As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. The current state of Bitcoin, as indicated by the data from CryptoQuant, is particularly intriguing. The robust demand, as evidenced by the strong buy walls across all exchanges, is a clear sign that investors are bullish on BTC.

According to the latest data from CryptoQuant, the buying power for Bitcoin has significantly increased on all trading platforms.

Currently, the purchasing activity is strong enough to balance out the selling force in the Bitcoin market, indicating a significant appetite for Bitcoin. This implies that the buying volume is substantial enough to soak up the additional selling volume, preventing it from further driving down the price and potentially leading to recovery.

#Bitcoin buy walls on all exchanges are now strong enough to neutralize sell walls.

— Ki Young Ju (@ki_young_ju) October 14, 2024

Over the last few months, Bitcoin has experienced significant selling pressure, but more recent weeks indicate a shift in this pattern. This change is depicted in the chart, which spans from early 2023 to mid-October 2024.

By October 12th, the buying barriers for Bitcoin had strengthened significantly to approximately 895 million dollars, whereas selling barriers vanished altogether. This suggests that investors are ready to purchase at significant price points, and the decline in the exchange reserve further supports this pattern, indicating a high demand for Bitcoin.

Buying strength suggests increasing optimism as well. When buying floors surpass selling floors, prices often become steady or increase. Continuing this pattern might lead to more Bitcoin price growth, contingent upon market liquidity and investor feelings.

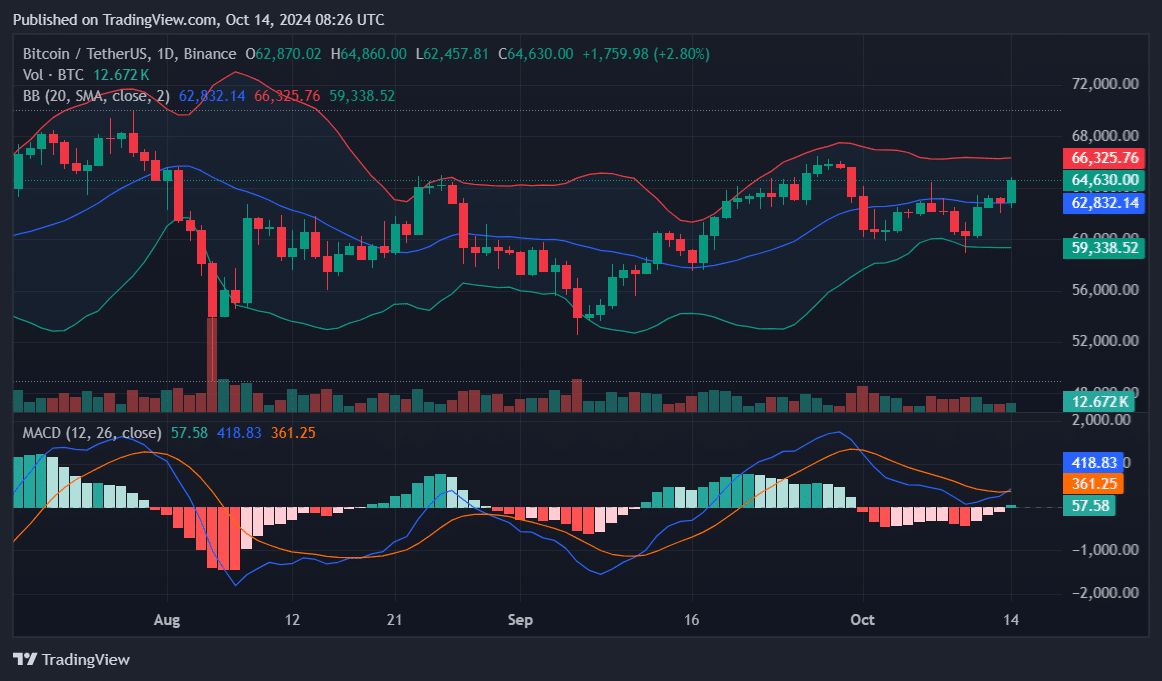

Remarkably, following a challenging weekend, the original cryptocurrency, Bitcoin, has started the new week with strength. Currently, it’s up by 2.80% in the last 24 hours and is being traded at approximately $64,630 as we speak.

The MACD (Moving Average Convergence Divergence) has recently turned positive, suggesting a resurgence of buying pressure for BTC. However, Bitcoin is currently encountering robust resistance at the upper Bollinger Band, which stands at approximately $66,325. If it manages to surpass this barrier, we might expect the price to potentially soar towards $68,000 or even higher in the immediate future.

Currently, the 20-day moving average is serving as a supportive level at around $62,832. Meanwhile, the lower Bollinger Band offers additional support at approximately $59,338. The MACD crossover indicates a bullish sentiment and the recent growth in buy walls hints at further potential increases. However, for Bitcoin to continue its upward trend, it needs to surmount its current resistance.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Silver Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- Black Myth: Wukong minimum & recommended system requirements for PC

- Former SNL Star Reveals Surprising Comeback After 24 Years

- Gold Rate Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-14 13:01