As a seasoned researcher with extensive experience delving into financial matters, I find it fascinating to observe the rapid evolution of regulatory action within the cryptocurrency industry. The sheer volume of fines levied against crypto companies in the last few years is staggering, and it’s evident that the U.S. regulators are not backing down anytime soon.

Among the cryptocurrency firms, which company faced the highest total in fines imposed by U.S. regulatory bodies for resolving compliance-related disagreements?

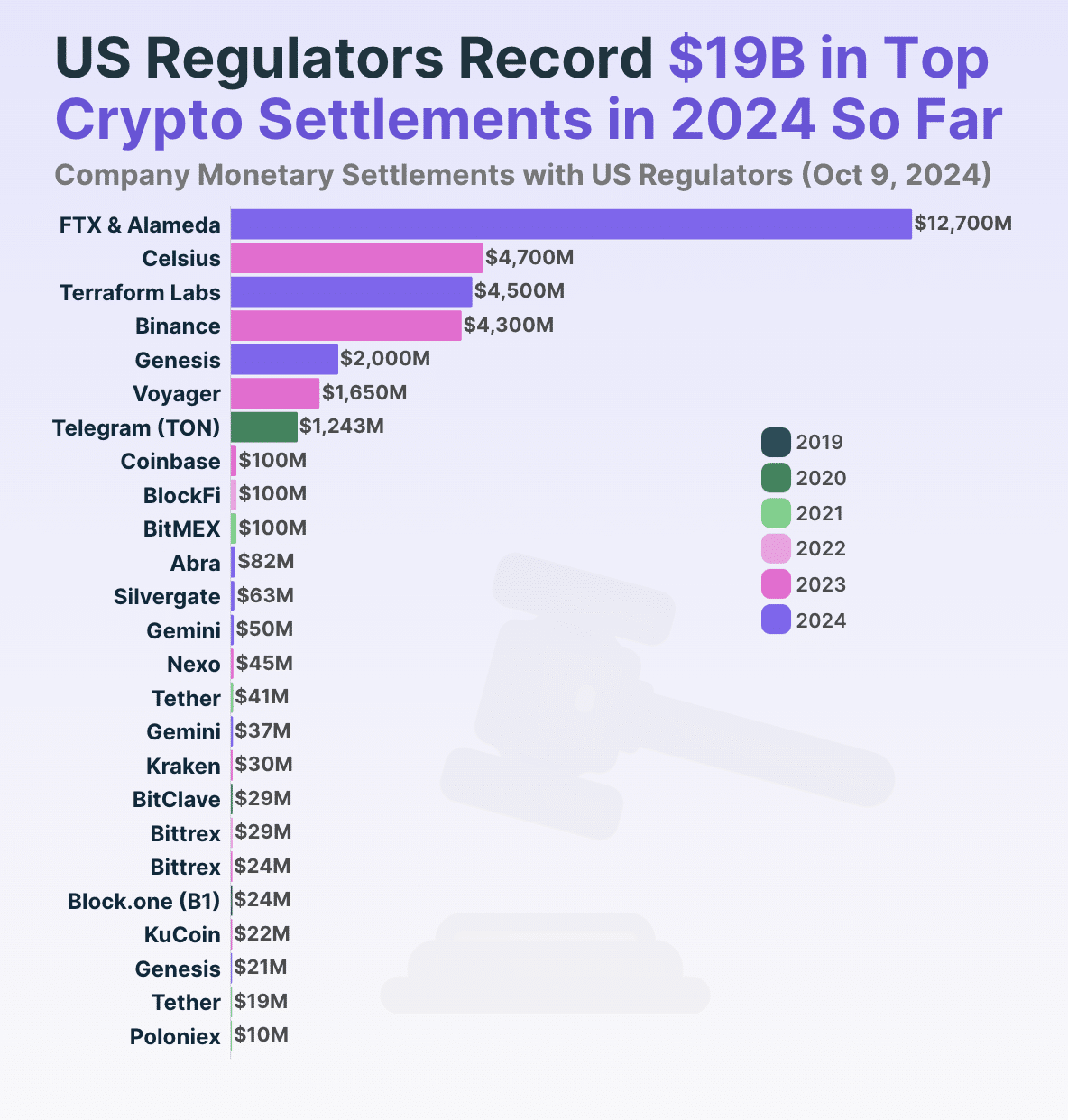

Approximately $19.45 billion was recorded as total earnings in 2024, primarily from a payment of $12.7 billion made to FTX and Alameda Research. This significant sum is a result of a court order by Judge Peter Castel, who mandated that the firms collectively repay $8.7 billion in compensation to those who suffered losses. Furthermore, the agreement stipulates an additional fee of $4 billion, paid as reparation for ill-acquired gains.

