As a seasoned investor with decades of experience in traditional real estate markets, I must admit that the concept of IVVIA piqued my interest immediately. Having witnessed the complexities and limitations of the conventional mortgage system firsthand, the idea of a decentralized, automated, and transparent platform like IVVIA is nothing short of revolutionary.

In my recent discourse on real estate tokenization, I delved into the intriguing yet seemingly stagnant innovation that was initially met with high anticipation due to its potential benefits. However, it’s become apparent that tokenization without a clearly defined economic objective is destined to remain a marginalized concept. The widespread adoption we envisioned has yet to materialize because, quite simply, the economic reasoning behind it hasn’t been convincingly established.

For quite some time now, I’ve passionately argued for the implementation of a blockchain-based property registry system. This system would issue title tokens representing actual property rights, rather than just securities or investment claims. Although governments have been hesitant to embrace this concept, I remain committed to investigating how tokenization can play a tangible, useful role in real estate transactions.

And then it struck me: an innovative approach that merges tokenization with decentralized finance to create a fourth way to acquire property. Something entirely different—what I’ve named IVVIA. Derived from the Latin ‘IV via,’ meaning the fourth way, IVVIA offers a new path for property acquisition.

Introducing the fourth way: IVVIA

Most people are familiar with the conventional methods of buying property: using cash, mortgages, or leasing. However, each option has its downsides. Cash purchases can be out of reach for many individuals, while mortgages involve long-term obligations and significant fees. Leases, on the other hand, don’t provide an opportunity for ownership or investment returns. Now, imagine a new approach that merges the advantages of owning property and making investments with the convenience of tokenization? This way, you can enjoy the best of both worlds!

