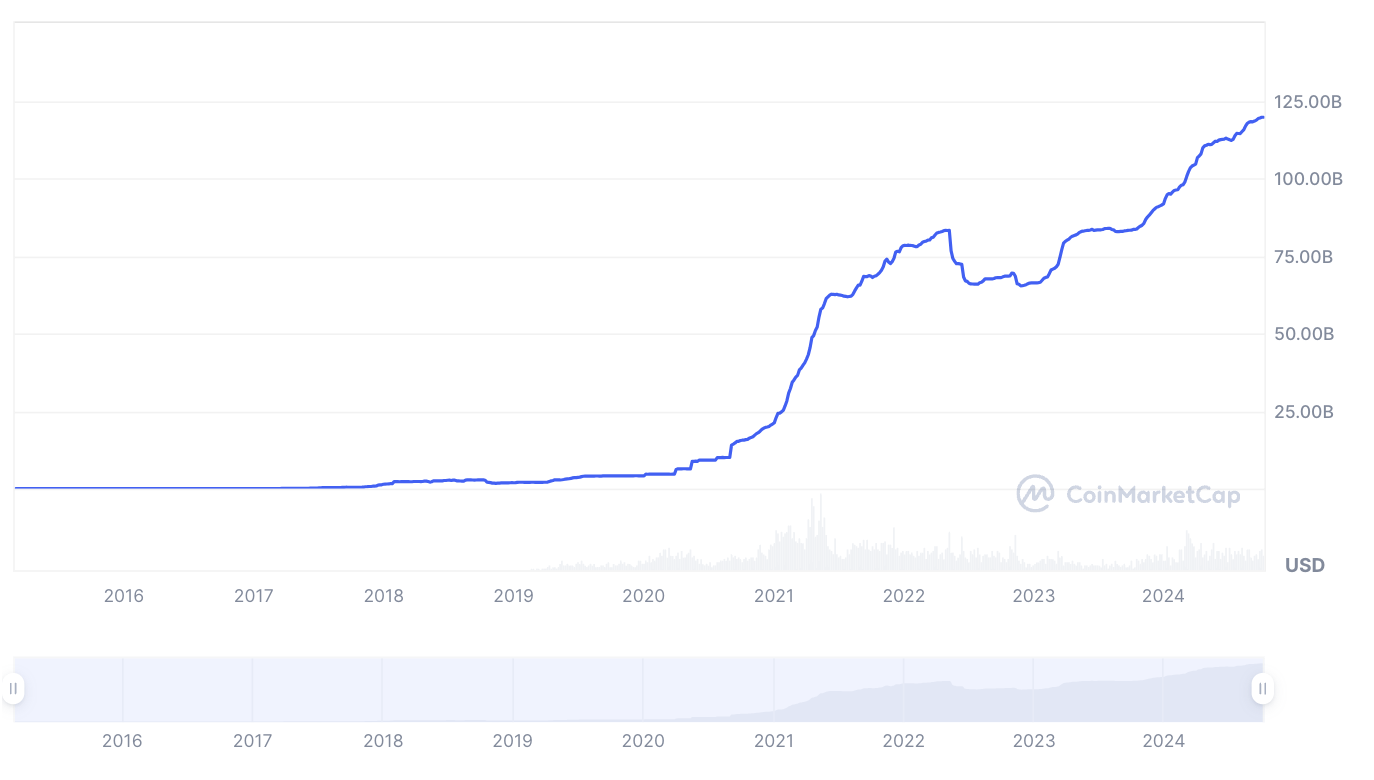

For quite some time now, Tether (USDT) has been the most commonly utilized stablecoin in the realm of cryptocurrency. Since its introduction ten years ago, USDT has expanded its market value to a staggering $120 billion, positioning it among the largest digital currencies that have ever existed.

A lifeline for developing countries

In response to the documentary’s launch, Ardoino noted that USDT stands as a representation of “decentralization, durability, and reliability.” The movie delves into the growing use of USDT across three nations: Argentina, Turkey, and Brazil.

What makes these particular countries stand out? A common thread among the various explanations is their susceptibility to economic upheavals.

1) In certain nations, they grapple with persistent inflation and an unsteady value of their native currencies. Moreover, many developing countries lack sufficient access to conventional banking systems. Cryptocurrencies such as Tether offer a means for people to engage in financial transactions without the need for banks – a crucial advantage in countries where banking knowledge is limited.

In simpler terms, Argentina encounters economic challenges including high inflation, depreciation of its currency, the peso, and limitations on foreign exchange dealings. As a result, people are seeking methods to safeguard their savings, and digital currencies like Bitcoin might serve as an option. The nation’s newly elected president, Javier Milei, also advocates for BTC and other payment methods as part of a plan to foster competition in the local currency market.

In Turkey, much like elsewhere, the populace is experiencing an unstable economy marked by escalating inflation rates and the weakening Turkish Lira. As a potential safeguard against inflation, cryptocurrencies have gained traction as a means of securing savings.

Beyond just economic difficulties, many individuals in Brazil lack access to traditional banking services. However, USDT offers them an opportunity to engage within the financial system and carry out transactions even without owning a bank account.

In the past decade, USDT (Tether) has grown significantly, becoming a crucial element in trading and a frequently chosen substitute for the U.S. dollar. This development provides individuals in emerging economies with an avenue to engage in the crypto market, enabling them to invest, trade, and execute transactions.

Despite its success, there are still many unclear moments in the history of Tether

Nonetheless, it’s important to acknowledge that Tether has had its share of challenging periods. Previously, Tether was subjected to scrutiny concerning potential market manipulation and the possibility of inflating the prices of Bitcoin (BTC) and other digital currencies.

As a crypto investor, I must admit that while Tether asserts that every USDT is equivalent to one U.S. dollar, there’s a lingering concern due to the absence of frequent and impartial audits. This uncertainty casts doubt on the stability and liquidity of their reserve, making me question if they truly have enough assets to fully back each USDT.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-07 21:54