As a seasoned crypto investor with a knack for reading market trends and understanding the intricacies of blockchain technology, I find myself both intrigued and cautious regarding ApeCoin’s recent performance. The sharp reversal following the launch of ApeChain was unexpected, but not entirely surprising given the volatile nature of this space.

On October 22nd, the value of an ApeCoin token underwent a significant turnaround, undoing some of the advancements achieved over the past five days.

The price of ApeCoin (APE), linked with Yuga Labs, the designers behind Bored Ape Yacht Club, fell to $1.44, representing a decline of almost 20% from its peak this week. Even so, it continues to sit 200% higher than its lowest point in August.

Two days following the launch of ApeChain, a layer 3 network on Arbitrum One by Yuga Labs, an unexpected incident occurred. ApeChain serves as a platform for developers to create apps across various sectors like gaming, decentralized finance, and non-fungible tokens.

As a researcher, I’d like to highlight an engaging feature of ApeChain – the opportunity for ApeCoin holders to yield returns. This is achieved through a mechanism known as staking, where token holders effectively lend their APE tokens to secure the network. In exchange, they receive rewards as compensation for their contribution.

ApeCoin stands out because it has an automatic yield function, which means that tokens can be invested automatically, thus optimizing potential gains.

Yuga Labs anticipates that ApeChain could broaden their ecosystem, given the current challenges faced by Bored Ape Yacht Club.

According to CryptoSlam’s data, sales of BAYC have decreased substantially this year. For instance, the total sales in September were only $7.1 million compared to $41 million in March – a notable drop. At its highest point in January 2021, BAYC recorded sales of an impressive $346 million.

The decrease in ApeCoin’s value can primarily be explained by two key reasons. Initially, it dropped when investors decided to cash out following the announcement of the news. This phenomenon is often observed, where assets experience a surge before and immediately after significant events, only to dip afterward as some investors realize their profits.

Afterward, the cost of APE decreased because investors expected additional difficulties for ApeChain, considering the extremely competitive nature of the layer 1, 2, and 3 sectors.

Moreover, the decline in prices was influenced by a general downturn across the crypto market. Bitcoin (BTC) dipped to $67,000 from its previous high of $69,300 on October 21st, and the combined value of all cryptocurrencies fell by 3%, reaching approximately $2.43 trillion.

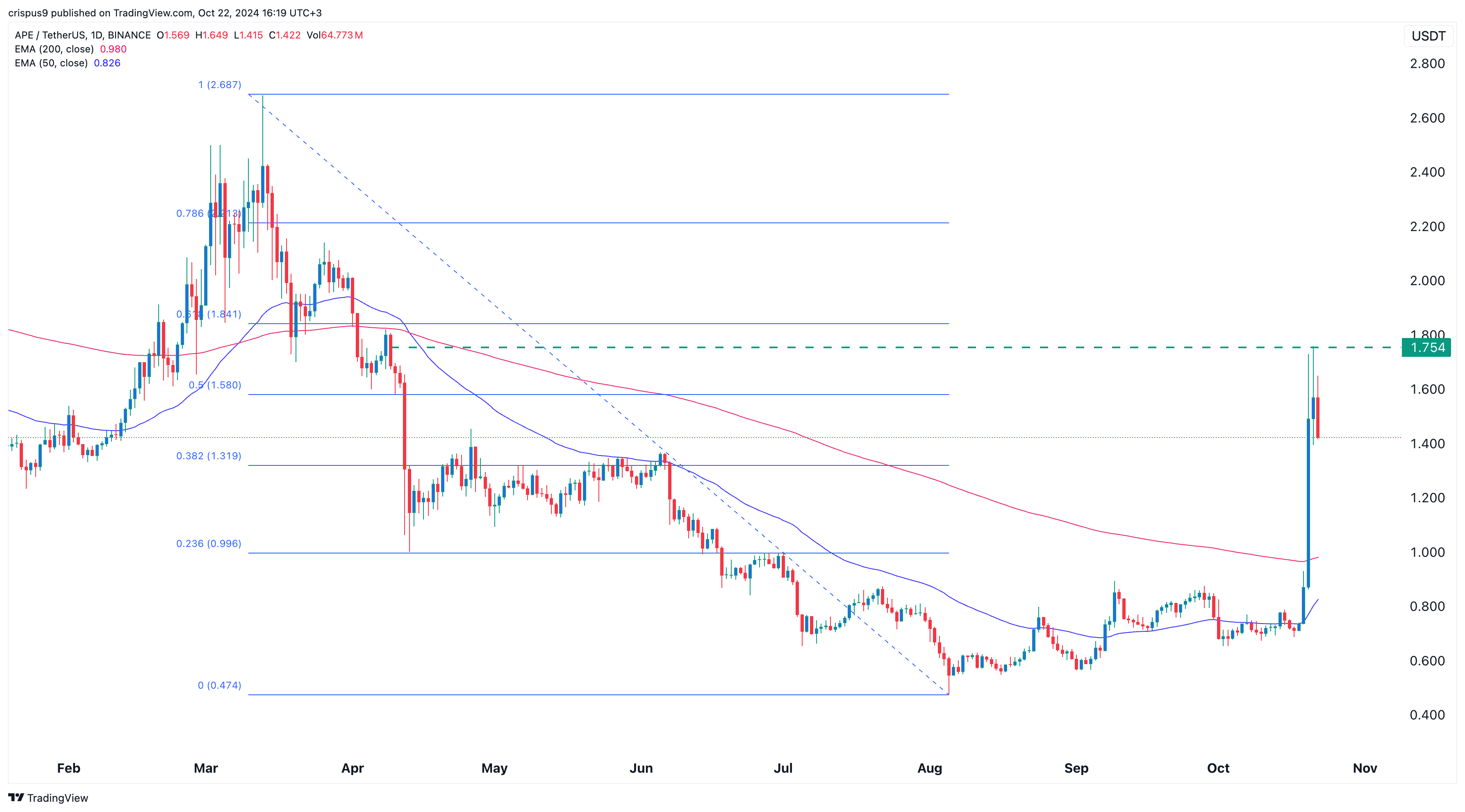

ApeCoin price formed a spinning top

On Monday, the APE token peaked at $1.754, just shy of the 61.8% Fibonacci Retracement level. Subsequently, it developed a spinning top candlestick, which typically has a small body and long wicks (or shadows) above and below. Although usually considered neutral, this pattern can sometimes indicate a potential reversal.

ApeCoin currently hovers over its 50-day and 200-day Exponential Moving Averages, as well as the 38.2% Fibonacci Retracement level. This suggests that the token might continue to decline and potentially reach a test of the 200-day moving average at approximately $0.980. However, this outlook could change if the token manages to surpass its current week’s high of $1.754.

Read More

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Box Office: ‘Jurassic World Rebirth’ Stomping to $127M U.S. Bow, North of $250M Million Globally

- USD CNY PREDICTION

- Silver Rate Forecast

- “Golden” Moment: How ‘KPop Demon Hunters’ Created the Year’s Catchiest Soundtrack

- Castle Duels tier list – Best Legendary and Epic cards

- Black Myth: Wukong minimum & recommended system requirements for PC

- Mech Vs Aliens codes – Currently active promos (June 2025)

2024-10-22 16:47