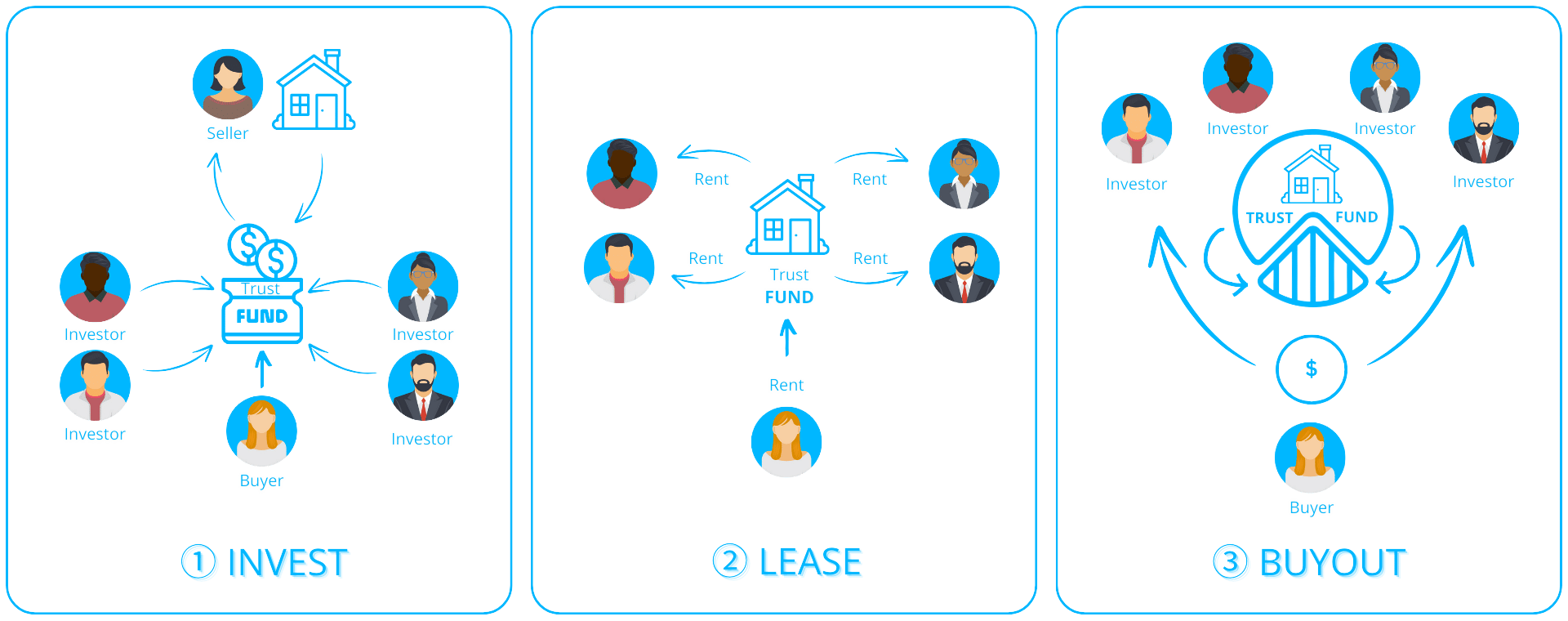

IVVIA’s concept is straightforward: it enables potential homeowners, or “ivviators,” to progressively purchase properties by acquiring tokens that symbolize portions of the real estate. This process mirrors a mortgage, as buyers can make regular payments, but without the constraints often associated with bank loans. Instead, they collaborate with real estate investors, known as “ivviatees,” who hold these tokens. Over time, ivviators purchase these tokens at market value, similar to paying off a mortgage, but with greater flexibility and fewer charges involved.

Unlike a traditional mortgage that binds you into a 20-year financial commitment, IVVIA provides flexibility. If an Ivviator (home occupier) needs to relocate to another city, they have the option to sell their accumulated tokens for their current market value and leave without any further obligations. Conversely, investors can take advantage of liquidity in this system. They are able to offload their tokens either to the Ivviator or on the open market at their own discretion anytime.

As a crypto investor, I find immense value in the smart contracts that govern our interactions, streamlining numerous day-to-day transactions, including token purchases and monthly rental payments. The charm of this system resides in its adaptability and openness, both attributes that are reinforced by the robust and transparent blockchain technology at its core.