In 2024, Terraform Labs agreed to a settlement worth approximately $4.5 billion with regulators. This includes paying around $3.59 billion in interest and penalties, as well as a fine of $420 million. The founder, Do Kwon, is required to pay $204.3 million in interest, fines, and restitution, with an additional obligation to contribute at least the same amount to the “bankruptcy estate.” This estate will then be distributed among the investors.

In 2023, two substantial penalties were imposed – Binance faced a fine of approximately $4.3 billion, while Celsius was fined about $4.7 billion. As part of this legal proceeding, the largest cryptocurrency exchange was mandated to pay a criminal penalty of around $1.81 billion and forfeit roughly $2.51 billion in damages.

In November 2023, the top worldwide cryptocurrency exchange decided to admit guilt in order to settle legal disputes with various U.S. regulatory bodies such as the Department of Justice (DOJ), Treasury Department, and the Commodity Futures Trading Commission (CFTC).

CoinGecko report

Regarding the fine under Celsius, in 2023, the U.S. Federal Trade Commission reached a settlement with Celsius Network. Under this agreement, Celsius and its affiliated companies were forbidden from providing, marketing, or advertising any product or service that could be utilized for depositing, exchanging, investing, or withdrawing assets.

In late 2022, Terra’s instability sparked a downturn in the crypto market, which was further exacerbated by the bankruptcy of Celsius and the eventual collapse of FTX. Among these platforms, Binance is the only one still active, currently leading as the largest centralized exchange by trading volume.

Yet, it was in the year 2023 that we witnessed a significant surge in recovery sums, as the combined settlements from lawsuits filed by eight U.S. government agencies reached an impressive total of $10.87 billion.

When did the significant crypto enforcement actions in the U.S. occur?

Over the past two years, the United States has witnessed a significant surge in regulatory actions against cryptocurrencies, with approximately 68% of these major actions taking place during this timeframe. This heightened activity is believed to be a response to the FTX crash towards the end of 2022, leading to increased scrutiny from enforcement agencies. In the year 2023, law enforcement bodies successfully resolved eight lawsuits, amassing a total settlement of $10.87 billion – a historic high and an astonishing increase of over 8,300% compared to the previous year.

In the year 2024, we successfully negotiated and finalized an additional eight agreements totaling $19.45 billion. As we approach the end of the year, it’s worth noting that this settlement value for 2024 has already grown by a substantial 78.9% compared to the previous year.

Since the U.S. regulatory bodies continue to intensify their examination of the cryptocurrency sector, it’s possible that 2024 could see a higher number of legal settlements compared to the previous year.

CoinGecko report

Between 2019 and 2022, U.S. regulatory bodies made advancements in significant cryptocurrency lawsuits. The initial substantial settlement was reached with Block.one at the end of 2019, as the SEC agreed to a $24 million settlement regarding unregistered securities sales. In 2020, the SEC resolved two major cases: BitClave paid $29.34 million in May, and Telegram was fined $1.24 billion.

2021 saw three notable instances of crypto-related cases as prices soared. Tether agreed to pay $18.5 million and later $41 million in a settlement with the Commodity Futures Trading Commission (CFTC). Similarly, Poloniex and BitMEX settled their lawsuits for $10.39 million and $100 million each. In 2022, BlockFi reached a $100 million settlement with the Securities and Exchange Commission (SEC), while Bittrex agreed to pay $29 million in a settlement with the U.S. Treasury Department.

Actual deductions may be even higher

Simultaneously, the experts at CoinGecko disregarded penalties and additional charges that specific high-ranking officials were required to pay by the Commodity Futures Trading Commission (CFTC).

More recently, the creator of Binance consented to a financial penalty amounting to $50 million and willingly appeared in an American courtroom following a summons, traveling from the UAE.

2020 saw a case involving accusations towards the cryptocurrency exchange, BitMEX. The U.S. authorities filed charges against BitMEX as well as its three founders, including Arthur Hayes who served as the head of the exchange. However, after leaving the company, Hayes admitted guilt, paid a $10 million fine, and received two years of probation.

The penalties for only two people amounted to an astonishing $60 million. But since these authorities often impose additional personal fines, their total earnings could potentially exceed several billions of dollars.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-10 23:08