As a seasoned crypto investor with over a decade of experience in this dynamic and ever-evolving market, I must admit that the recent surge in Stellar Lumens (XLM) has piqued my interest once again. The partnership with Mastercard, a financial behemoth valued at over $474 billion, is undeniably a game-changer. This collaboration could potentially bring mass adoption to XLM and elevate its status in the crypto sphere.

The price of Stellar Lumens tokens rose significantly, hitting a peak not seen since October 1, during the ongoing Meridian Conference.

Stellar (XLM), one of the biggest cryptocurrencies, rose to $0.096, pushing its market capitalization to over $2.8 billion. The main catalyst for the token’s rise was the announcement of a new partnership between the Stellar Foundation and Mastercard, the fintech giant valued at over $474 billion.

Through this collaboration, Mastercard’s Crypto Credential service is set to be implemented on the Stellar platform. This innovative service, designed to authenticate transactions between consumers and businesses via blockchain technology, will become an integral part of the Stellar network.

At today’s Meridian2024 event in London, we revealed a fresh collaboration with Mastercard, aiming to incorporate their Crypto Credential technology into the Stellar network.

— Stellar (@StellarOrg) October 15, 2024

As an analyst, I’m excited to announce that I’ve just learned that Mastercard has joined Stellar as its second significant collaborator, following MoneyGram. This strategic partnership with MoneyGram empowers us, the users, to effortlessly send and receive USDC stablecoins at thousands of retail outlets spread across the globe.

One of the leading blockchain platforms, Stellar, operates within the USDC network. As stated on Circle’s official site, more than 176 million USDC tokens are in circulation on this network.

As an analyst, I’m excited to share that I’ve been involved with Stellar, a dynamic company that’s recently teamed up with Franklin Templeton – a global asset manager boasting more than a trillion dollars in managed assets. This strategic collaboration has given birth to the Franklin OnChain U.S. Government Money Fund, a venture that has already amassed over $435 million worth of assets under its management.

Following a collaboration between Stellar’s developers and Dune Analytics – a prominent data platform within the cryptocurrency sector – there was an increase in the value of Stellar tokens as well. The data network indicates that Stellar’s network has processed more than 4.12 billion transactions, with the number of users in its ecosystem surging beyond 26 million.

A key challenge for Stellar holders, however, is the potential for more dilution in the coming years. XLM has a total circulating supply of nearly 30 billion tokens compared to the maximum supply limit of 50 billion.

Stellar lumens has hit resistance

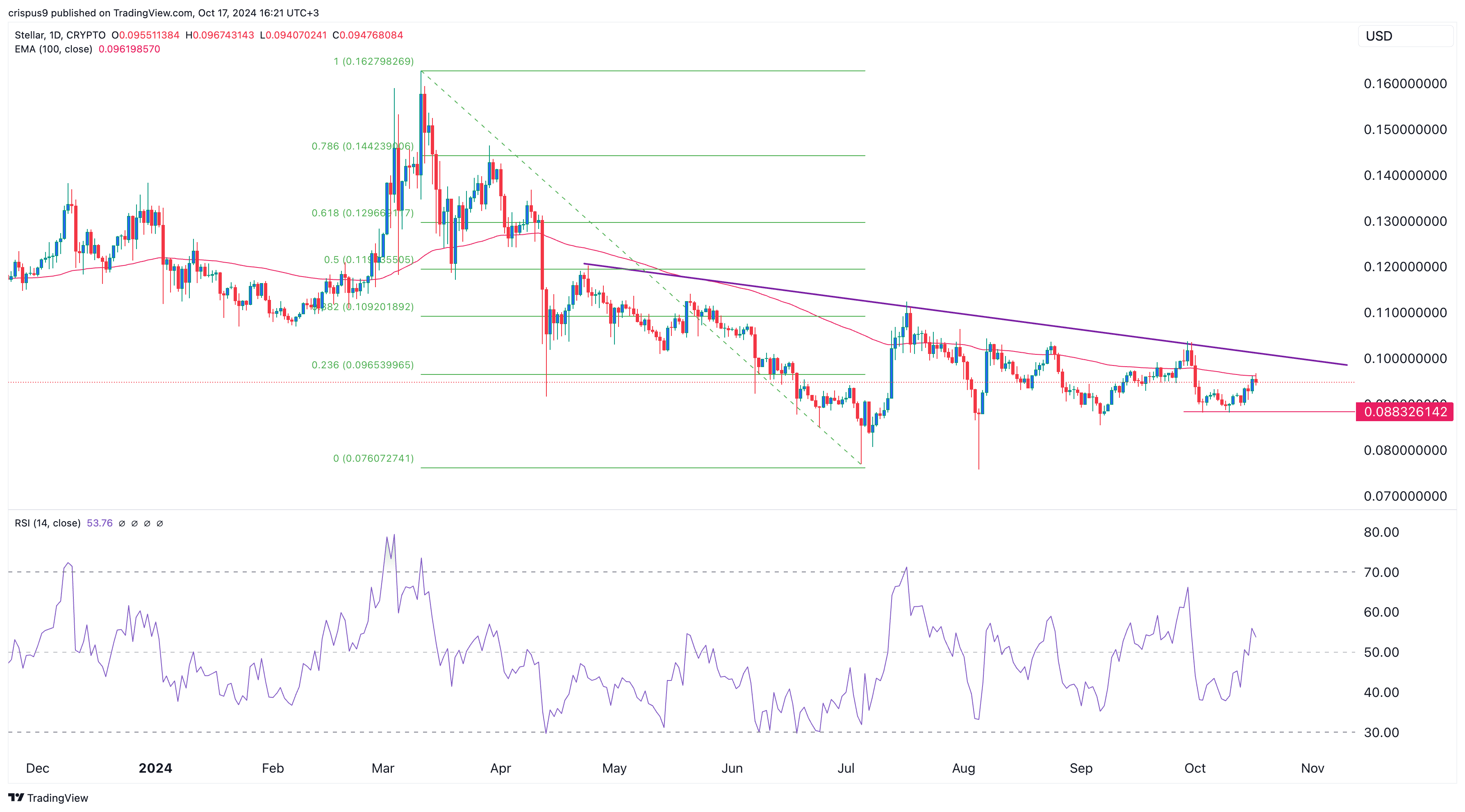

The Stellar XLM token has gradually risen after bottoming at $0.0883 on Oct. 3. Its rebound has faced significant resistance at the 100-day moving average and the 23.6% Fibonacci retracement level at $0.096.

On the upside, the Relative Strength Index (RSI) has moved above the 50 mark, suggesting a pickup in momentum. Additionally, the token appears to have created an inverted head-and-shoulders structure, which is often seen as a positive sign for potential bullish trends.

Consequently, Stellar’s upward movement will be validated when it surpasses the significant mark of $0.10. This level is also where a downward trendline, connecting the highest peaks since April, lies.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- Black Myth: Wukong minimum & recommended system requirements for PC

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-17 17:36