The economics of IVVIA: A real-world scenario

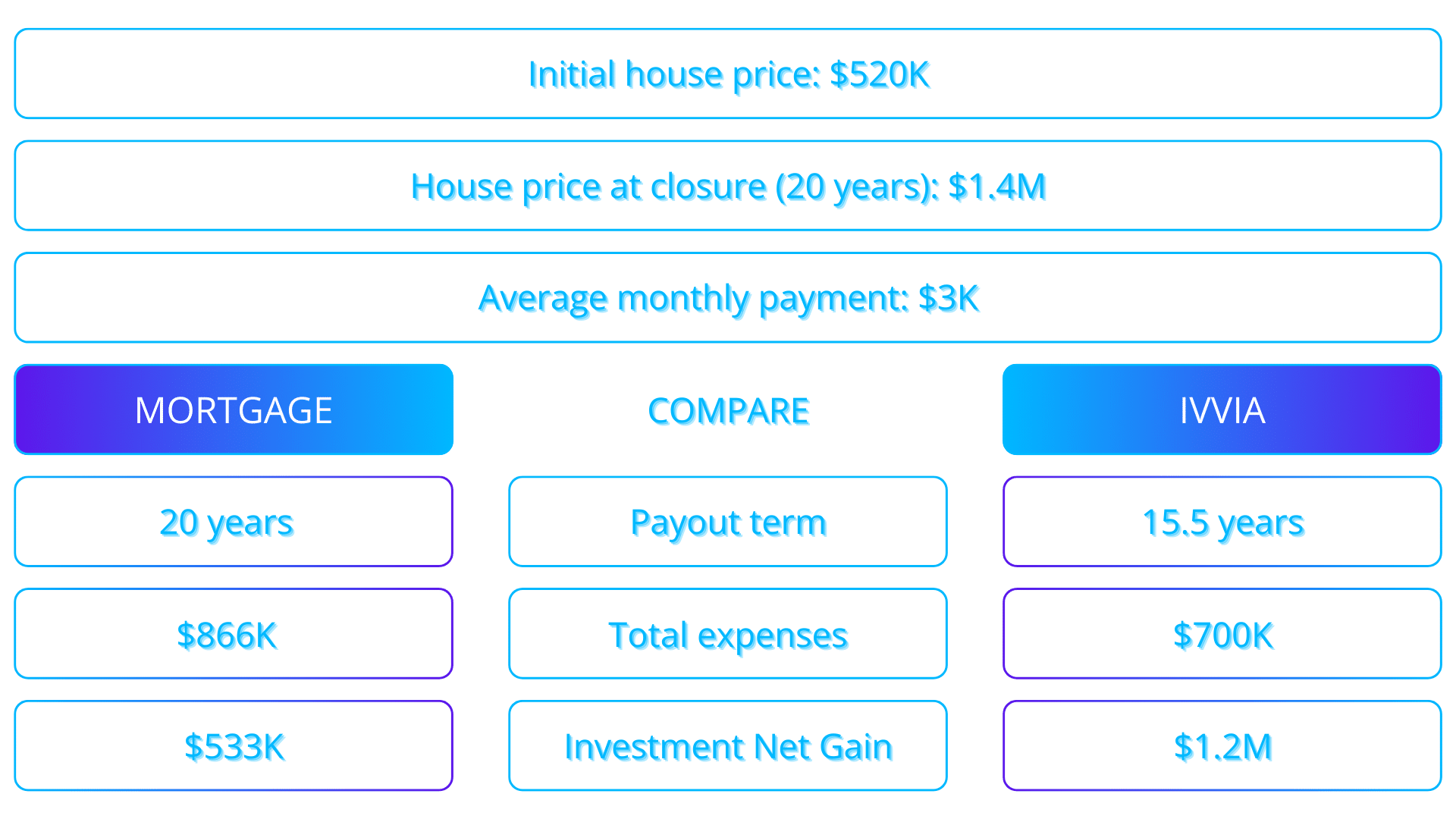

To explore if this idea could work in practice, I delved into two decades worth of market data from the Australian Bureau of Statistics, focusing on aspects like property prices, mortgage rates, rent, and bank deposit rates. Then, I simulated the expected outcomes for traditional mortgages as well as the IVVIA system. The findings were quite remarkable.

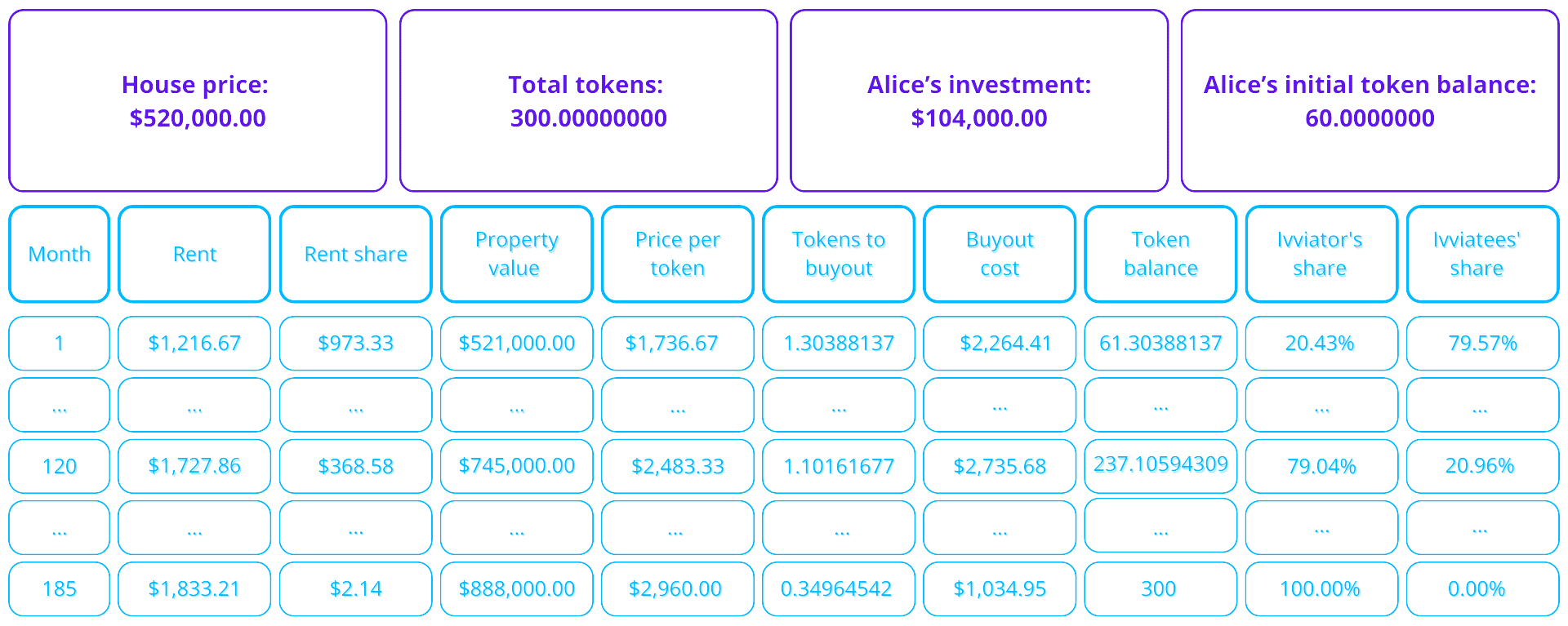

In the year 2004, Alice purchased a two-bedroom house in Auburn, a suburb of Sydney, for $520,000. She put down a 20% deposit of $104,000 and took out a 20-year mortgage with an average interest rate of 6.44%. This led to monthly payments of $3,175. Over the course of 20 years, Alice’s total expenses (including both loan interest and house costs) amounted to $866,000. By the year 2024, the property’s value had risen to $1,400,000. If Alice decides to sell, her net profit would be approximately $533,000 (after subtracting the total costs of $866,000).

