As a seasoned analyst with decades of observing market trends and generational shifts, I find it intriguing to see how the investment landscape is evolving. The Bank of America study underscores a clear divide between younger and older investors, reflecting not just changing economic priorities but also societal values.

As a forward-thinking crypto investor, I’ve noticed a significant shift in preference among my fellow younger investors. Instead of the traditional U.S. stocks, we’re leaning towards cryptocurrencies, indicating a clear generation gap in our investing philosophies. This intriguing trend suggests that we see the future differently and are eager to embrace innovative investment opportunities.

With Generation X pioneers reaching their sixties, there’s a substantial shift in wealth distribution influencing the investing tendencies across America. Cryptocurrencies are increasingly becoming popular choices amongst the younger generation, based on recent findings by Bank of America’s research.

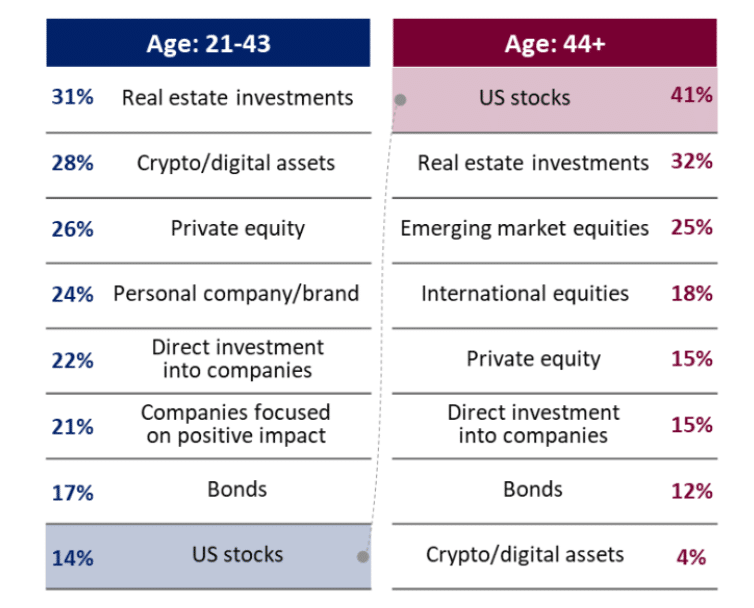

The research shows significant differences in perspectives among generations regarding investment choices. Younger wealthy individuals are progressively favoring unconventional options such as cryptocurrency and private equity, whereas their older counterparts continue to prefer conventional stocks.

According to the 2024 Study of Affluent Americans, Bank of America reveals that younger investors, mainly Generation Z and millennials, tend to favor real estate (31%), cryptocurrencies (28%), and private equity (26%) as more lucrative paths for growth compared to establishing their own businesses/brands (24%) or investing directly in companies (22%).

Conversely, individuals who are 44 years old and above tend to show a greater preference towards U.S. stocks (41%) and real estate investments (32%).

According to Katy Knox, President of Bank of America Private Bank, we’re currently experiencing a significant phase of social, economic, and technological transformation, coinciding with an unprecedented transfer of wealth across generations.

Instead of passing on philanthropic values as older generations assume, it seems that younger individuals are showing a noticeable gap in this area, favoring more effective ways of charitable giving.

With wealth shifting towards a younger generation, diverse viewpoints could spark fresh investment patterns, according to the report. This finding encourages financial advisors to adjust their strategies to cater to the changing preferences of this upcoming group of investors. The research polled U.S. adults who have at least $3 million in investable resources.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- USD CNY PREDICTION

- Kanye “Ye” West Struggles Through Chaotic, Rain-Soaked Shanghai Concert

- Arknights celebrates fifth anniversary in style with new limited-time event

- Mech Vs Aliens codes – Currently active promos (June 2025)

- Every Upcoming Zac Efron Movie And TV Show

- Hero Tale best builds – One for melee, one for ranged characters

2024-10-08 12:21