In the IVVIA system, instead of taking out a mortgage, Alice teams up with four investors – Bob, Chuck, Dave, and Eve – who each contribute $104,000, which is the same as Alice’s 20% down payment. These investors are typically individuals interested in real estate, who would otherwise go to the bank. Together, they establish a trust, buy the house, and tokenize it, with each member receiving an equivalent number of tokens representing their share of ownership.

In this situation, Alice maintains her monthly payment amount of $3,175, similar to what she would pay under a mortgage, which we’ll call her “Expenditure Limit.” Instead of repaying a loan to a bank, Alice uses her monthly “Expenditure Limit” to divide her expenses between renting and purchasing her investors’ tokens.

In this setup, Alice is responsible for paying a portion of the monthly rent based on her ownership of the property’s tokens. Since she owns 20% of the tokens, she would pay 80% of the total rent to her fellow investors, amounting to $973 (80% of $1,216). The remaining $2,202 from her monthly budget, known as the Expenditure Cap, is then utilized to purchase tokens from her co-investors, at a price that mirrors the current market value of the property.

Initially, in the first month with a property valued at $521,000, Alice could purchase 1.30 tokens, which represented a 20.44% ownership share. Over time, as her ownership grew, her rent decreased. After a decade had passed, she would own approximately 79% of the property, meaning her rent payments would account for only 21% of the market rate – equating to $368 per month. At this stage, the property’s value would have escalated to $745,000, with Alice purchasing around 1.1 tokens each month.

As an analyst, I find myself reflecting on Alice’s property ownership journey: After 15.5 years, all the property will be hers, with a total investment of $700,000 factoring in the initial down payment, rental payments, and token buyouts. This equates to a substantial saving of approximately $166,000 compared to the conventional mortgage path.

The investor’s perspective

Regarding investors, in the context of IVVIA, they stand to profit not only from rental income but also from the appreciation of their tokens, which is the gap between the initial token price and the selling price. This dual source of income begins a month after the property purchase, depending on their share. A straightforward calculation indicates that an investment of $104,000 could potentially bring about a total return of $44,000.

From my perspective as an analyst, to create a comparable situation with a mortgage, let’s set some conditions. While IVVIA offers monthly cash flow for investors, a mortgage requires a portion of one’s household income to be dedicated towards monthly repayments over 20 years, thereby tying up wealth in the property’s value. To ensure fair comparison, let’s imagine an investor like Bob, who doesn’t spend his rental profits or token sale earnings but instead saves them, similar to a homeowner accumulating equity. Over 20 years, this savings could amount to approximately $1,200,000 – that’s around 140% more than the $533,000 an individual would earn through traditional mortgage payments.

From naïve to a real-world solution

While IVVIA represents a real solution to the challenges of real estate tokenization, there are some hurdles to consider. Long-term investments, like those in real estate, can run into legal complications—such as disputes, bankruptcies, or even deaths of the ivviatees. A simple smart contract doesn’t easily resolve these issues.

To effectively grow IVVIA, we’ll probably require skilled contract administrators specializing in smart contracts. These professionals will be responsible for maintaining the system objectively, dealing with legal intricacies, and adhering to the constantly changing regulatory landscapes. Despite the hurdles, the benefits of automation and decentralization make this a significantly more streamlined solution compared to conventional real estate finance systems.

Conclusion

The concept of tokenizing real estate isn’t fresh, but what sets IVVIA apart is a genuinely viable economic approach. By combining the adaptability of tokenization with the reliability of real estate, IVVIA addresses the challenge that has prevented widespread adoption of property tokenization. This isn’t just another example of blockchain application; it represents a significant shift in perspectives on property ownership and investment.

IVVIA operates by synchronizing the goals of buyers and investors, transforming real estate into a fluid, exchangeable commodity while providing individuals with a customizable option for homeownership. Utilizing cutting-edge technologies such as smart contracts, DeFi, and shared ownership, IVVIA might just be the blueprint for the future of the real estate market—a potential fourth method that could eventually become standard practice.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- Black Myth: Wukong minimum & recommended system requirements for PC

- 10 Most Anticipated Anime of 2025

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Hero Tale best builds – One for melee, one for ranged characters

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Gold Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

2024-10-12 14:20